Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please explain how to get all the blue numbers in table of question 6 b (the last table). Use the following information for

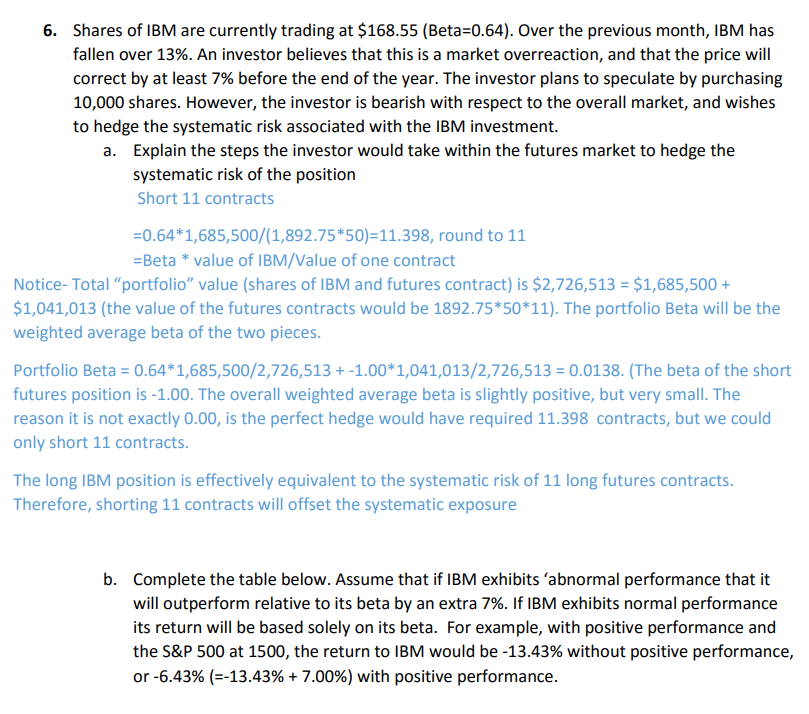

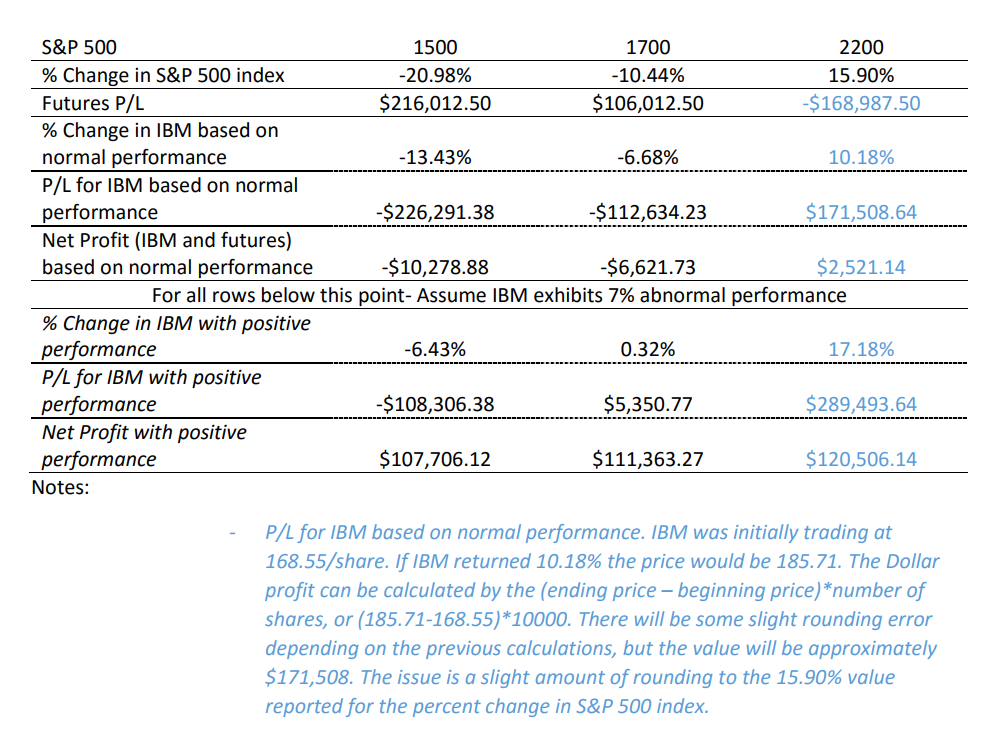

Can you please explain how to get all the blue numbers in table of question 6 b (the last table).

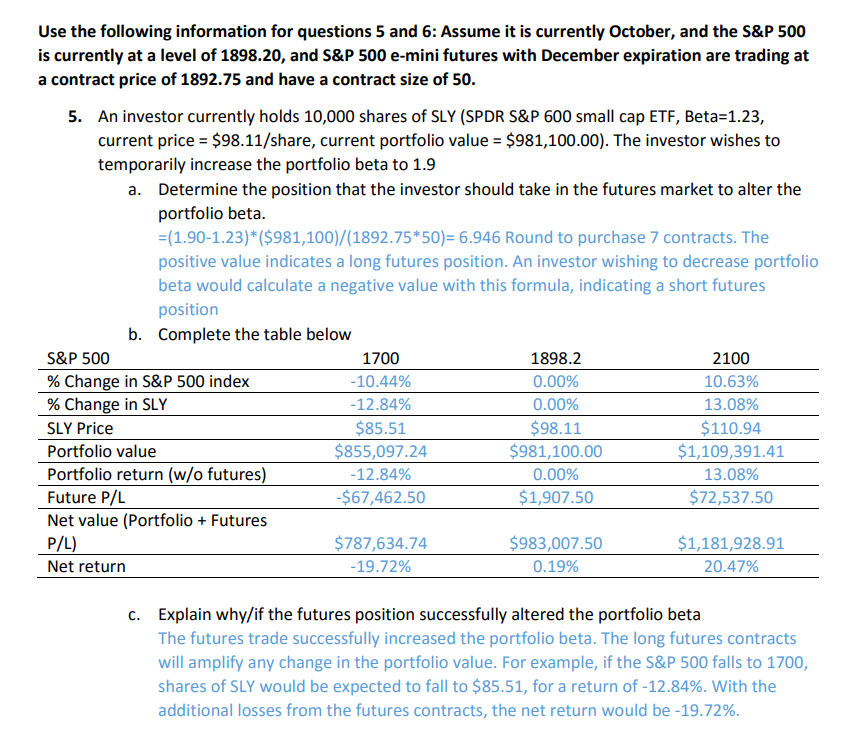

Use the following information for questions 5 and 6: Assume it is currently october, and the S&P 500 is currently at a level of 1898.20, and S&P 500 e-mini futures with December expiration are trading at a contract price of 1892.75 and have a contract size of 50 5. An investor currently holds 10,000 shares of SLY (SPDR S&P 600 small cap ETF, Beta 1.23, current price $98.11/share, current portfolio value J$981,100.00). The investor wishes to temporarily increase the portfolio beta to 1.9 a. Determine the position that the investor should take in the futures market to alter the portfolio beta. positive value indicates a long futures position. An investor wishing to decrease portfolio beta would calculate a negative v with this formula, indicating a short futures position b. Complete the table below S&P 500 1700 2100 1898.2 Change in S&P 500 index 10.44% 0.00% 10.63% Change in SLY 12.84% 0.00% 13.08% SLY Price $85.51 $98.11 $110.94 Portfolio value $855,097.24 $1,109,391.41 $981,100.00 Portfolio return (w/o futures) 12.84% 0.00% 13.08% -$67,462.50 $1,907.50 $72,537.50 Future P/L Net value (Portfolio Futures $787,634.74 $983,007.50 $1,181,928.91 P/L) -19.72% Net return 0.19 20.47% c. Explain why/if the futures position successfully altered the portfolio beta The futures trade successfully increased the portfolio beta. The long futures contracts will amplify any change in the portfolio value. For example, if the S&P 500 falls to 1700 shares of SLY would be expected to fall to $85.51, for a return of -12.84%. With the additional losses from the futures contracts, the net return would be -19.72%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started