Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please yar solve the question please provide me the right solution of this one of your tutor send me the same question

Old MathJax webview

please yar solve the question

please provide me the right solution of this one of your tutor send me the same question as I send for the solution he didn't send me the answer

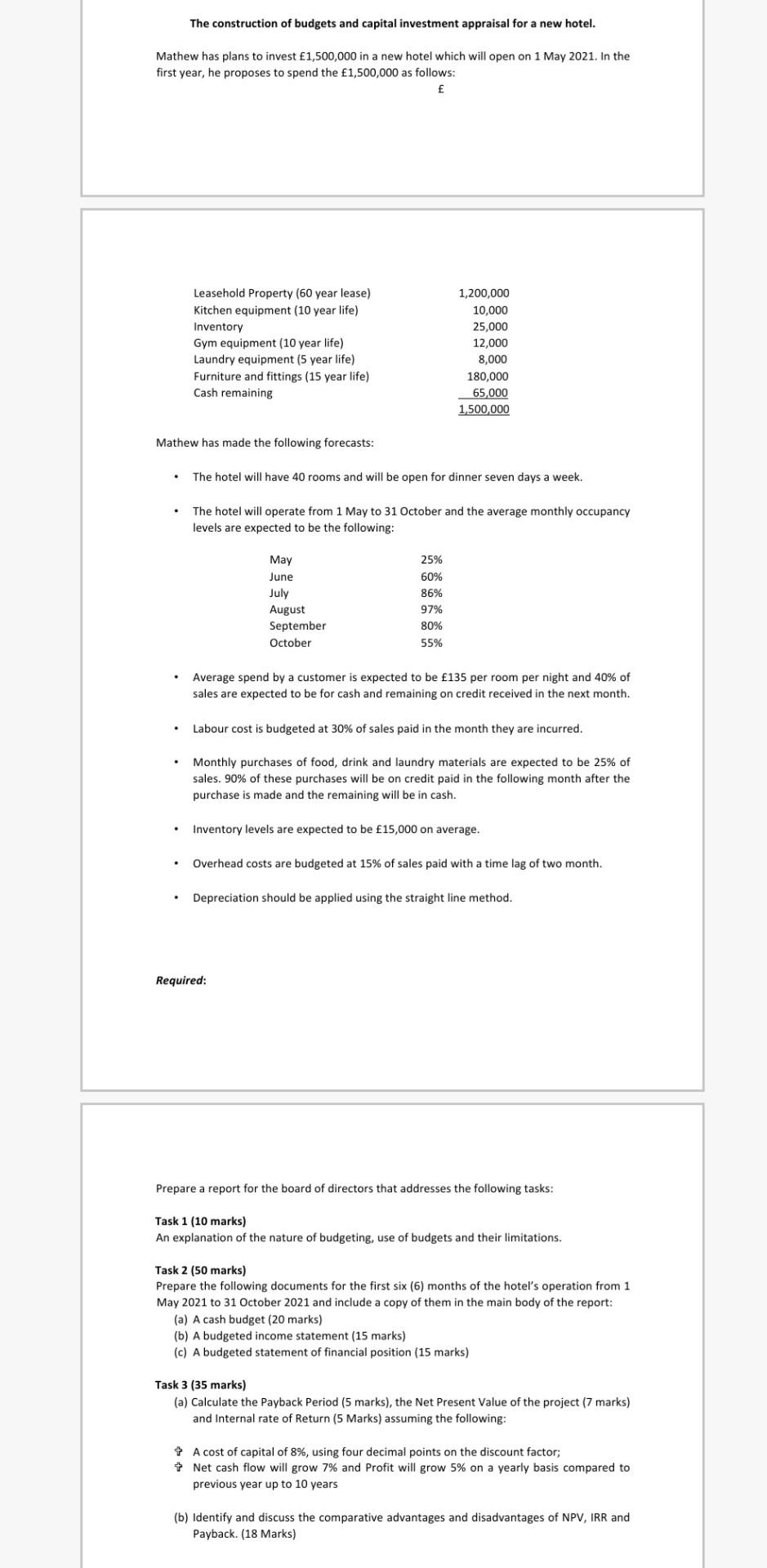

The construction of budgets and capital investment appraisal for a new hotel. Mathew has plans to invest 1,500,000 in a new hotel which will open on 1 May 2021. In the first year, he proposes to spend the 1,500,000 as follows: f Leasehold Property (60 year lease) Kitchen equipment (10 year life) Inventory Gym equipment (10 year life) Laundry equipment (5 year life) Furniture and fittings (15 year life) Cash remaining 1,200,000 10,000 25,000 12,000 8,000 180,000 65,000 1,500,000 Mathew has made the following forecasts: The hotel will have 40 rooms and will be open for dinner seven days a week. The hotel will operate from 1 May to 31 October and the average monthly occupancy levels are expected to be the following: May June July August September October 25% 60% 86% 97% 80% 55% Average spend by a customer is expected to be 135 per room per night and 40% of sales are expected to be for cash and remaining on credit received in the next month, Labour cost is budgeted at 30% of sales paid in the month they are incurred. Monthly purchases of food, drink and laundry materials are expected to be 25% of sales. 90% of these purchases will on credit paid in the following month after the purchase is made and the remaining will be in cash. Inventory levels are expected to be 15,000 on average. . Overhead costs are budgeted at 15% of sales paid with a time lag of two month. Depreciation should be applied using the straight line method. Required: Prepare a report for the board of directors that addresses the following tasks: Task 1 (10 marks) An explanation of the nature of budgeting, use of budgets and their limitations. Task 2 (50 marks) Prepare the following documents for the first six (6) months of the hotel's operation from 1 May 2021 to 31 October 2021 and include a copy of them in the main body of the report: (a) A cash budget (20 marks) (b) A budgeted income statement (15 marks) (c) A budgeted statement of financial position (15 marks) Task 3 (35 marks) (a) Calculate the Payback Period (5 marks), the Net Present Value of the project (7 marks) and Internal rate of Return (5 Marks) assuming the following: + A cost of capital of 8%, using four decimal points on the discount factor; + Net cash flow will grow 7% and Profit will grow 5% on a yearly basis compared to previous year up to 10 years (b) Identify and discuss the comparative advantages and disadvantages of NPV, IRR and Payback. (18 Marks) The construction of budgets and capital investment appraisal for a new hotel. Mathew has plans to invest 1,500,000 in a new hotel which will open on 1 May 2021. In the first year, he proposes to spend the 1,500,000 as follows: f Leasehold Property (60 year lease) Kitchen equipment (10 year life) Inventory Gym equipment (10 year life) Laundry equipment (5 year life) Furniture and fittings (15 year life) Cash remaining 1,200,000 10,000 25,000 12,000 8,000 180,000 65,000 1,500,000 Mathew has made the following forecasts: The hotel will have 40 rooms and will be open for dinner seven days a week. The hotel will operate from 1 May to 31 October and the average monthly occupancy levels are expected to be the following: May June July August September October 25% 60% 86% 97% 80% 55% Average spend by a customer is expected to be 135 per room per night and 40% of sales are expected to be for cash and remaining on credit received in the next month, Labour cost is budgeted at 30% of sales paid in the month they are incurred. Monthly purchases of food, drink and laundry materials are expected to be 25% of sales. 90% of these purchases will on credit paid in the following month after the purchase is made and the remaining will be in cash. Inventory levels are expected to be 15,000 on average. . Overhead costs are budgeted at 15% of sales paid with a time lag of two month. Depreciation should be applied using the straight line method. Required: Prepare a report for the board of directors that addresses the following tasks: Task 1 (10 marks) An explanation of the nature of budgeting, use of budgets and their limitations. Task 2 (50 marks) Prepare the following documents for the first six (6) months of the hotel's operation from 1 May 2021 to 31 October 2021 and include a copy of them in the main body of the report: (a) A cash budget (20 marks) (b) A budgeted income statement (15 marks) (c) A budgeted statement of financial position (15 marks) Task 3 (35 marks) (a) Calculate the Payback Period (5 marks), the Net Present Value of the project (7 marks) and Internal rate of Return (5 Marks) assuming the following: + A cost of capital of 8%, using four decimal points on the discount factor; + Net cash flow will grow 7% and Profit will grow 5% on a yearly basis compared to previous year up to 10 years (b) Identify and discuss the comparative advantages and disadvantages of NPV, IRR and Payback. (18 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started