Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please answer all questions correct i post this third time questions is complete QUESTION 3 We are evaluating a project that costs

Old MathJax webview

please answer all questions correct i post this third time

questions is complete

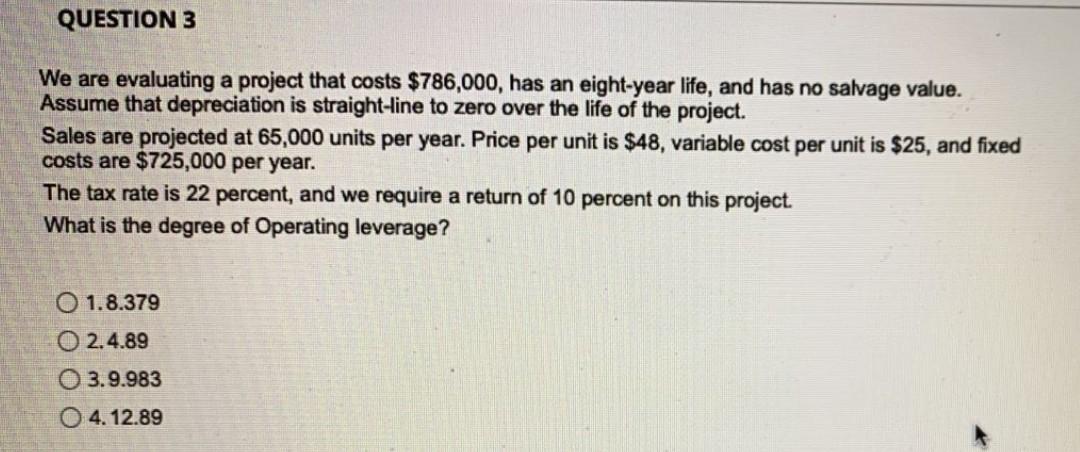

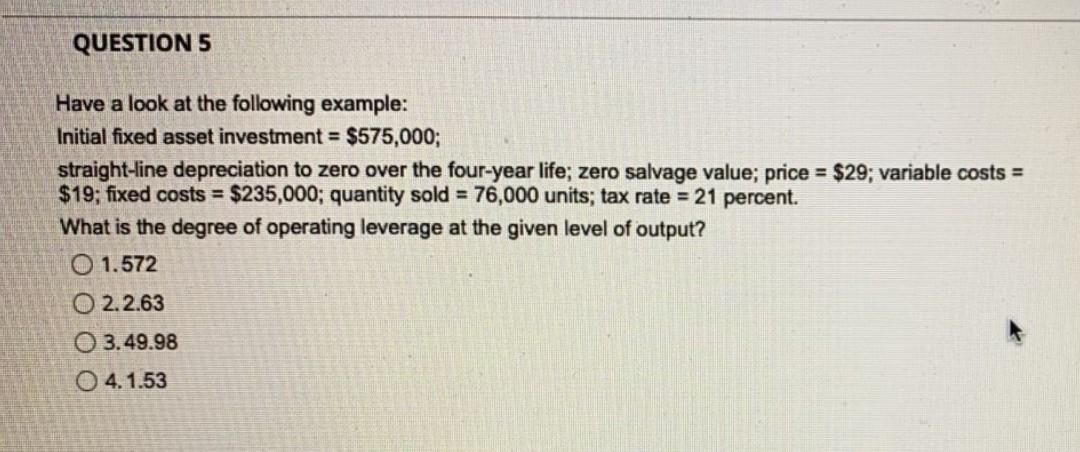

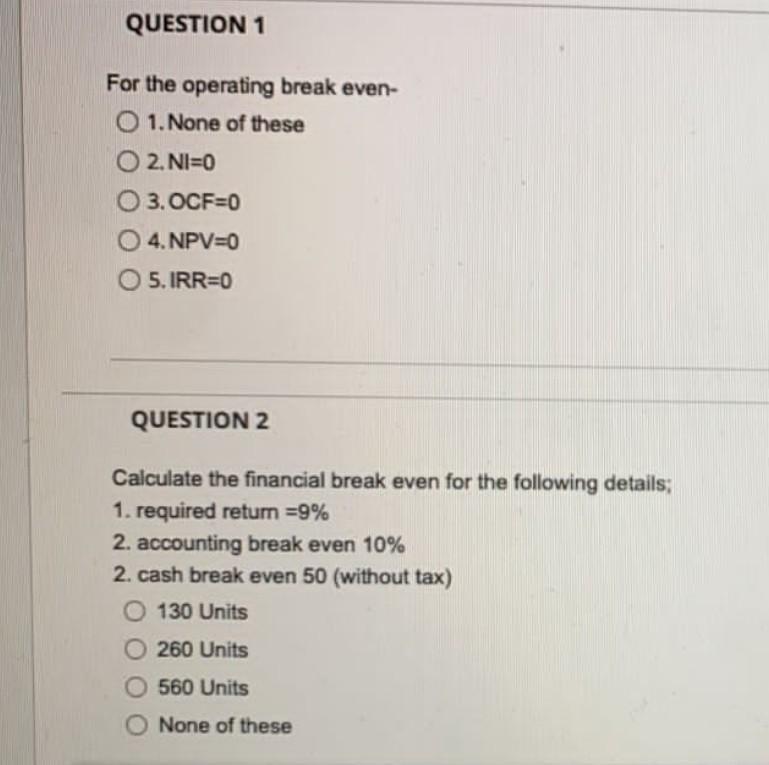

QUESTION 3 We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. What is the degree of Operating leverage ? O 1.8.379 O 2.4.89 0 3.9.983 04.12.89 QUESTION 5 Have a look at the following example: a Initial fixed asset investment = $575,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $29; variable costs = $19; fixed costs = $235,000; quantity sold = 76,000 units; tax rate = 21 percent. What is the degree of operating leverage at the given level of output? O 1.572 O 2.2.63 O 3.49.98 0 4. 1.53 QUESTION 1 For the operating break even- O 1. None of these O 2. NI=0 O 3. OCF=0 4.NPV=0 O 5. IRR=0 QUESTION 2 Calculate the financial break even for the following details; 1. required return =9% 2. accounting break even 10% 2. cash break even 50 (without tax) O 130 Units 0 260 Units 560 Units None of these QUESTION 3 We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. What is the degree of Operating leverage ? O 1.8.379 O 2.4.89 0 3.9.983 04.12.89 QUESTION 5 Have a look at the following example: a Initial fixed asset investment = $575,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $29; variable costs = $19; fixed costs = $235,000; quantity sold = 76,000 units; tax rate = 21 percent. What is the degree of operating leverage at the given level of output? O 1.572 O 2.2.63 O 3.49.98 0 4. 1.53 QUESTION 1 For the operating break even- O 1. None of these O 2. NI=0 O 3. OCF=0 4.NPV=0 O 5. IRR=0 QUESTION 2 Calculate the financial break even for the following details; 1. required return =9% 2. accounting break even 10% 2. cash break even 50 (without tax) O 130 Units 0 260 Units 560 Units None of theseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started