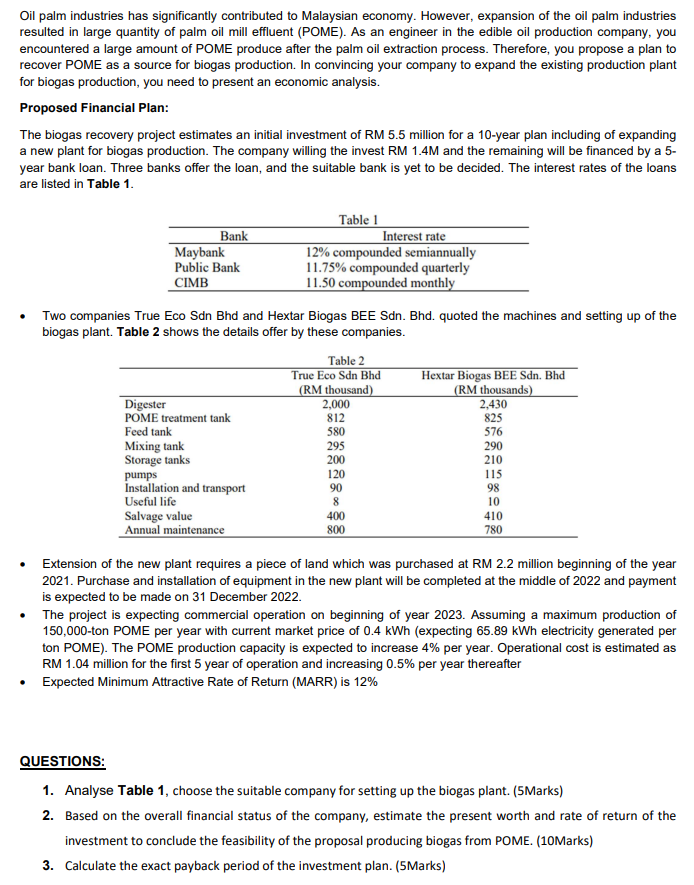

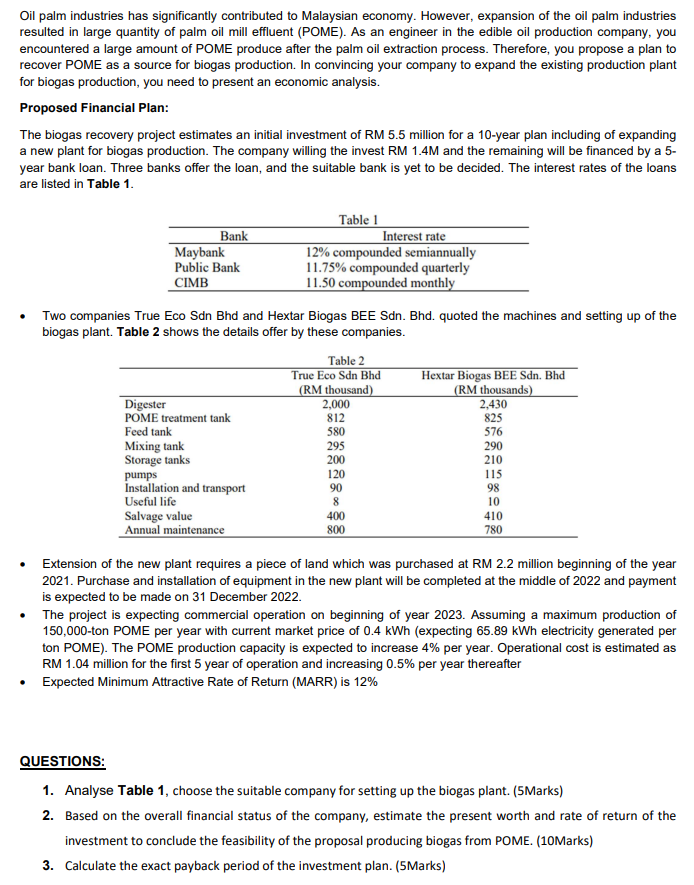

Oil palm industries has significantly contributed to Malaysian economy. However, expansion of the oil palm industries resulted in large quantity of palm oil mill effluent (POME). As an engineer in the edible oil production company, you encountered a large amount of POME produce after the palm oil extraction process. Therefore, you propose a plan to recover POME as a source for biogas production. In convincing your company to expand the existing production plant for biogas production, you need to present an economic analysis. Proposed Financial Plan: The biogas recovery project estimates an initial investment of RM 5.5 million for a 10-year plan including of expanding a new plant for biogas production. The company willing the invest RM 1.4M and the remaining will be financed by a 5- year bank loan. Three banks offer the loan, and the suitable bank is yet to be decided. The interest rates of the loans are listed in Table 1. Table 1 Bank Interest rate Maybank 12% compounded semiannually Public Bank 11.75% compounded quarterly CIMB 11.50 compounded monthly Two companies True Eco Sdn Bhd and Hextar Biogas BEE Sdn. Bhd. quoted the machines and setting up of the biogas plant. Table 2 shows the details offer by these companies. Digester POME treatment tank Feed tank Mixing tank Storage tanks pumps Installation and transport Useful life Salvage value Annual maintenance Table 2 True Eco Sdn Bhd (RM thousand) 2,000 812 580 295 200 120 90 8 400 800 Hextar Biogas BEE Sdn. Bhd (RM thousands) 2,430 825 576 290 210 115 98 10 410 780 Extension of the new plant requires a piece of land which was purchased at RM 2.2 million beginning of the year 2021. Purchase and installation of equipment in the new plant will be completed at the middle of 2022 and payment is expected to be made on 31 December 2022. The project is expecting commercial operation on beginning of year 2023. Assuming a maximum production of 150,000-ton POME per year with current market price of 0.4 kWh (expecting 65.89 kWh electricity generated per ton POME). The POME production capacity is expected to increase 4% per year. Operational cost is estimated as RM 1.04 million for the first 5 year of operation and increasing 0.5% per year thereafter Expected Minimum Attractive Rate of Return (MARR) is 12% QUESTIONS: 1. Analyse Table 1, choose the suitable company for setting up the biogas plant. (SMarks) 2. Based on the overall financial status of the company, estimate the present worth and rate of return of the investment to conclude the feasibility of the proposal producing biogas from POME. (10Marks) 3. Calculate the exact payback period of the investment plan. (5Marks) Oil palm industries has significantly contributed to Malaysian economy. However, expansion of the oil palm industries resulted in large quantity of palm oil mill effluent (POME). As an engineer in the edible oil production company, you encountered a large amount of POME produce after the palm oil extraction process. Therefore, you propose a plan to recover POME as a source for biogas production. In convincing your company to expand the existing production plant for biogas production, you need to present an economic analysis. Proposed Financial Plan: The biogas recovery project estimates an initial investment of RM 5.5 million for a 10-year plan including of expanding a new plant for biogas production. The company willing the invest RM 1.4M and the remaining will be financed by a 5- year bank loan. Three banks offer the loan, and the suitable bank is yet to be decided. The interest rates of the loans are listed in Table 1. Table 1 Bank Interest rate Maybank 12% compounded semiannually Public Bank 11.75% compounded quarterly CIMB 11.50 compounded monthly Two companies True Eco Sdn Bhd and Hextar Biogas BEE Sdn. Bhd. quoted the machines and setting up of the biogas plant. Table 2 shows the details offer by these companies. Digester POME treatment tank Feed tank Mixing tank Storage tanks pumps Installation and transport Useful life Salvage value Annual maintenance Table 2 True Eco Sdn Bhd (RM thousand) 2,000 812 580 295 200 120 90 8 400 800 Hextar Biogas BEE Sdn. Bhd (RM thousands) 2,430 825 576 290 210 115 98 10 410 780 Extension of the new plant requires a piece of land which was purchased at RM 2.2 million beginning of the year 2021. Purchase and installation of equipment in the new plant will be completed at the middle of 2022 and payment is expected to be made on 31 December 2022. The project is expecting commercial operation on beginning of year 2023. Assuming a maximum production of 150,000-ton POME per year with current market price of 0.4 kWh (expecting 65.89 kWh electricity generated per ton POME). The POME production capacity is expected to increase 4% per year. Operational cost is estimated as RM 1.04 million for the first 5 year of operation and increasing 0.5% per year thereafter Expected Minimum Attractive Rate of Return (MARR) is 12% QUESTIONS: 1. Analyse Table 1, choose the suitable company for setting up the biogas plant. (SMarks) 2. Based on the overall financial status of the company, estimate the present worth and rate of return of the investment to conclude the feasibility of the proposal producing biogas from POME. (10Marks) 3. Calculate the exact payback period of the investment plan. (5Marks)