Answered step by step

Verified Expert Solution

Question

1 Approved Answer

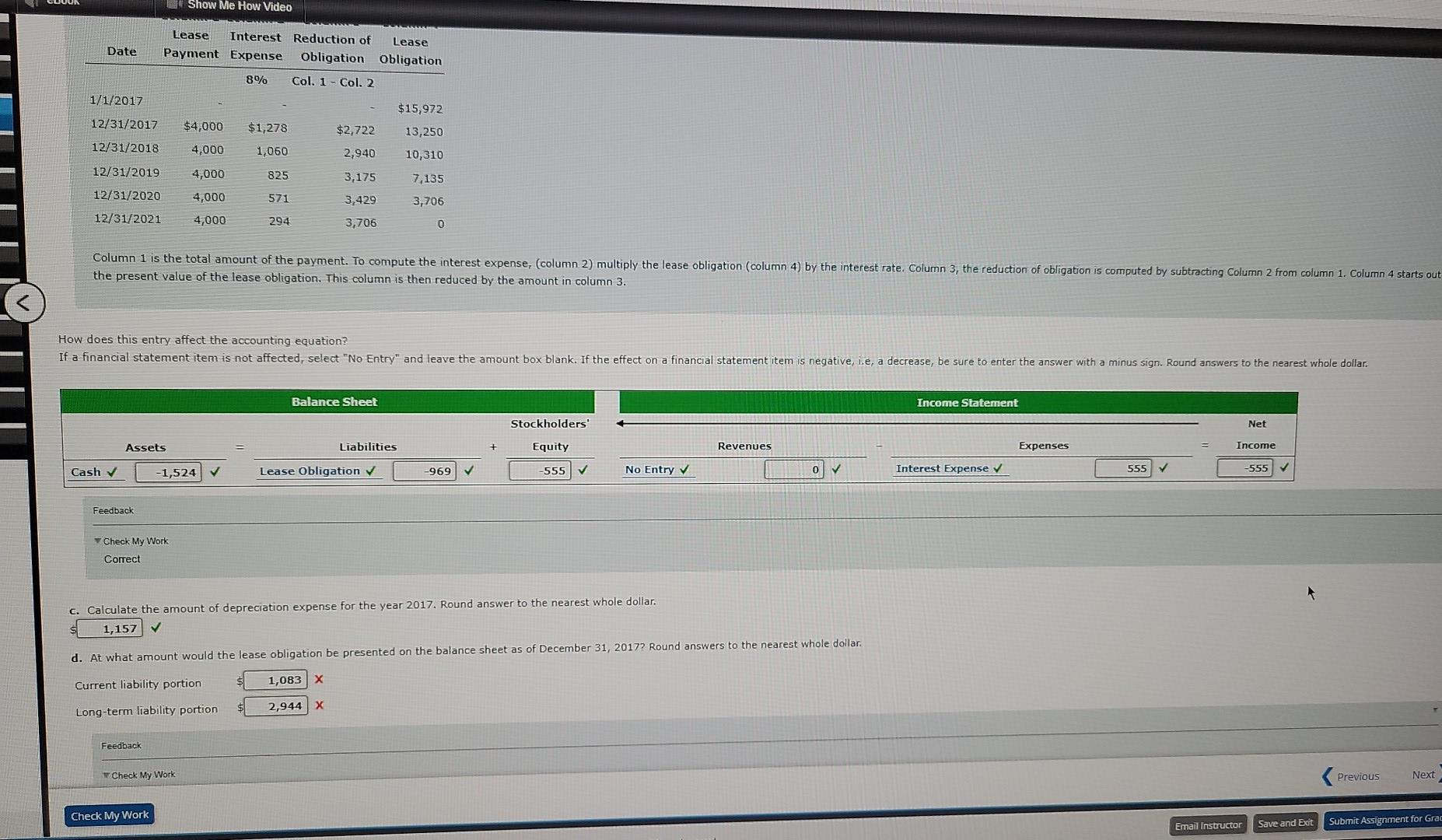

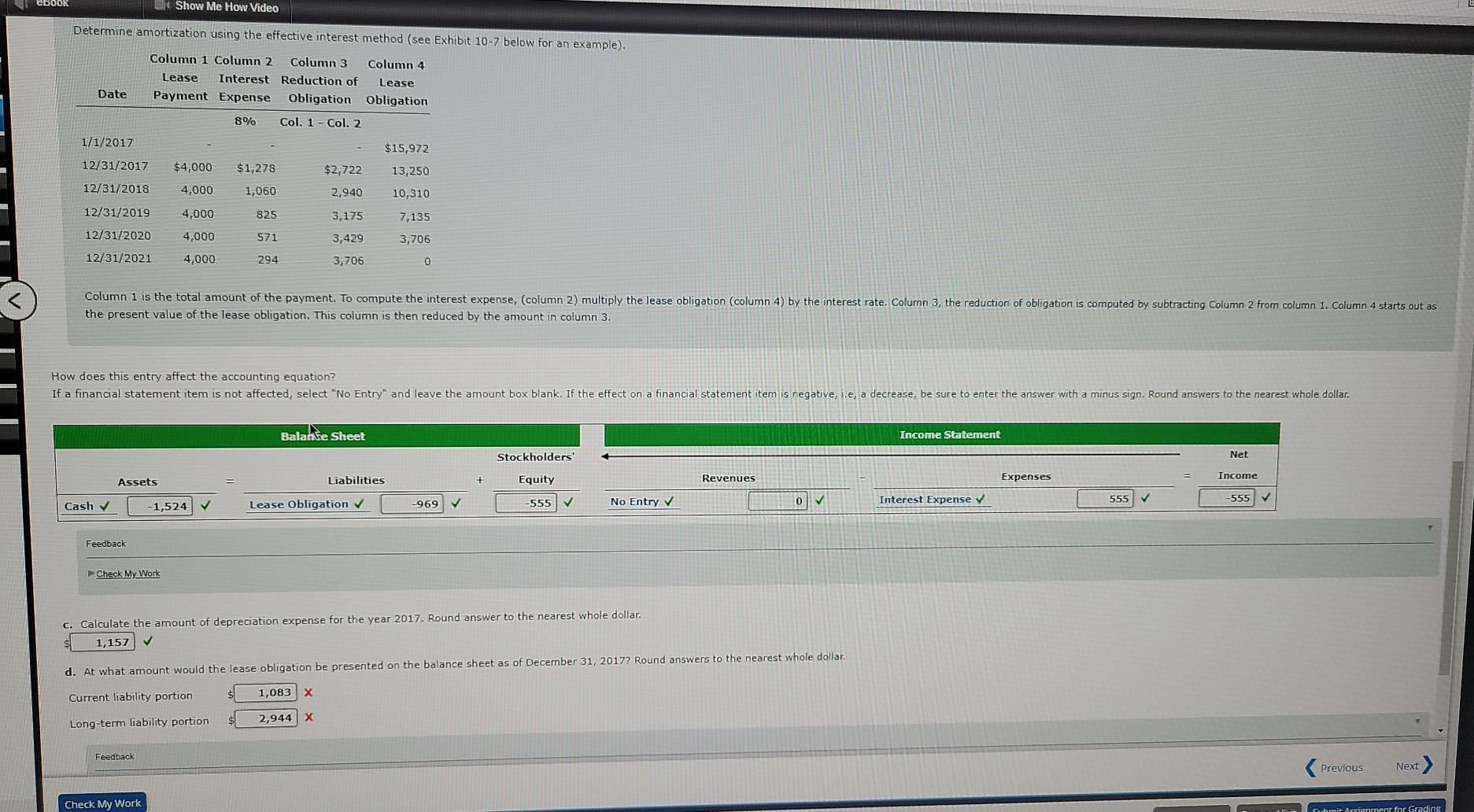

Old MathJax webview Just need the (d) answered Show Me How Video Lease Interest Reduction of Lease Payment Expense Obligation Obligation Date 8% Col. 1

Old MathJax webview

Just need the (d) answered

Show Me How Video Lease Interest Reduction of Lease Payment Expense Obligation Obligation Date 8% Col. 1 - Col. 2 1/1/2017 12/31/2017 $15,972 13,250 $4,000 $1,278 $2,722 12/31/2018 4,000 1,060 2,940 12/31/2019 10,310 7,135 4,000 825 3,175 12/31/2020 4,000 571 3,429 3,706 12/31/2021 4,000 294 3,706 0 Column 1 is the total amount of the payment. To compute the interest expense, (column 2) multiply the lease obligation (column 4) by the interest rate. Column 3, the reduction of obligation is computed by subtracting Column 2 from column 1 Column 4 starts out the present value of the lease obligation. This column is then reduced by the amount in column 3. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, ie, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar. Balance Sheet Income Statement Stockholders Net Assets Liabilities Equity Revenues Expenses Income Cash -1,524 Lease Obligation -969 -555 No Entry 555 Interest Expense -555 Feedback Check My Work Correct C. Calculate the amount of depreciation expense for the year 2017. Round answer to the nearest whole dollar. 1,157 d. At what amount would the lease obligation be presented on the balance sheet as of December 31, 20172 Round answers to the nearest whole dollar. Current liability portion 1,083 x Long-term liability portion 2,944 X Feedback * Check My Work Previous Next Check My Work Email Instructor Save and Edt Submit Assignment for Grad EBOOK Show Me How Video Determine amortization using the effective interest method (see Exhibit 10-7 below for an example). Column 1 Column 2 Column 3 Column 4 Lease Interest Reduction of Lease Payment Expense Obligation Obligation 8% Col. 1 - Col. 2 Date 1/1/2017 $15,972 12/31/2017 $4,000 $1,278 $2,722 13,250 12/31/2018 4,000 1,060 2,940 10,310 12/31/2019 4,000 825 3,175 7,135 12/31/2020 571 3,429 3,706 4,000 4,000 12/31/2021 294 3,706 C Column 1 is the total amount of the payment. To compute the interest expense, (column 2) multiply the lease obligation (column 4) by the interest rate. Column 3, the reduction of obligation is computed by subtracting Column 2 from column 1 Column 4 starts out as the present value of the lease obligation. This column is then reduced by the amount in column 3. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar. Balance Sheet Income Statement Stockholders Net Assets Liabilities Equity Revenues Expenses Income -1,524 555 Cash Lease Obligation Interest Expense -555 -555 No Entry -969 Feedback Check My Work c. Calculate the amount of depreciation expense for the year 2017. Round answer to the nearest whole dollar. 1,157 d. At what amount would the lease obligation be presented on the balance sheet as of December 31, 2017? Round answers to the nearest whole dollar Current liability portion 1,083 x 2,944 x Long-term liability portion Feedback Previous Next Check My Work Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started