Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please Consider the following three stocks. (a) Stock Q is expected to pay a dividend of $2.20 per share forever no growth

Old MathJax webview

please

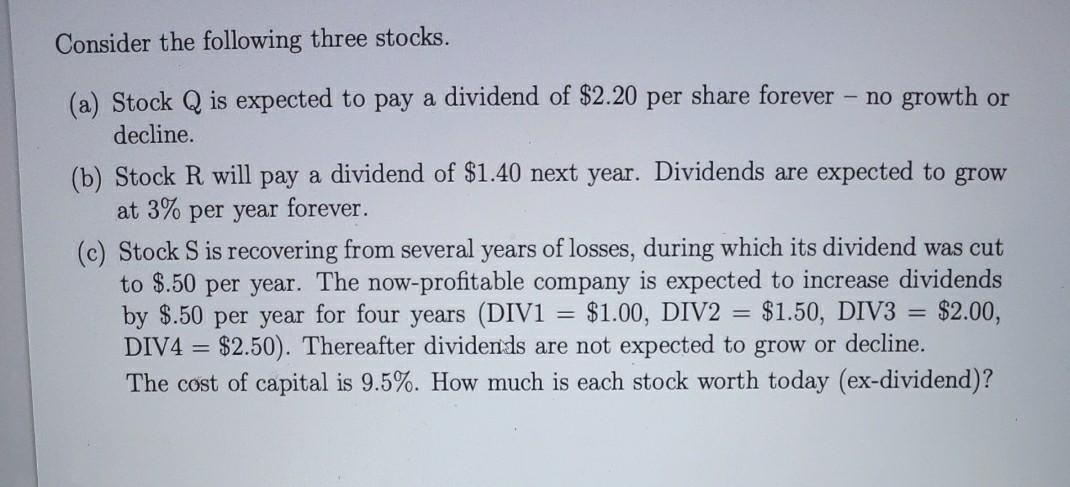

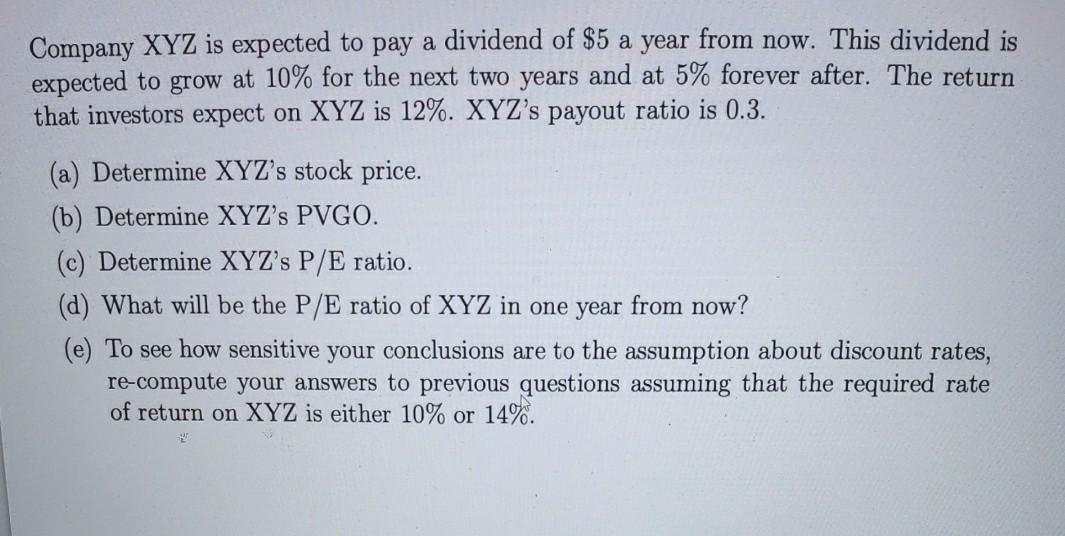

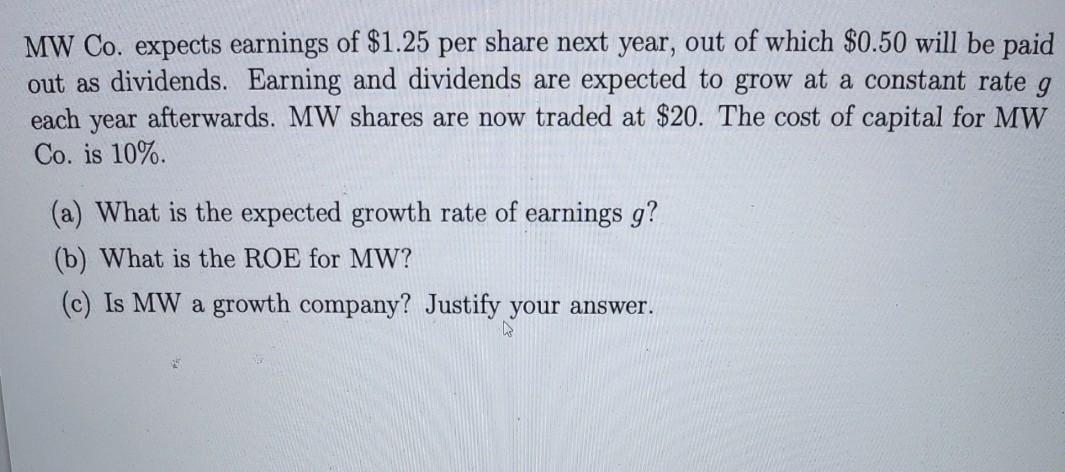

Consider the following three stocks. (a) Stock Q is expected to pay a dividend of $2.20 per share forever no growth or decline. (b) Stock R will pay a dividend of $1.40 next year. Dividends are expected to grow at 3% per year forever. (c) Stock S is recovering from several years of losses, during which its dividend was cut to $.50 per year. The now-profitable company is expected to increase dividends by $.50 per year for four years (DIV1 = $1.00, DIV2 = $1.50, DIV3 $2.00, DIV4 = $2.50). Thereafter dividends are not expected to grow or decline. The cost of capital is 9.5%. How much is each stock worth today (ex-dividend)? = Company XYZ is expected to pay a dividend of $5 a year from now. This dividend is expected to grow at 10% for the next two years and at 5% forever after. The return that investors expect on XYZ is 12%. XYZ's payout ratio is 0.3. (a) Determine XYZ's stock price. (b) Determine XYZ's PVGO. (c) Determine XYZ's P/E ratio. (d) What will be the P/E ratio of XYZ in one year from now? (e) To see how sensitive your conclusions are to the assumption about discount rates, re-compute your answers to previous questions assuming that the required rate of return on XYZ is either 10% or 14%. MW Co. expects earnings of $1.25 per share next year, out of which $0.50 will be paid out as dividends. Earning and dividends are expected to grow at a constant rate g each year afterwards. MW shares are now traded at $20. The cost of capital for MW Co. is 10%. (a) What is the expected growth rate of earnings g? (b) What is the ROE for MW? (c) Is MW a growth company? Justify your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started