Answered step by step

Verified Expert Solution

Question

1 Approved Answer

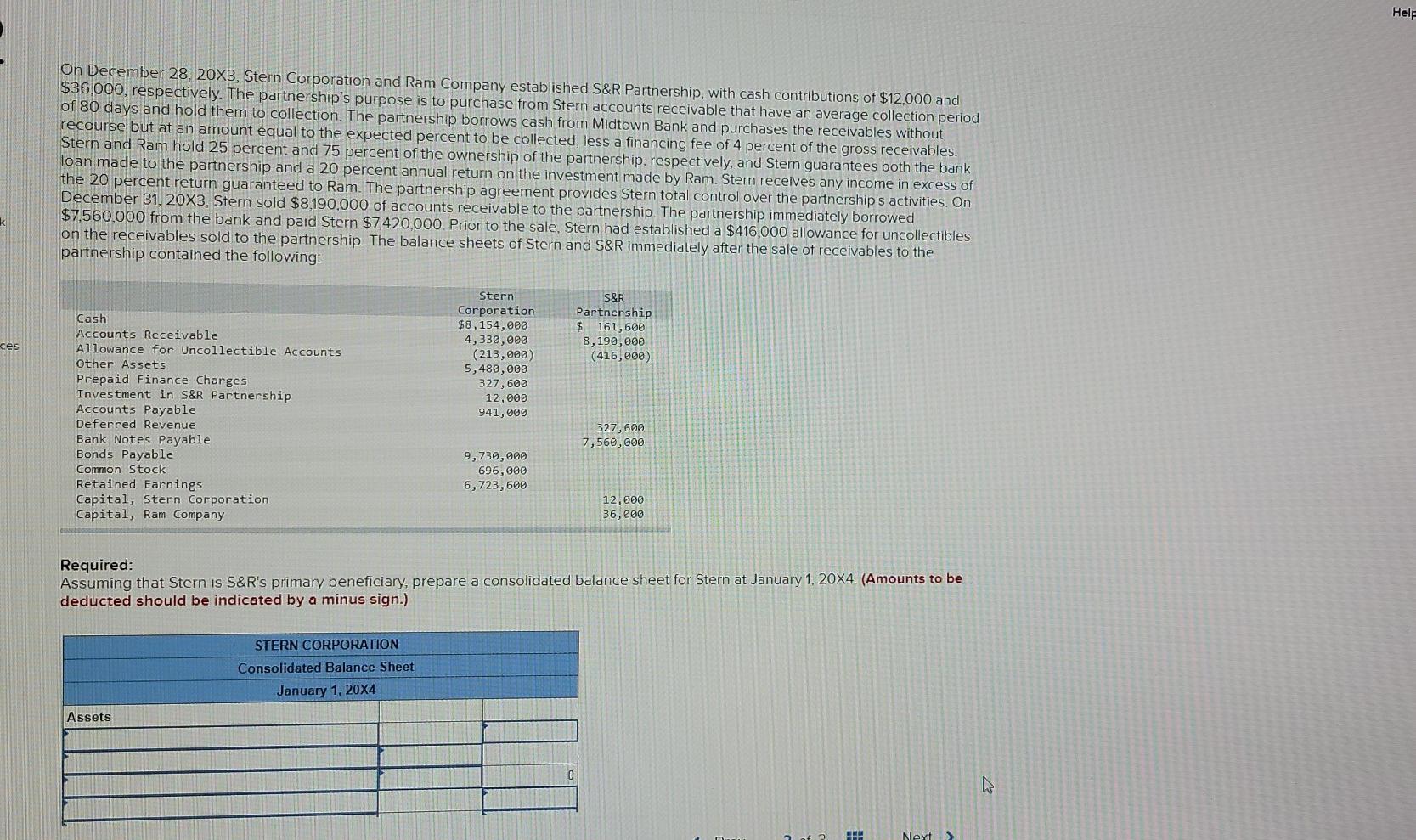

Old MathJax webview Hele On December 28, 20X3, Stern Corporation and Ram Company established S&R Partnership, with cash contributions of $12,000 and $36.000, respectively. The

Old MathJax webview

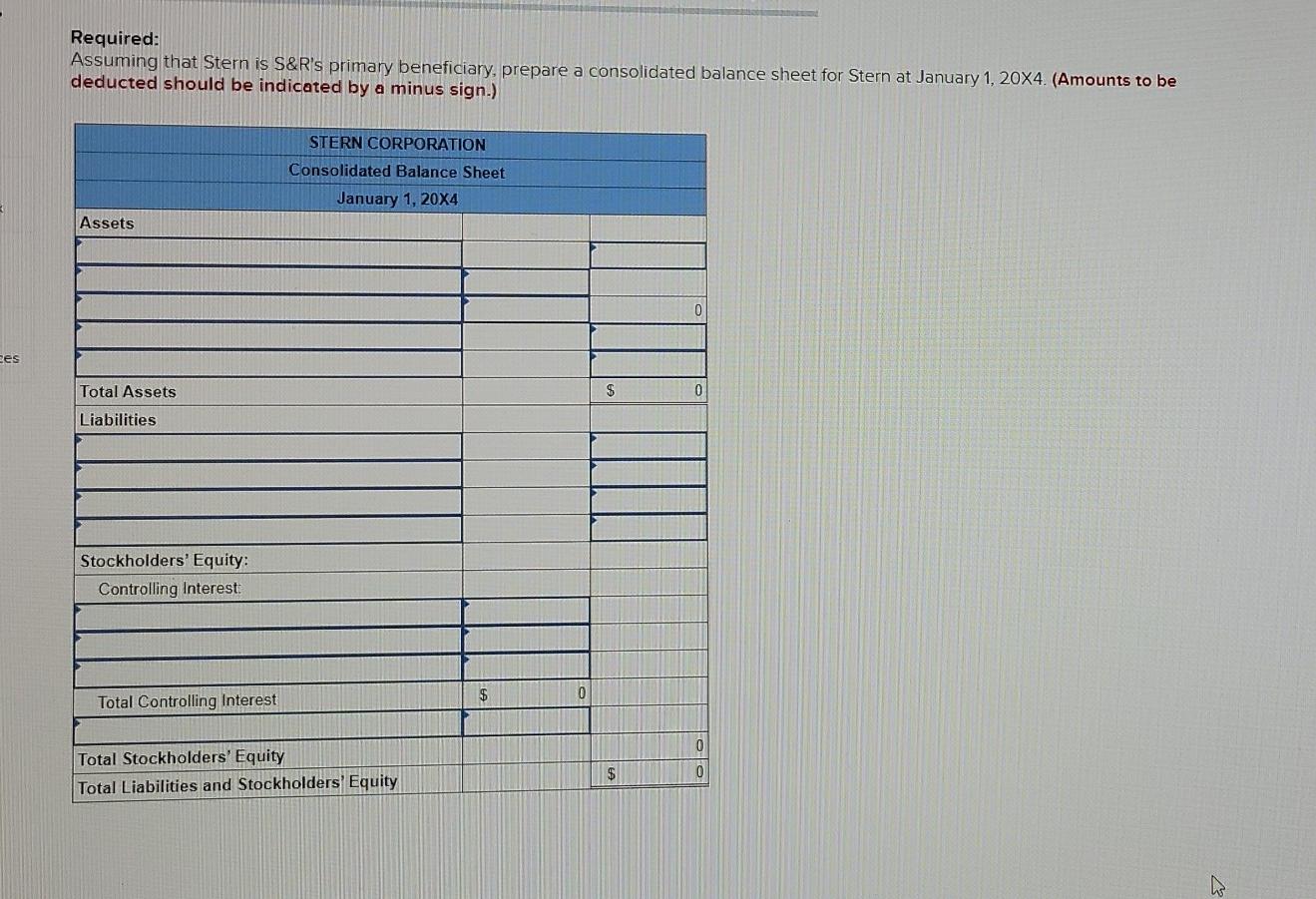

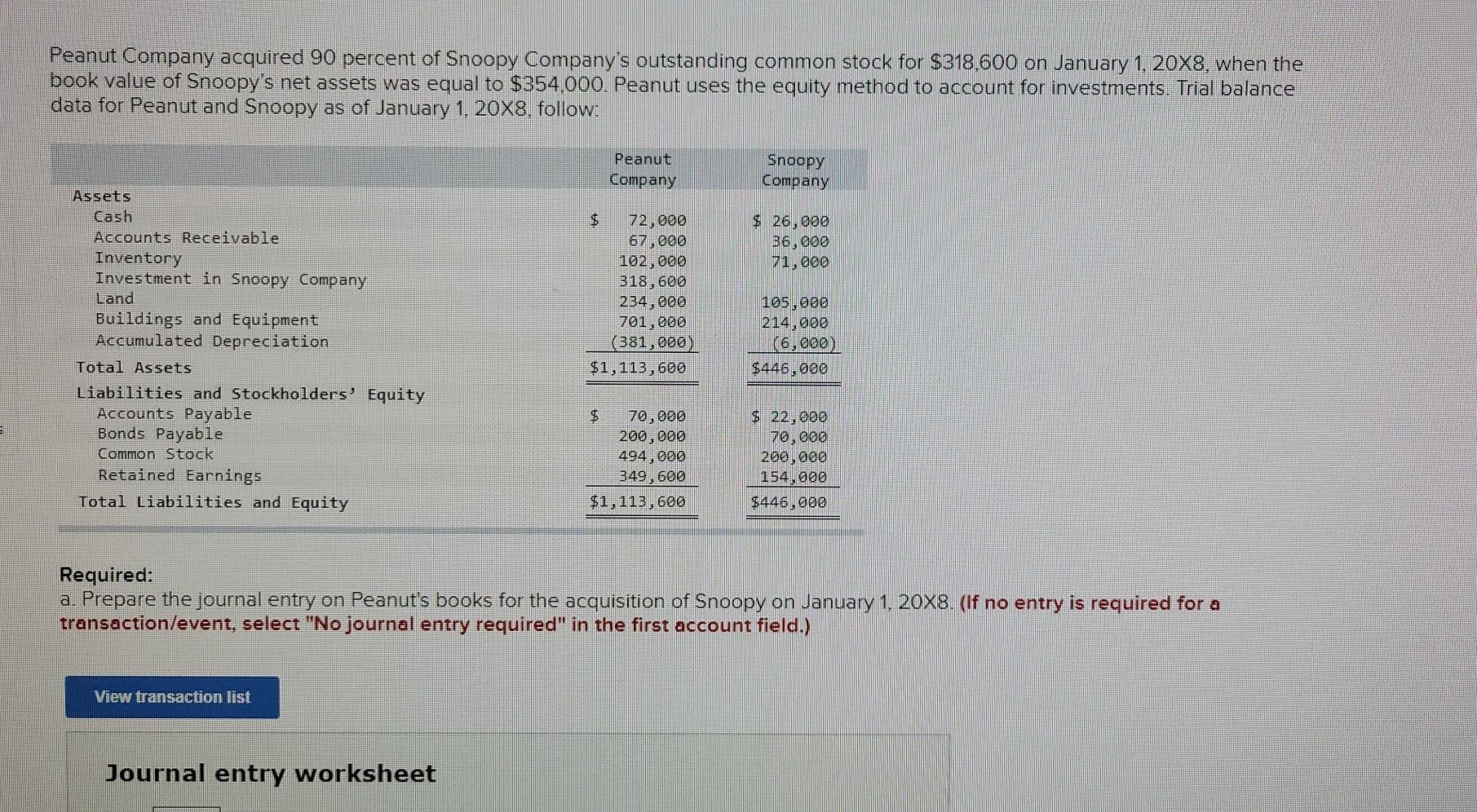

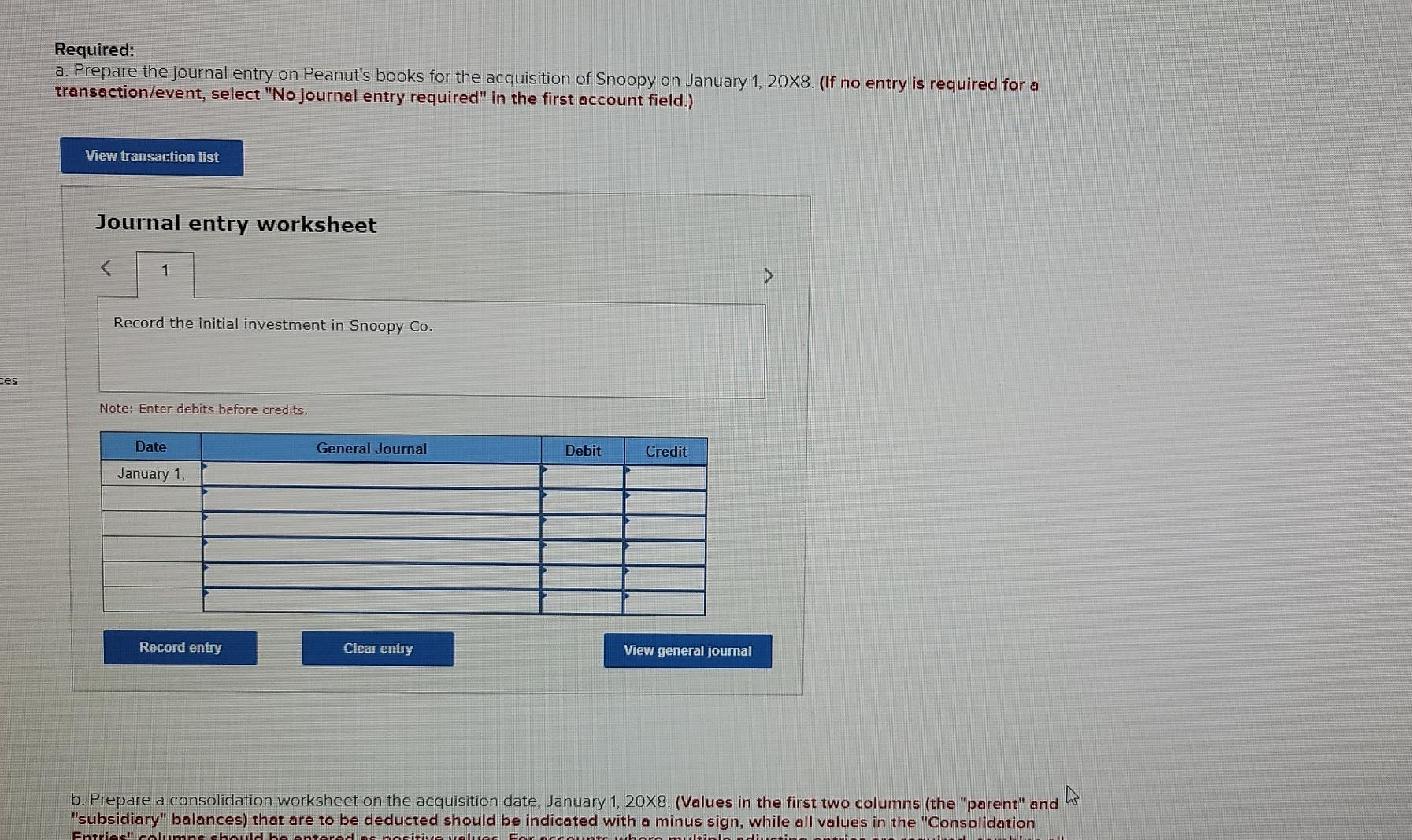

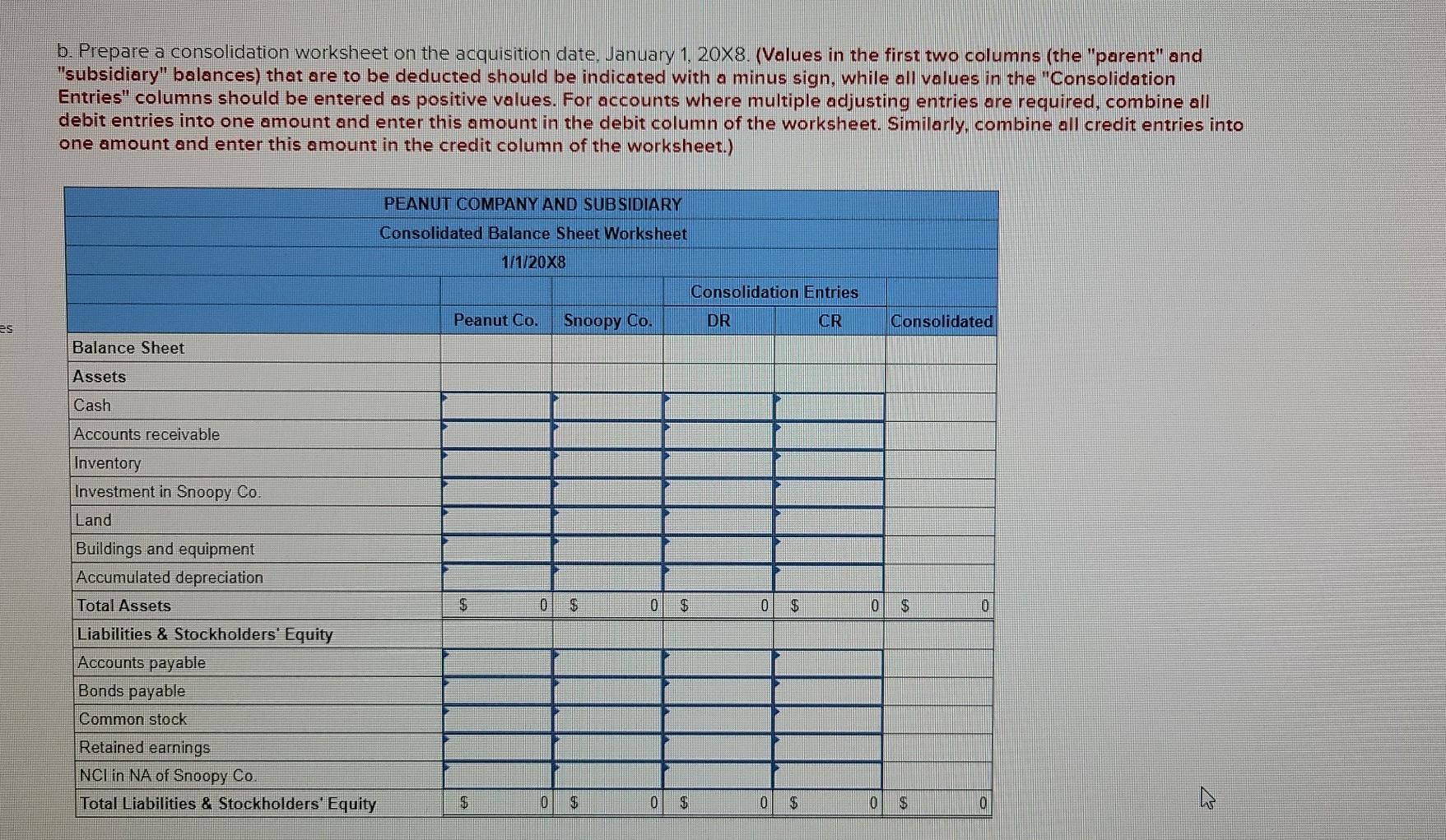

Hele On December 28, 20X3, Stern Corporation and Ram Company established S&R Partnership, with cash contributions of $12,000 and $36.000, respectively. The partnership's purpose is to purchase from Stern accounts receivable that have an average collection period of 80 days and hold them to collection. The partnership borrows cash from Midtown Bank and purchases the receivables without recourse but at an amount equal to the expected percent to be collected, less a financing fee of 4 percent of the gross receivables. Stern and Ram hold 25 percent and 75 percent of the ownership of the partnership, respectively, and Stern guarantees both the bank loan made to the partnership and a 20 percent annual return on the investment made by Ram. Stern receives any income in excess of the 20 percent return guaranteed to Ram. The partnership agreement provides Stern total control over the partnership's activities. On December 31, 20X3, Stern sold $8,190,000 of accounts receivable to the partnership. The partnership immediately borrowed $7,560,000 from the bank and paid Stern $7,420,000. Prior to the sale, Stern had established a $416,000 allowance for uncollectibles on the receivables sold to the partnership. The balance sheets of Stern and S&R immediately after the sale of receivables to the partnership contained the following: S&R Partnership $ 161,600 8,190,000 (416,000) ces Stern Corporation $8,154,000 4,330,000 (213,000) 5,480,000 327,600 12,000 941,000 Cash Accounts Receivable Allowance for Uncollectible Accounts Other Assets Prepaid Finance Charges Investment in S&R Partnership Accounts Payable Deferred Revenue Bank Notes Payable Bonds Payable Common Stock Retained Earnings Capital, Stern Corporation Capital, Ram Company 327,600 7,560,000 9,730,000 696,000 6,723,600 12,000 36,000 Required: Assuming that Stern is S&R's primary beneficiary, prepare a consolidated balance sheet for Stern at January 1, 20X4. (Amounts to be deducted should be indicated by a minus sign.) STERN CORPORATION Consolidated Balance Sheet January 1, 20X4 Assets FEH Neyt Required: Assuming that Stern is S&R's primary beneficiary, prepare a consolidated balance sheet for Stern at January 1, 20X4. (Amounts to be deducted should be indicated by a minus sign.) STERN CORPORATION Consolidated Balance Sheet January 1, 20X4 Assets 0 ees Total Assets $ 0 Liabilities Stockholders' Equity: Controlling Interest: $ 0 Total Controlling Interest 0 Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ 0 Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $318,600 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $354,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of January 1, 20X8. follow: Peanut Company Snoopy Company $ 26,000 36,000 71, 800 Assets Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Accumulated Depreciation Total Assets Liabilities and Stockholders' Equity Accounts Payable Bonds Payable Common Stock Retained Earnings Total Liabilities and Equity $ 72,000 67,000 102,000 318,600 234,000 701,000 (381, 000) $1,113,600 105,000 214,000 (6, 000) $446,000 $ 5 70,000 200,000 494, 000 349,600 $1,113,600 $ 22,000 70,000 200,000 154,000 $446,000 Required: a. Prepare the journal entry on Peanut's books for the acquisition of Snoopy on January 1, 20X8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Required: a. Prepare the journal entry on Peanut's books for the acquisition of Snoopy on January 1, 20X8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the initial investment in Snoopy Co. ces Note: Enter debits before credits. Date General Journal Debit Credit January 1 Record entry Clear entry View general journal b. Prepare a consolidation worksheet on the acquisition date, January 1, 20X8. (Values in the first two columns (the parent" and a "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entriello limeenteraadi teema are made b. Prepare a consolidation worksheet on the acquisition date, January 1, 20X8. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) PEANUT COMPANY AND SUBSIDIARY Consolidated Balance Sheet Worksheet 1/120X8 Consolidation Entries Peanut Co. DR Snoopy Co. CR es Consolidated Balance Sheet Assets Cash Accounts receivable $ 0 $ 0 $ 0 $ 0 $ 0 Inventory Investment in Snoopy Co. Land Buildings and equipment Accumulated depreciation Total Assets Liabilities & Stockholders' Equity Accounts payable Bonds payable Common stock Retained earnings NCI in NA of Snoopy Co. Total Liabilities & Stockholders' Equity $ 10 $ 0 $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started