Question

OhBank is a small Australian bank. The government regulator has provided OhBank with the following table of risk weights of different residential mortgage types: You

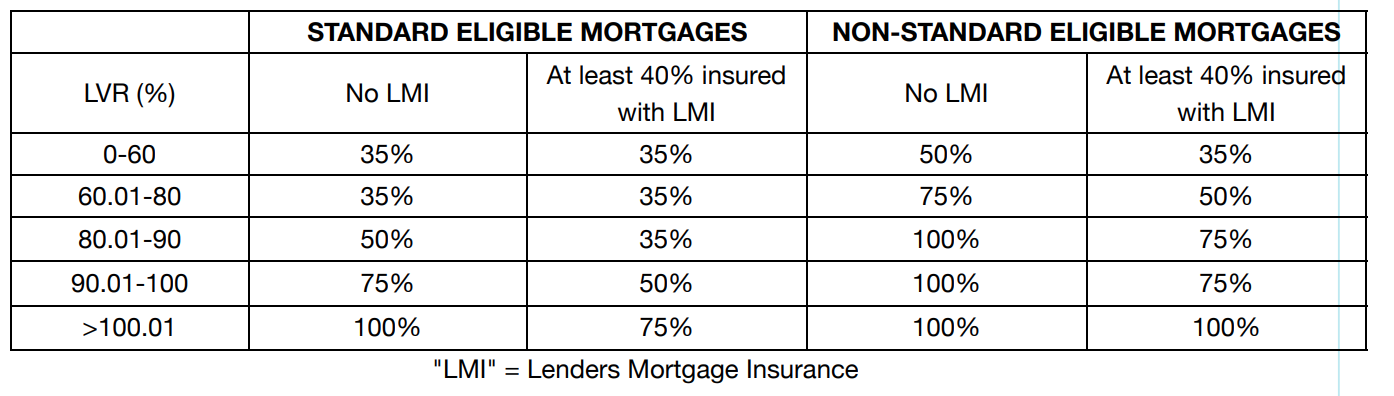

OhBank is a small Australian bank. The government regulator has provided OhBank with the following table of risk weights of different residential mortgage types:

You have the following formation about some home loans that OhBank Bank issued recently: A loan of $475,000 to Mr Singh who purchased an apartment for $500,000. Mr Singh took out lenders mortgage insurance ("LMI") on the full value of the property. A loan to Mr & Mrs Huang for a house at a purchase price of $3.5 million. They chose not to take out LMI. They put down a deposit of $0.875 million toward the purchase price. A loan to Bad Luck Brian, who borrowed 85% of his house's $500,000 purchase price and obtained full LMI. Since taking possession of the house, Brian's house has been exposed to a toxic chemical leak. OhBank's independent valuer estimates this will cause Brian's house to fall in value by 95%. In addition, they estimate the property will not be able to be sold for 10 years. Assuming Basel III requirements, what is the minimum amount of total capital (T1 + T2) required to support these 3 mortgages?

Select one: a. $0.2820 million b. $0.2630 million c. $0.1265 million d. $0.1963 million e. $0.1523 million f. $0.1065 million g. $0.0775 million

LVR (%) 0-60 60.01-80 80.01-90 90.01-100 >100.01 STANDARD ELIGIBLE MORTGAGES NON-STANDARD ELIGIBLE MORTGAGES At least 40% insured At least 40% insured No LMI No LMI with LMI with LMI 35% 35% 50% 35% 35% 35% 75% 50% 50% 35% 100% 75% 75% 50% 100% 75% 100% 75% 100% 100% "LMI" = Lenders Mortgage Insurance LVR (%) 0-60 60.01-80 80.01-90 90.01-100 >100.01 STANDARD ELIGIBLE MORTGAGES NON-STANDARD ELIGIBLE MORTGAGES At least 40% insured At least 40% insured No LMI No LMI with LMI with LMI 35% 35% 50% 35% 35% 35% 75% 50% 50% 35% 100% 75% 75% 50% 100% 75% 100% 75% 100% 100% "LMI" = Lenders Mortgage InsuranceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started