Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Okapuka Tannery in Windhoek district runs a butchery on their farm in addition to other activities on the property. Okapuka Farm rears the cattle

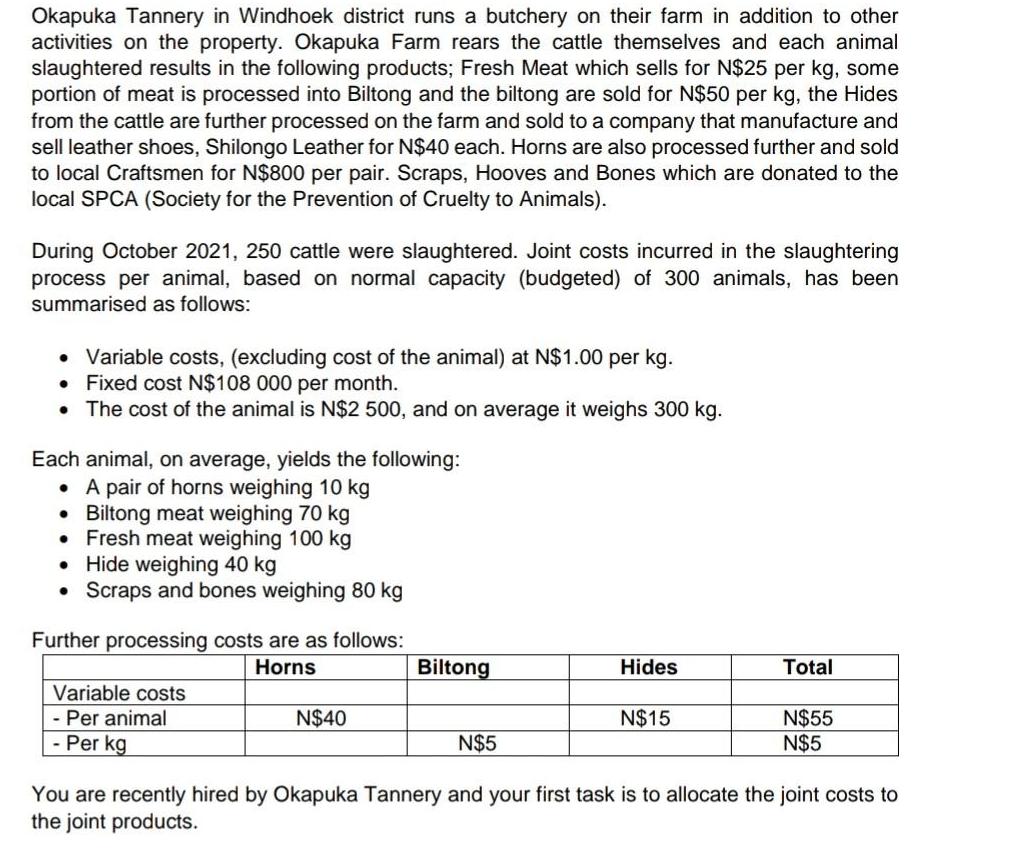

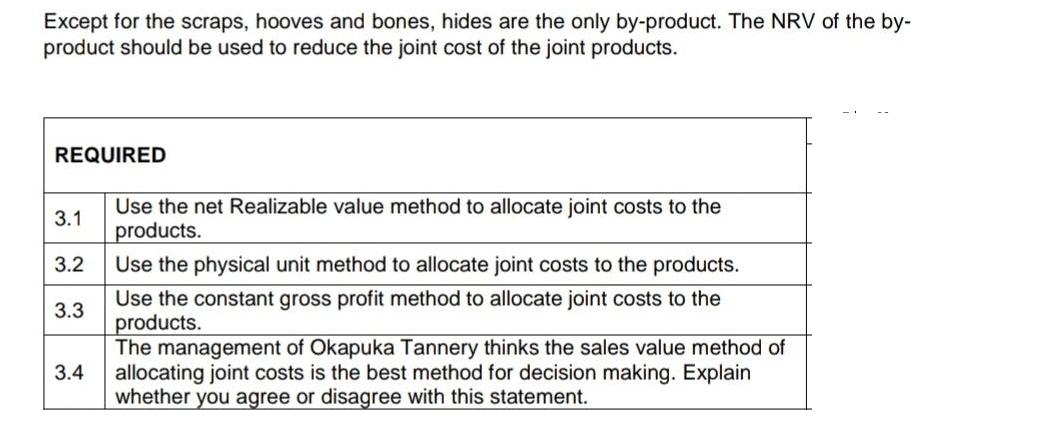

Okapuka Tannery in Windhoek district runs a butchery on their farm in addition to other activities on the property. Okapuka Farm rears the cattle themselves and each animal slaughtered results in the following products; Fresh Meat which sells for N$25 per kg, some portion of meat is processed into Biltong and the biltong are sold for N$50 per kg, the Hides from the cattle are further processed on the farm and sold to a company that manufacture and sell leather shoes, Shilongo Leather for N$40 each. Horns are also processed further and sold to local Craftsmen for N$800 per pair. Scraps, Hooves and Bones which are donated to the local SPCA (Society for the Prevention of Cruelty to Animals). During October 2021, 250 cattle were slaughtered. Joint costs incurred in the slaughtering process per animal, based on normal capacity (budgeted) of 300 animals, has been summarised as follows: Variable costs, (excluding cost of the animal) at N$1.00 per kg. Fixed cost N$108 000 per month. The cost of the animal is N$2 500, and on average it weighs 300 kg. Each animal, on average, yields the following: . A pair of horns weighing 10 kg Biltong meat weighing 70 kg Fresh meat weighing 100 kg Hide weighing 40 kg Scraps and bones weighing 80 kg Further processing costs are as follows: Horns Variable costs - Per animal - Per kg N$40 Biltong N$5 Hides N$15 Total N$55 N$5 You are recently hired by Okapuka Tannery and your first task is to allocate the joint costs to the joint products. Except for the scraps, hooves and bones, hides are the only by-product. The NRV of the by- product should be used to reduce the joint cost of the joint products. REQUIRED 3.1 3.2 3.3 3.4 Use the net Realizable value method to allocate joint costs to the products. Use the physical unit method to allocate joint costs to the products. Use the constant gross profit method to allocate joint costs to the products. The management of Okapuka Tannery thinks the sales value method of allocating joint costs is the best method for decision making. Explain whether you agree or disagree with this statement.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given information in the question Fresh M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started