Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview A financial manager must choose between three alternative Assets: 1, 2, and 3. Each asset costs $40,000 and is expected to provide

Old MathJax webview

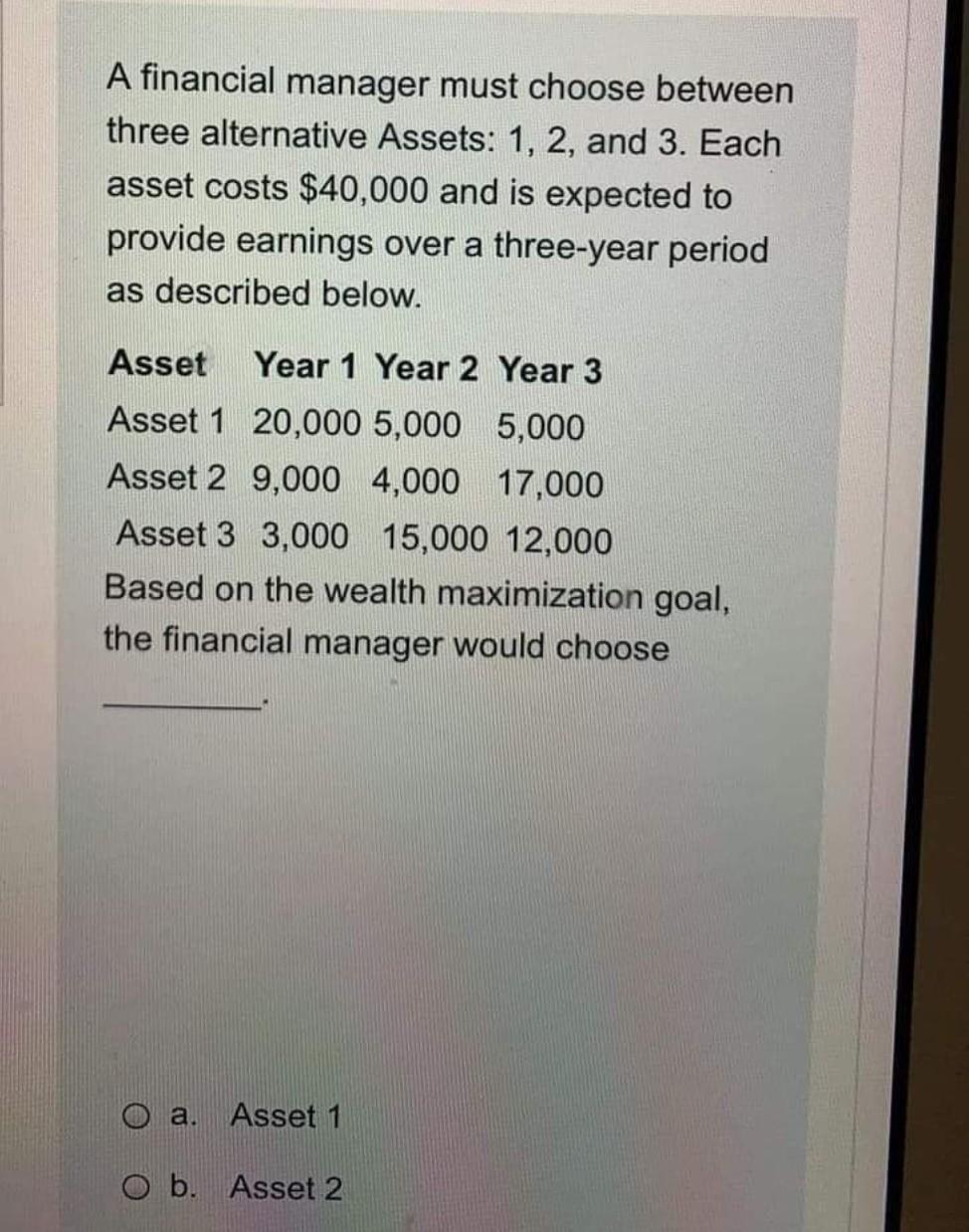

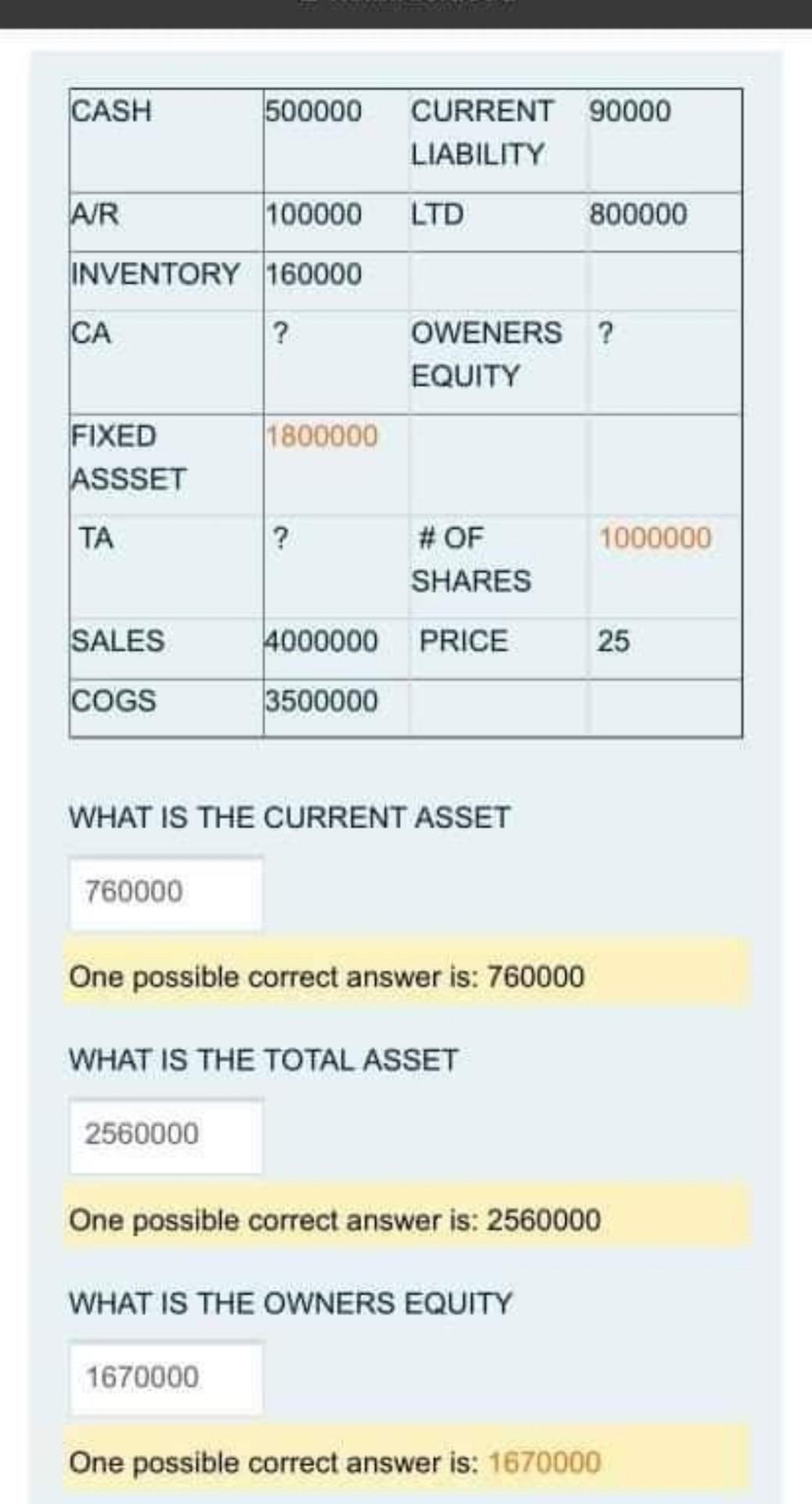

A financial manager must choose between three alternative Assets: 1, 2, and 3. Each asset costs $40,000 and is expected to provide earnings over a three-year period as described below. Asset Year 1 Year 2 Year 3 Asset 1 20,000 5,000 5,000 Asset 2 9,000 4,000 17,000 Asset 3 3,000 15,000 12,000 Based on the wealth maximization goal, the financial manager would choose O a. Asset 1 b. Asset 2 CASH 500000 CURRENT 90000 LIABILITY AIR 100000 LTD 800000 INVENTORY 160000 CA ? OWENERS? EQUITY 1800000 FIXED ASSSET TA ? 1000000 # OF SHARES SALES 4000000 PRICE 25 COGS 3500000 WHAT IS THE CURRENT ASSET 760000 One possible correct answer is: 760000 WHAT IS THE TOTAL ASSET 2560000 One possible correct answer is: 2560000 WHAT IS THE OWNERS EQUITY 1670000 One possible correct answer is: 1670000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started