Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview ASAP Question No.2: Marks (25), Approx. Time (60 MIN) PART (A) Marks (10) / Time 30 minutes Novus Nyet Company has two

Old MathJax webview

ASAP

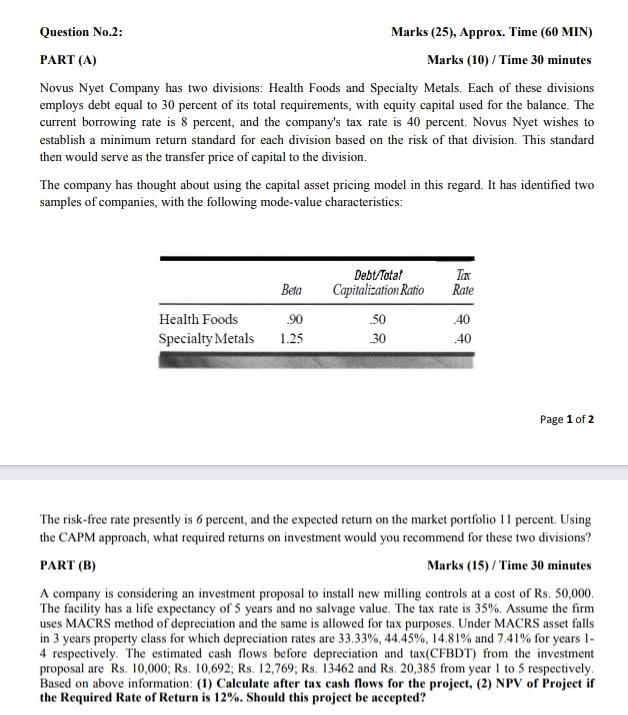

Question No.2: Marks (25), Approx. Time (60 MIN) PART (A) Marks (10) / Time 30 minutes Novus Nyet Company has two divisions: Health Foods and Specialty Metals. Each of these divisions employs debt equal to 30 percent of its total requirements, with equity capital used for the balance. The current borrowing rate is 8 percent, and the company's tax rate is 40 percent. Novus Nyet wishes to establish a minimum return standard for each division based on the risk of that division. This standard then would serve as the transfer price of capital to the division. The company has thought about using the capital asset pricing model in this regard. It has identified two samples of companies, with the following mode-value characteristics: Beta Debt Total Capitalization Ratio Tax Rate Health Foods 90 .50 .40 Specialty Metals 1.25 30 .40 Page 1 of 2 The risk-free rate presently is 6 percent, and the expected return on the market portfolio 11 percent. Using the CAPM approach, what required returns on investment would you recommend for these two divisions? PART (B) Marks (15)/Time 30 minutes A company is considering an investment proposal to install new milling controls at a cost of Rs. 50,000 The facility has a life expectancy of 5 years and no salvage value. The tax rate is 35%. Assume the firm uses MACRS method of depreciation and the same is allowed for tax purposes. Under MACRS asset falls in 3 years property class for which depreciation rates are 33.33%, 44.45%, 14.81% and 7.41% for years 1- 4 respectively. The estimated cash flows before depreciation and tax(CFBDT) from the investment proposal are Rs 10,000; Rs. 10,692, Rs. 12,769; Rs. 13462 and Rs 20,385 from year 1 to 5 respectively, Based on above information: (1) Calculate after tax cash flows for the project, (2) NPV of Project if the Required Rate of Return is 12%. Should this project be accepted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started