okay i will update it

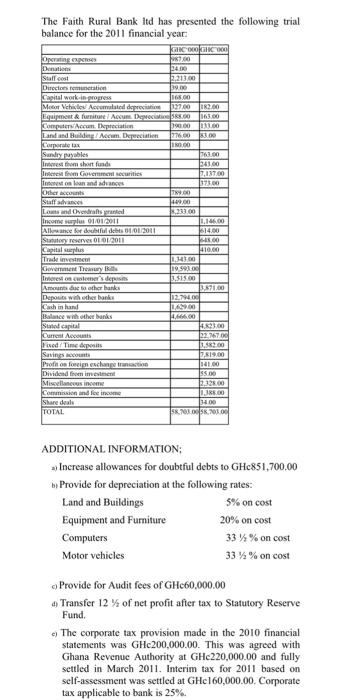

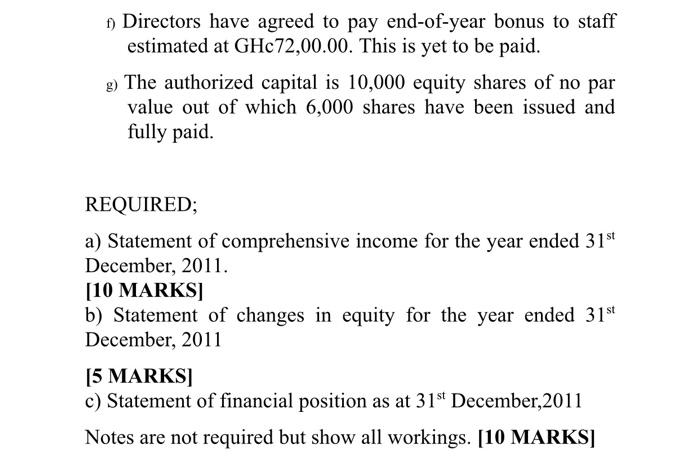

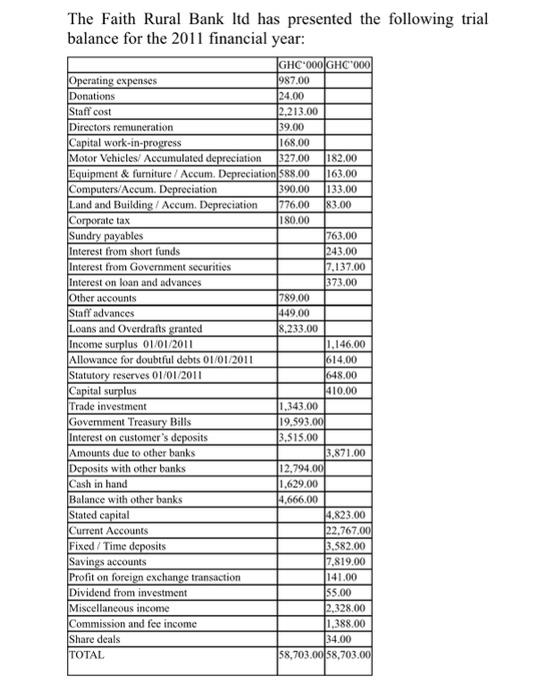

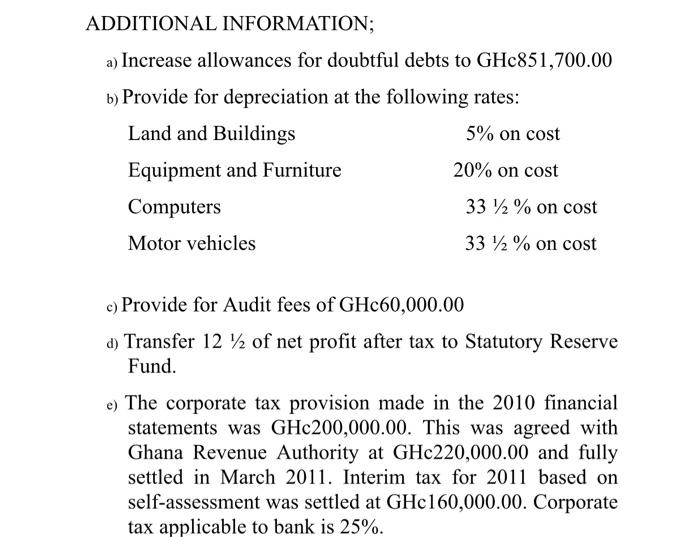

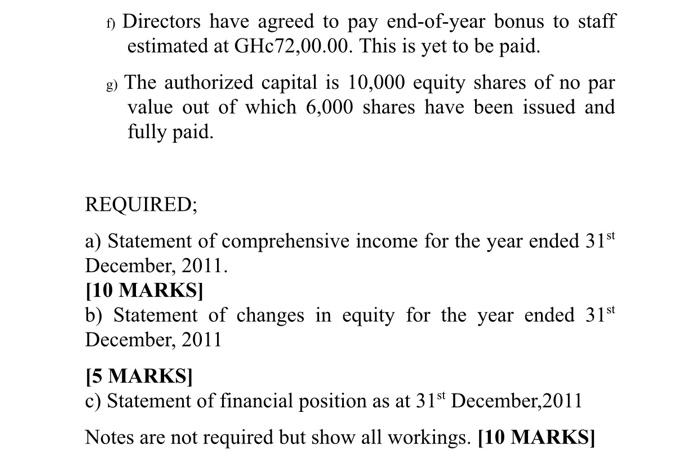

The Faith Rural Bank itd has presented the following trial balance for the 2011 financial year: 24.00 00 39.00 10.00 27.00 JUR 163.00 9000 101100 276.00 GO balo 17,137,00 10730 Operating expenses Denti Stallet Directions toetatic Capital work Mecor Vehicle Accumulated depreciation Equipment furniture Acum Computer Accum. Depreciation Land and Bucum. Decirten Corporate tax Sandry payables Interest tom short funds Interest Coveries Imetolon and advances Other Staffan Loma and Overdraftsgrundel Incomes 01/01/2011 Allenance for doubtfuldebts 01.01.2011 Stay reserves IOI 2011 Capital surplus : Trade mest Gover Towy Interest ones deposits Amount to other hanks Depouts with the bank Cath in hand Balance with the banks Stato capital Current Accounts Hive/Time depois Savings Profit on foreign exchana Dividend investment Miscellanesino Commission and lice income Share dal TOTAL 149.00 233.00 1.146.00 $14.00 00 410.00 0.00 1959,00 1.515.00 1.571.00 020 0.00 4.66.00 23.00 PM 17.519.00 1000 SS. 100 11.10 11:40 58.70100 SR, 2030 ADDITIONAL INFORMATION: - Increase allowances for doubtful debts to GHc851.700.00 by Provide for depreciation at the following rates: Land and Buildings 5% on cost Equipment and Furniture 20% on cost Computers 33 %% on cost Motor vehicles 33 %% on cost Provide for Audit fees of GH060,000.00 Transfer 12 % of net profit after tax to Statutory Reserve Fund. The corporate tax provision made in the 2010 financial statements was GHc200,000.00. This was agreed with Ghana Revenue Authority at GHc220,000.00 and fully settled in March 2011. Interim tax for 2011 based on self-assessment was settled at GHc160,000.00. Corporate tax applicable to bank is 25% f) Directors have agreed to pay end-of-year bonus to staff estimated at GHc72,00.00. This is yet to be paid. g) The authorized capital is 10,000 equity shares of no par value out of which 6,000 shares have been issued and fully paid. REQUIRED; a) Statement of comprehensive income for the year ended 31st December, 2011. [10 MARKS] b) Statement of changes in equity for the year ended 31st December, 2011 [5 MARKS] c) Statement of financial position as at 31st December,2011 Notes are not required but show all workings. [10 MARKS] The Faith Rural Bank itd has presented the following trial balance for the 2011 financial year: 24.00 00 39.00 10.00 27.00 JUR 163.00 9000 101100 276.00 GO balo 17,137,00 10730 Operating expenses Denti Stallet Directions toetatic Capital work Mecor Vehicle Accumulated depreciation Equipment furniture Acum Computer Accum. Depreciation Land and Bucum. Decirten Corporate tax Sandry payables Interest tom short funds Interest Coveries Imetolon and advances Other Staffan Loma and Overdraftsgrundel Incomes 01/01/2011 Allenance for doubtfuldebts 01.01.2011 Stay reserves IOI 2011 Capital surplus : Trade mest Gover Towy Interest ones deposits Amount to other hanks Depouts with the bank Cath in hand Balance with the banks Stato capital Current Accounts Hive/Time depois Savings Profit on foreign exchana Dividend investment Miscellanesino Commission and lice income Share dal TOTAL 149.00 233.00 1.146.00 $14.00 00 410.00 0.00 1959,00 1.515.00 1.571.00 020 0.00 4.66.00 23.00 PM 17.519.00 1000 SS. 100 11.10 11:40 58.70100 SR, 2030 ADDITIONAL INFORMATION: - Increase allowances for doubtful debts to GHc851.700.00 by Provide for depreciation at the following rates: Land and Buildings 5% on cost Equipment and Furniture 20% on cost Computers 33 %% on cost Motor vehicles 33 %% on cost Provide for Audit fees of GH060,000.00 Transfer 12 % of net profit after tax to Statutory Reserve Fund. The corporate tax provision made in the 2010 financial statements was GHc200,000.00. This was agreed with Ghana Revenue Authority at GHc220,000.00 and fully settled in March 2011. Interim tax for 2011 based on self-assessment was settled at GHc160,000.00. Corporate tax applicable to bank is 25% ADDITIONAL INFORMATION; a) Increase allowances for doubtful debts to GHc851,700.00 b) Provide for depreciation at the following rates: Land and Buildings 5% on cost Equipment and Furniture 20% on cost Computers 332 % on cost Motor vehicles 33 2 % on cost c) Provide for Audit fees of GHc60,000.00 d) Transfer 12 12 of net profit after tax to Statutory Reserve Fund. e) The corporate tax provision made in the 2010 financial statements was GHc200,000.00. This was agreed with Ghana Revenue Authority at GHc220,000.00 and fully settled in March 2011. Interim tax for 2011 based on self-assessment was settled at GHc160,000.00. Corporate tax applicable to bank is 25%. f) Directors have agreed to pay end-of-year bonus to staff estimated at GHc72,00.00. This is yet to be paid. g) The authorized capital is 10,000 equity shares of no par value out of which 6,000 shares have been issued and fully paid. REQUIRED; a) Statement of comprehensive income for the year ended 31st December, 2011. [10 MARKS] b) Statement of changes in equity for the year ended 31st December, 2011 [5 MARKS] c) Statement of financial position as at 31st December,2011 Notes are not required but show all workings. [10 MARKS]