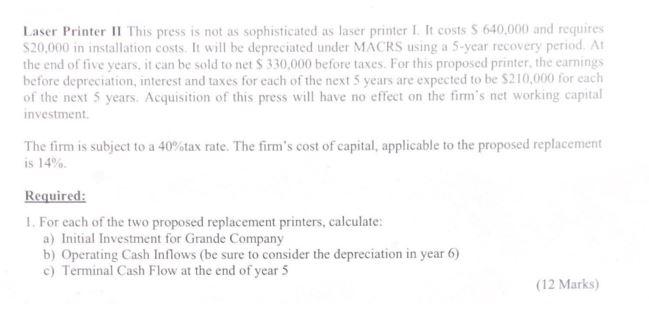

Old Laser Printer Originally purchased three years ago at an installed cost of $ 400,000, it is being depreciated under MACRS using a 5-year recovery period. The old press has a remaining economic life of 5 years. It can be sold today to net $ 420,000 before taxes, if it is retained, it can be sold to net $ 150,000 before taxes at the end of year 5. Earnings before depreciation, interest and taxes for the present printer are expected to be $120,000 for each of the successive 5 years, Laser Printer 1 This highly automated press can be purchased for S 830,000 and will require $ 40,000 installation costs. It will be depreciated under MACRS using a 5-year recovery period. At the end of the 5years, the machine could be sold to net $ 400,000 before taxes. If this machine is acquired, it is anticipated that the following current account changes would result an increase in cash $25,400, account payables will increase $35,000, inventories will decrease $20,000 and account receivables will increase $120,000. For this proposed printer, the expected earnings before depreciation, interest and taxes for each of the next 5 years are $250,000, $270,000, $300,000, 5330,000 and $370,000 respectively Laser Printer 1 This press is not as sophisticated as laser printer I. It costs $ 640,000 and requires $20,000 in installation costs. It will be depreciated under MACRS using a 5-year recovery period. At the end of five years, it can be sold to net $ 330,000 before taxes. For this proposed printer the earings before depreciation, interest and taxes for each of the next 5 years are expected to be $210,000 for each of the next 5 years. Acquisition of this press will have no effect on the firm's net working capital investment The firm is subject to a 40% tax rate. The firm's cost of capital, applicable to the proposed replacement is 14% Required: 1. For each of the two proposed replacement printers, calculate. a) Initial Investment for Grande Company b) Operating Cash Inflows (be sure to consider the depreciation in year 6) c) Terminal Cash Flow at the end of year 5 (12 Marks)