Answered step by step

Verified Expert Solution

Question

1 Approved Answer

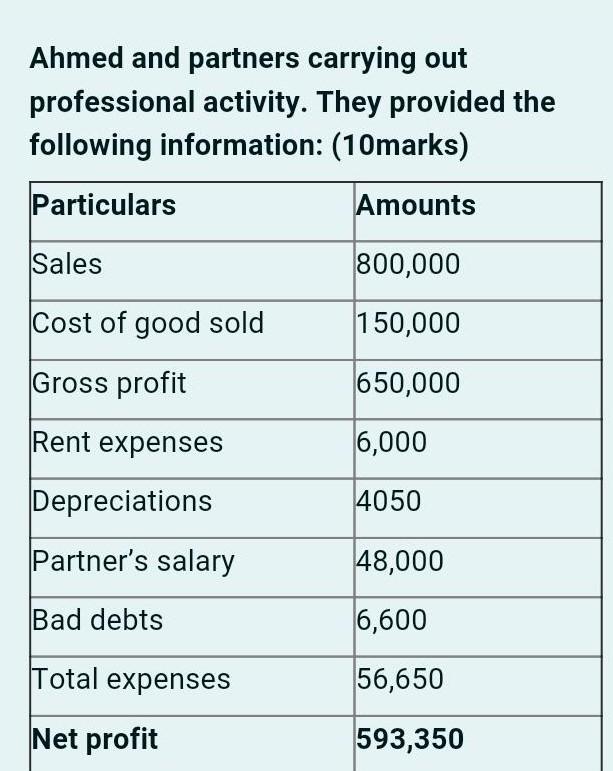

Old MathJax webview Ahmed and partners carrying out professional activity. They provided the following information: (10marks) Particulars Amounts Sales 800,000 Cost of good sold 150,000

Old MathJax webview

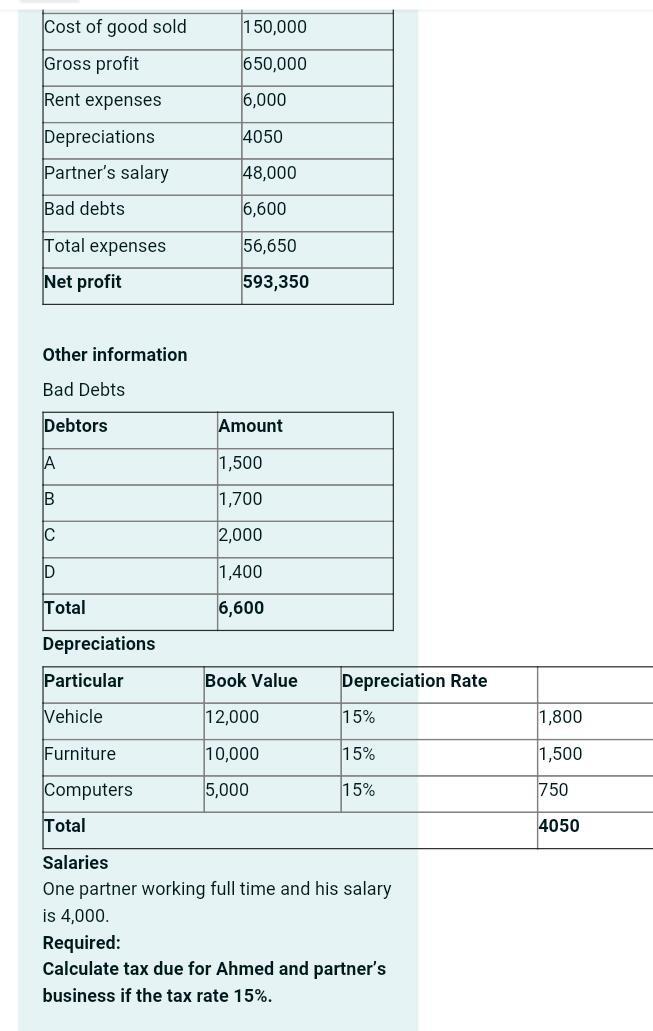

Ahmed and partners carrying out professional activity. They provided the following information: (10marks) Particulars Amounts Sales 800,000 Cost of good sold 150,000 Gross profit 650,000 Rent expenses 6,000 Depreciations 4050 Partner's salary 48,000 Bad debts 6,600 Total expenses 56,650 Net profit 593,350 150,000 Cost of good sold Gross profit 650,000 Rent expenses 6,000 Depreciations 4050 Partner's salary 48,000 Bad debts 6,600 56,650 Total expenses Net profit 593,350 Other information Bad Debts Debtors Amount A 1,500 1,700 IC 2,000 ID 1,400 Total 6,600 Depreciations Particular Book Value Depreciation Rate Vehicle 12,000 15% 1,800 Furniture 10,000 15% 1,500 Computers 5,000 15% 750 Total 4050 Salaries One partner working full time and his salary is 4,000 Required: Calculate tax due for Ahmed and partner's business if the tax rate 15%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started