Question

Ok, another scenario. And only three questions here. This is a continuation of the problem we did in class, the one where John Ford starts

Ok, another scenario. And only three questions here.

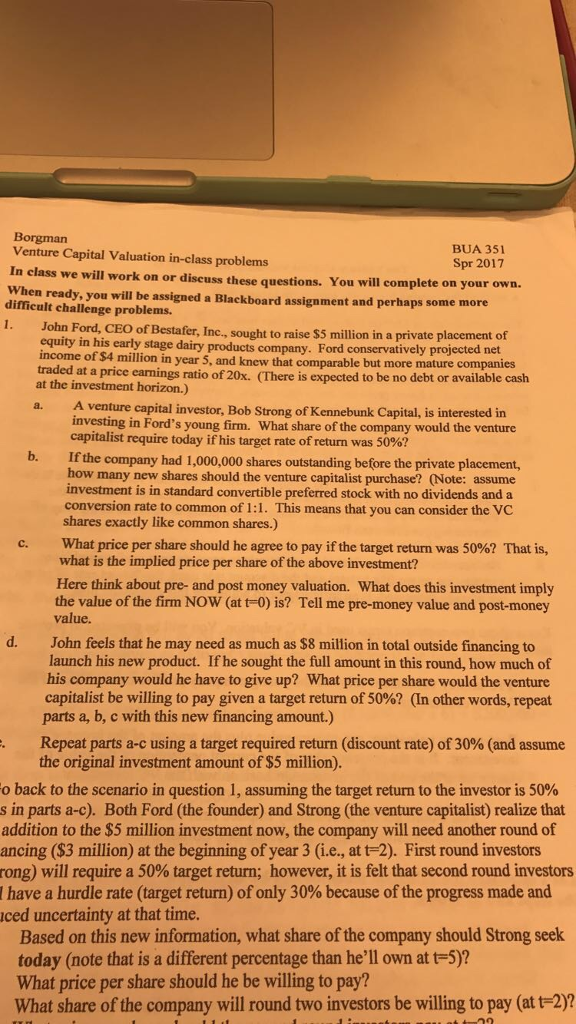

This is a continuation of the problem we did in class, the one where John Ford starts a firm Bestafer and Bob Strong is the venture capitalist. It is not really hard but it might make you think a little. The situation is as follows: John Ford, CEO of Bestafer, Inc., sought to raise $5 million in a private placement of equity in his early stage dairy products company. Ford conservatively projected net income of $4 million in year 5, and knew that comparable but more mature companies traded at a price earnings ratio of 20x. The venture capitalist, Bob Strong, has a 50% target rate of return. Ford has 1,000,000 shares. (There is expected to be no debt or available cash at the investment horizon.) All this is as before.

But here is what is different: Bob Strong of Kennebunk Capital liked Ford's plan, but thought it naive in one respect: to recruit a senior management team, he felt Ford would have to grant generous stock options in addition to the salaries projected in his business plan. From past experience, he felt management should have the ability to own at least a 15% share of the company by the end of year 5 (at t=5). That is, management will be rewarded with stock options that Strong feels will result in these managers (not including Ford) owning 15% of all shares as of t=5. (Those shares will not be issued at t=0)

Given these beliefs, how many shares should Strong insist on today if his target rate of return is 50%? (The assumption here is that a wise venture capitalist will anticipate this 15% management pool at the time of the financing.) Assume that $5 million must be invested now. Do not use commas in your answer.

1.The same scenario. What price per share at t=0 does that represent? Answer in dollar to two decimal places, but do not use the dollar sign.

2.The final question. The same scenario. What percentage of the firm does Strong obtain at t=0? (Remember the shares in the management pool are anticipated but not yet issued at t=0.) Please answer in decimal form to 4 places.

BUA 351 Venture Capital valuation in-class problems In class Spr 2017 we will work on or discuss these questions. You will comple on your own ready, will assigned a Blackboard assignment and perhaps some more difficult challenge problems. John Ford, CEO of Bestafer, Inc., sought to raise $5 million in a private placement of equity in his early stage dairy products company. Fo atively projected net income of $4 million in year 5, and knew that comparable but more mature companies xpected to be no debt or available cash at the investment horizon.) venture capital investor, Bob Strong of Kennebunk Capital, is interested in A investing in Ford's young firm. What share of the company would the venture capitalist require today if his target rate of return was 50 b. If the company had 1,000,000 shares outstanding before the private placement, how many new shares should the venture capitalist purchase? (Note: assume investment is in standard convertible preferred stock with no dividends and a conversion rate to common of 1:1. This means that you can consider VC the shares exactly like common shares.) What price per share should he agree to pay if the target return was 50%? That is what is the implied price per share of the above investment? Here think about pre- and post money valuation. What does this investment imply the value of the firm Now (at t-0) is? Tell me pre-money value and post-money John feels that he may need as much as $8 mi on in total outside financing to launch his new product. If he sought the full amount in this round, how much of his company would he have to give up? What price per share would the venture capitalist be willing to pay given a target return of 50%? (n other words, repeat parts a, b, c with this new financing amount.) Repeat parts a-c using a target required return (discount rate) of 30% (and assume the original investment amount of $5 million) o back to the scenario in question 1, assuming the target return to the investor is 50% s in parts a-c). Both Ford (the founder) and Strong (the venture capitalist) realize that addition to the $5 million investment now, the company will need another round of ancing ($3 million) at the beginning of year 3 (i.e., at t-2). First round investors rong) will require a 50% target return; however, it is felt that second round investors have a hurdle rate (target return) of only 30% because of the progress made and uced uncertainty at that time Based on this new information, what share of the company should Strong seek today (note that is a different percentage than he'll own at t-5)? What price per share should he be willing to pay? What share of the company will round two investors be willing to pay (at t-2)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started