Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview question is almost solved please the ones are worng in red and Also part d On December 1, 20x1, Micro World Inc.

Old MathJax webview

question is almost solved please the ones are worng in red and Also part d

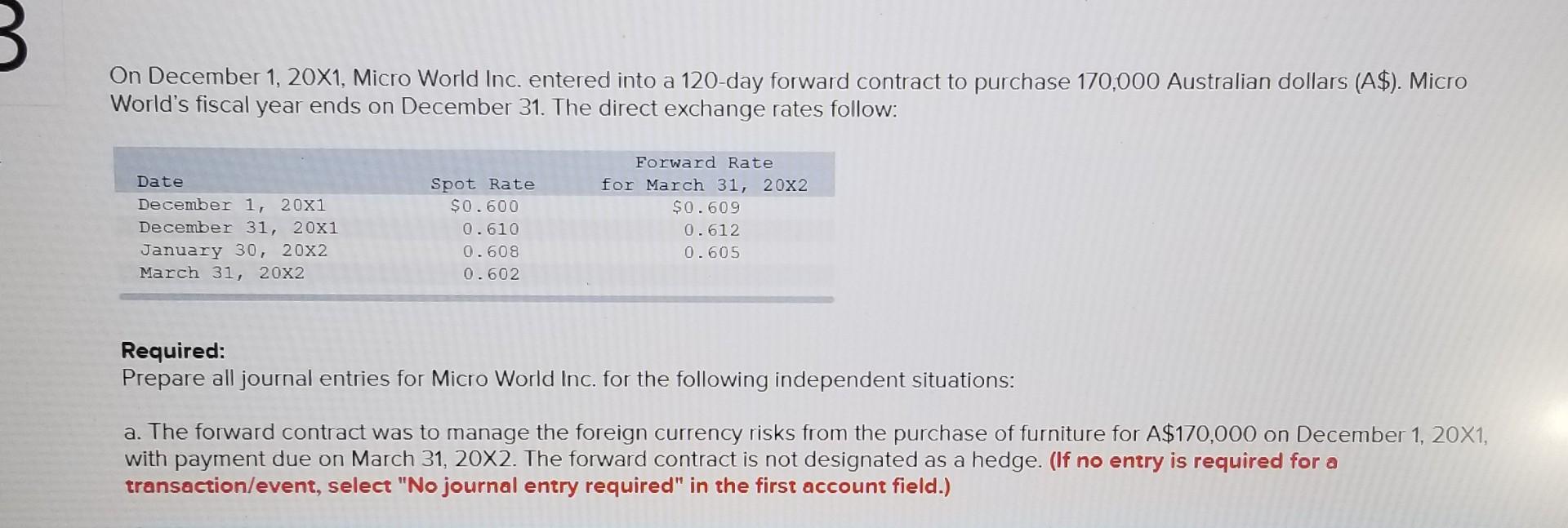

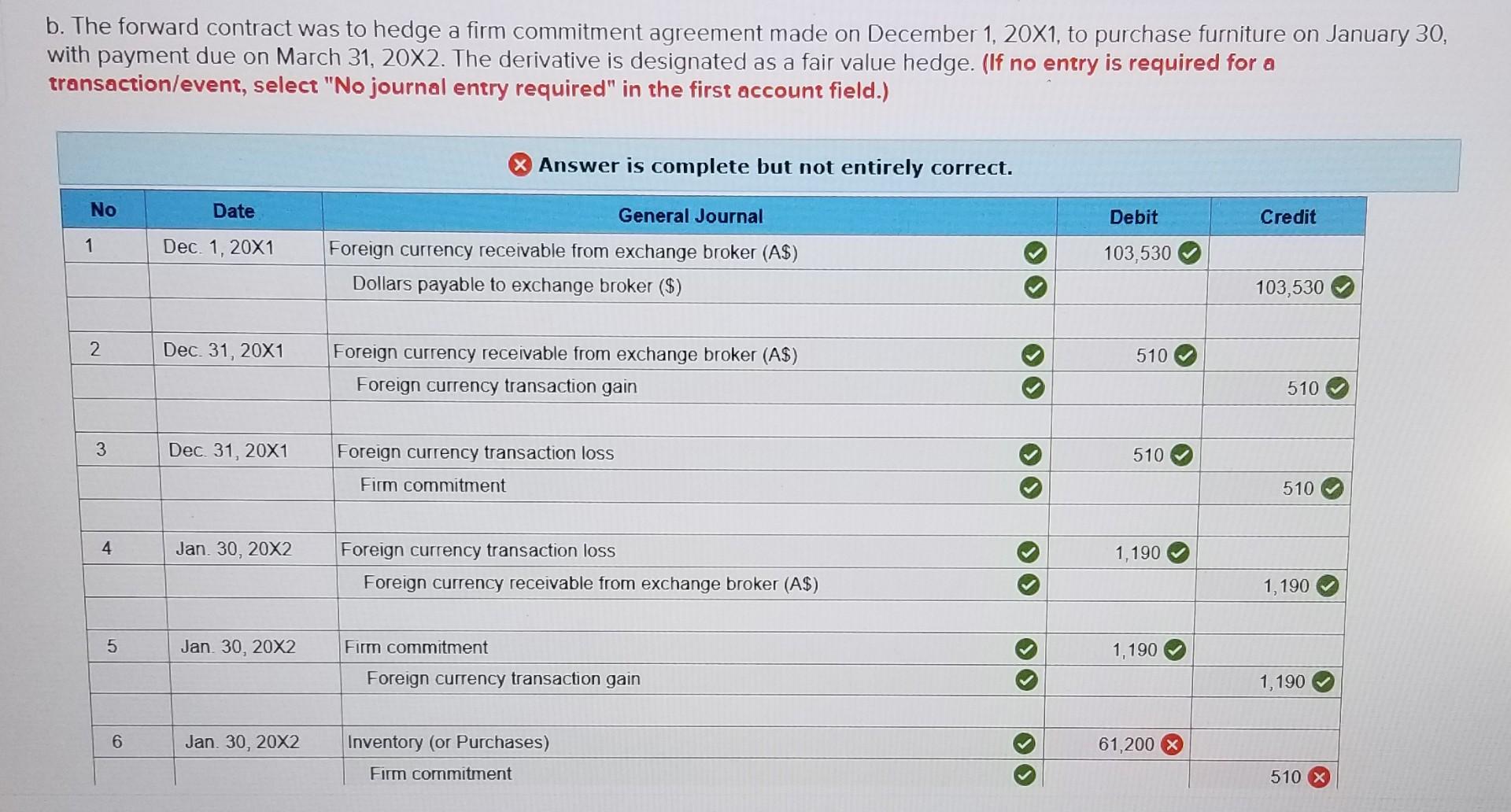

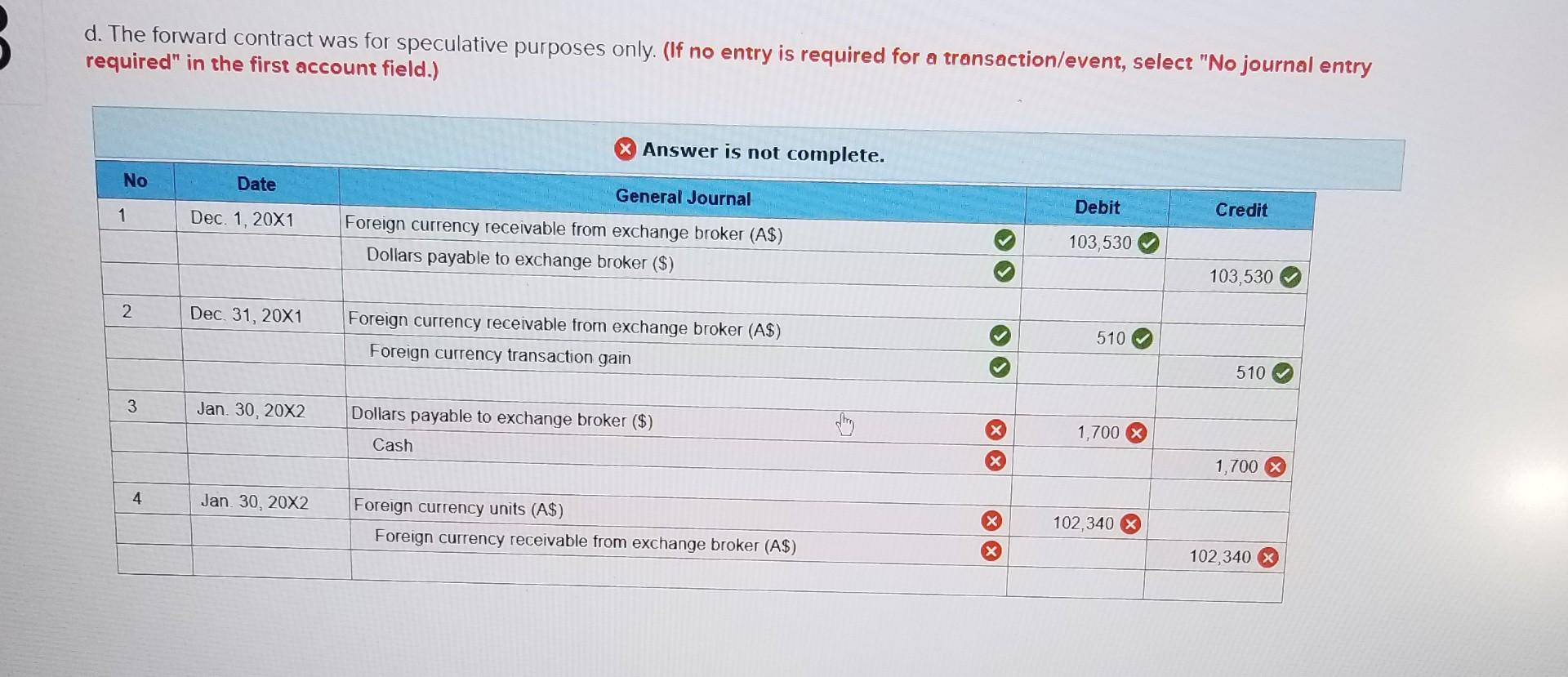

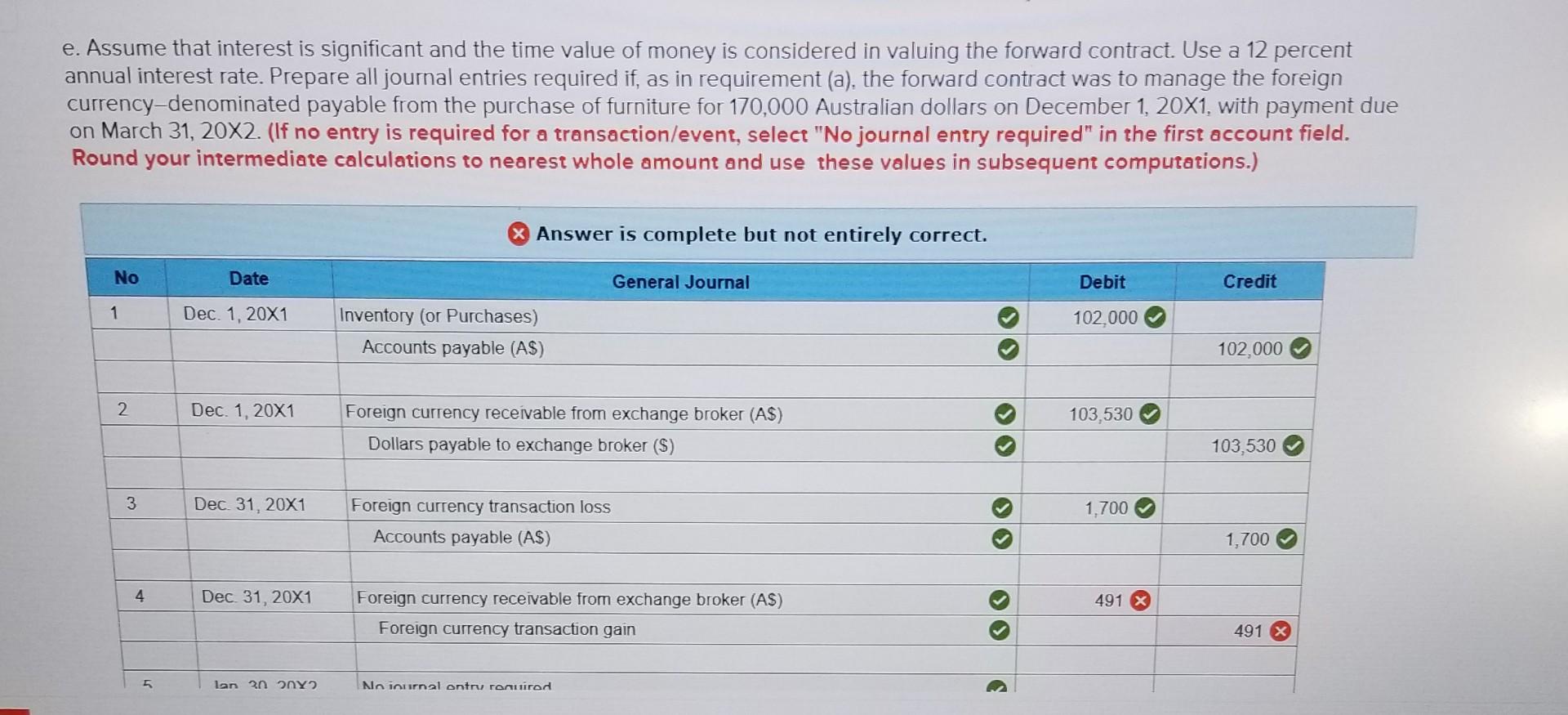

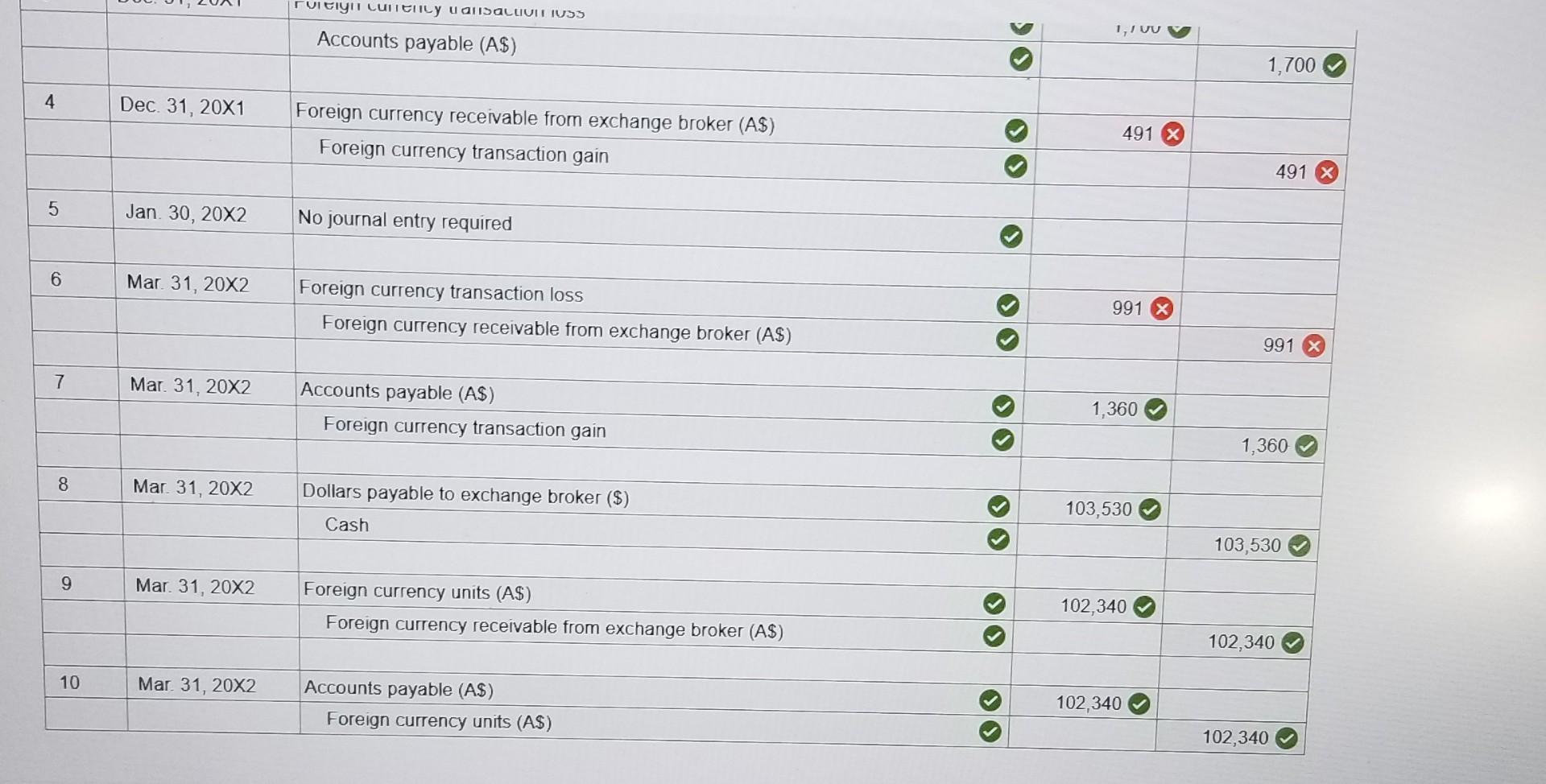

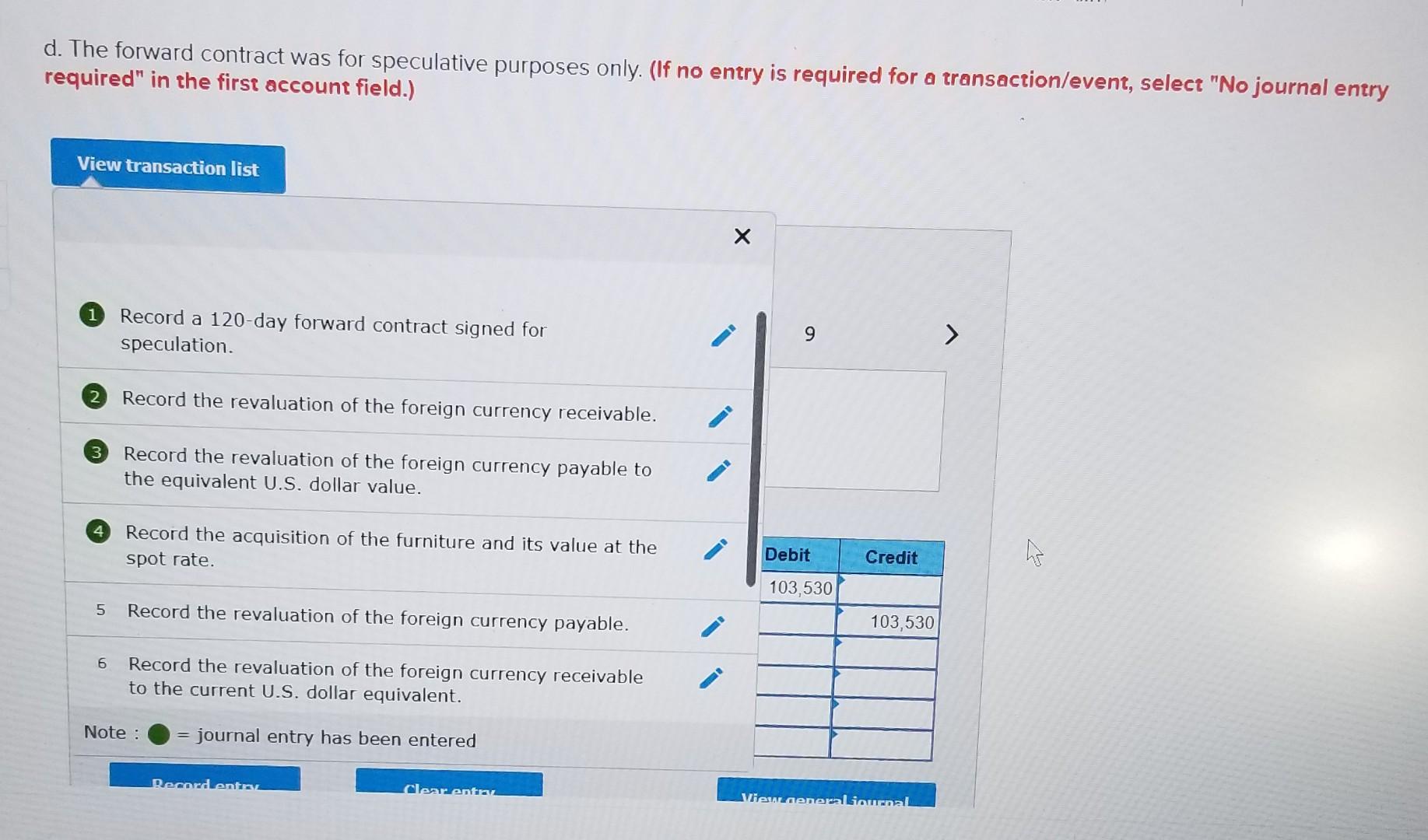

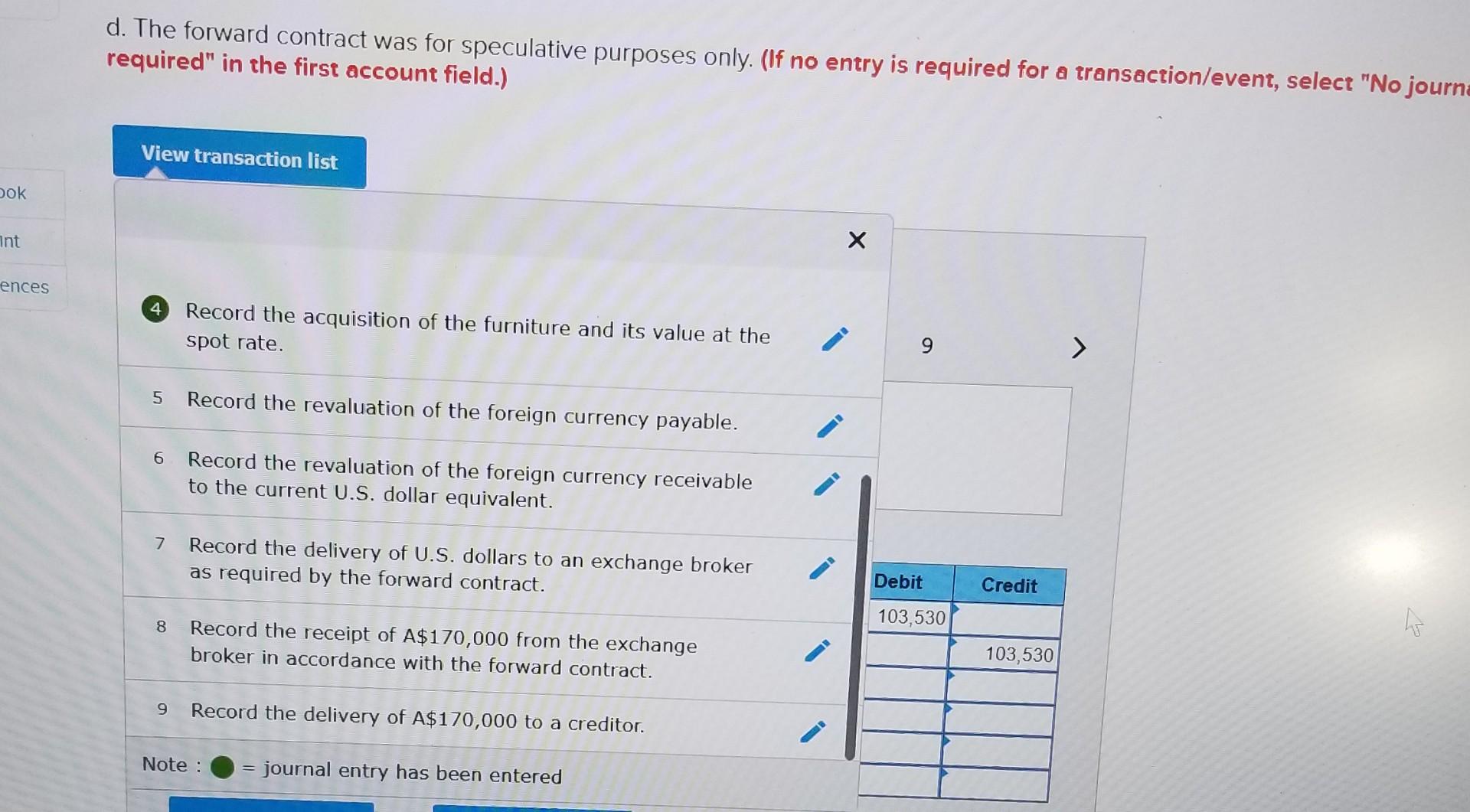

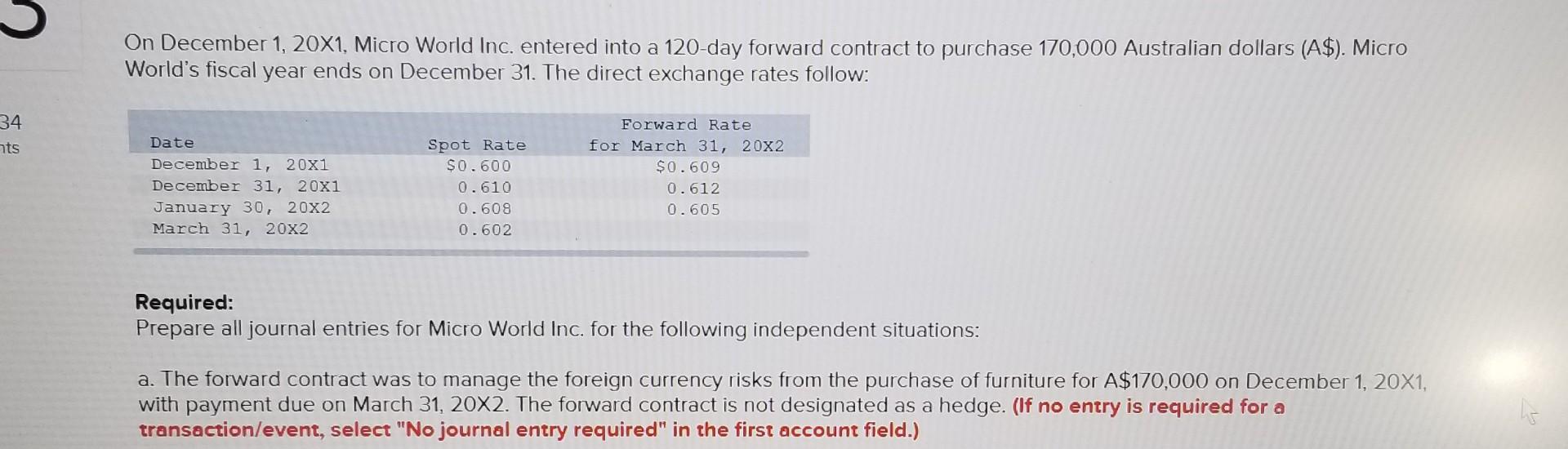

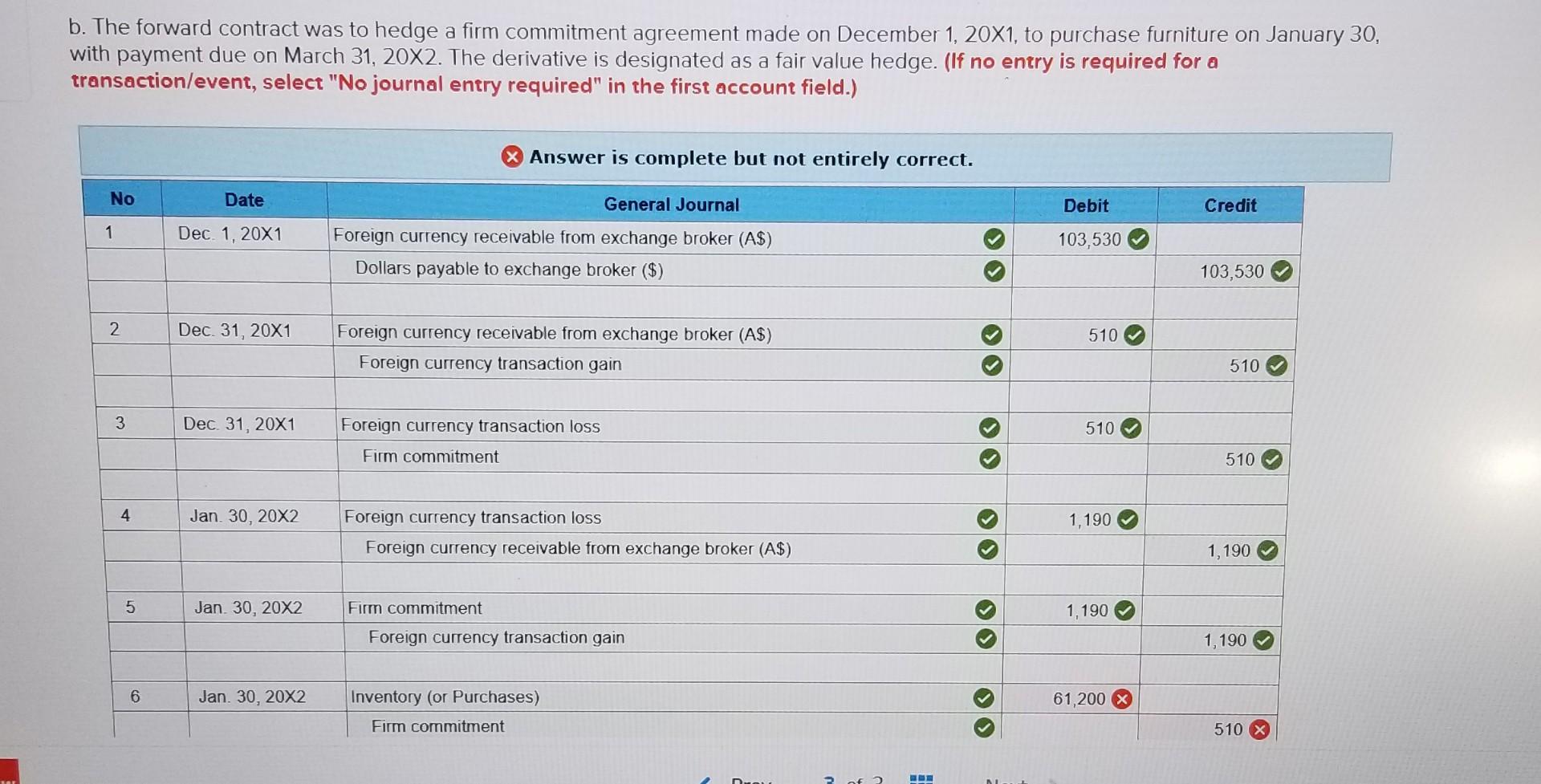

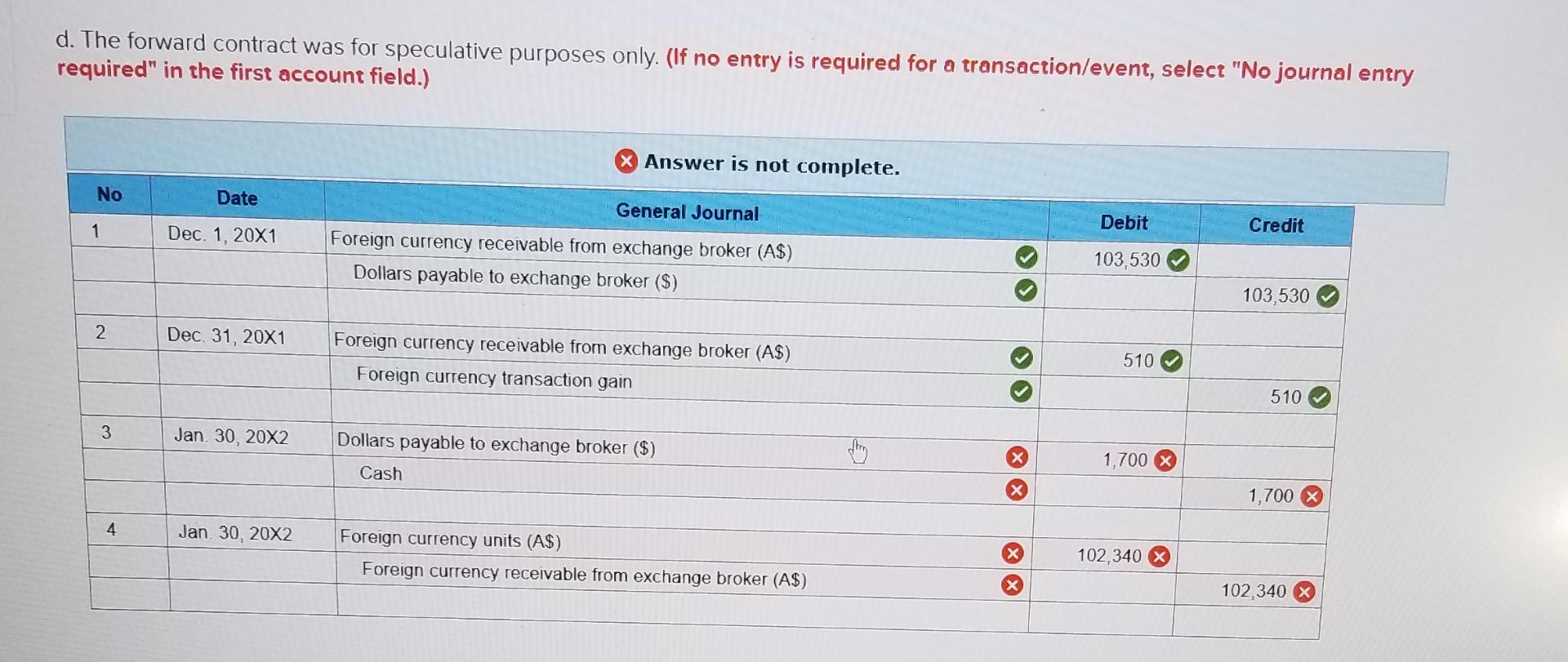

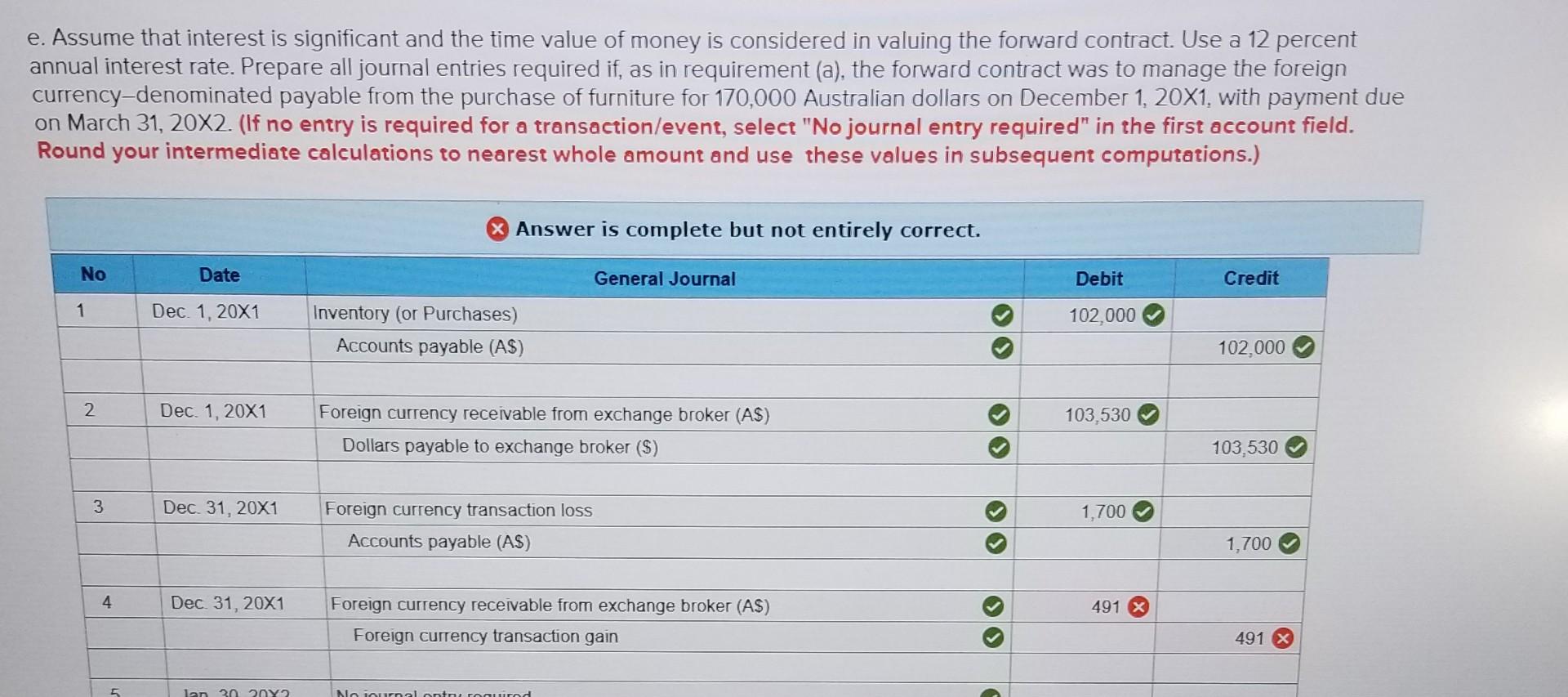

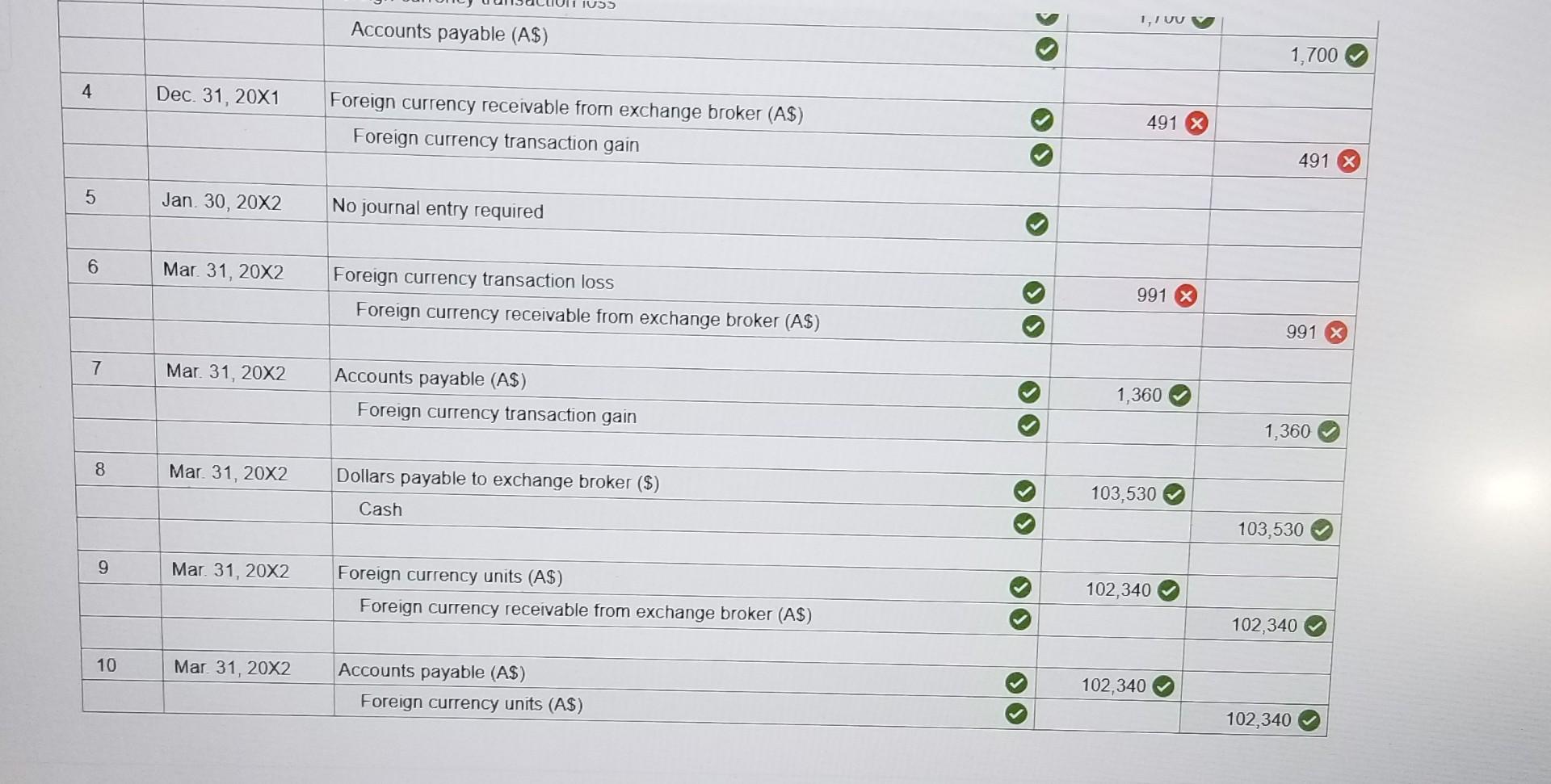

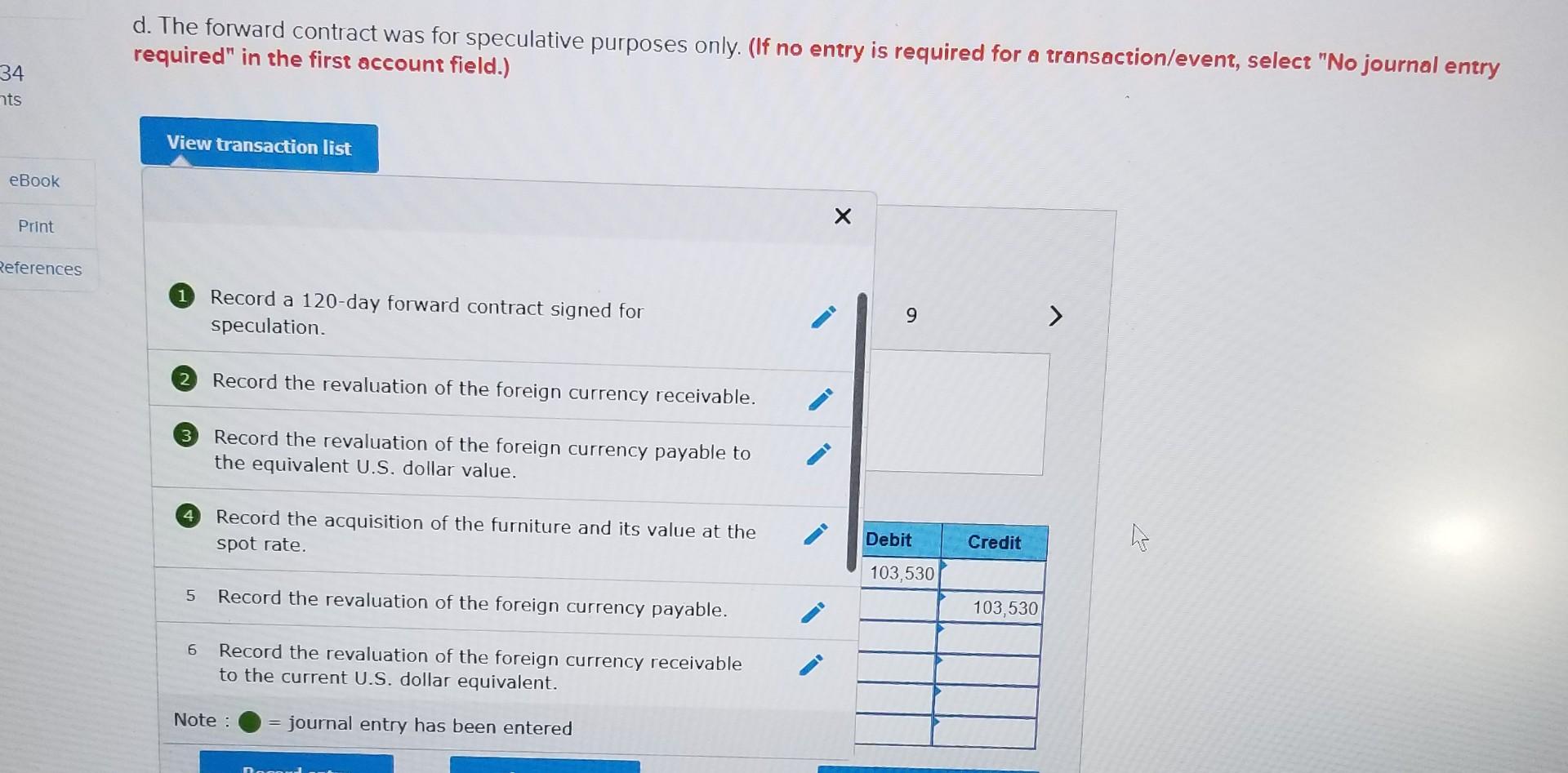

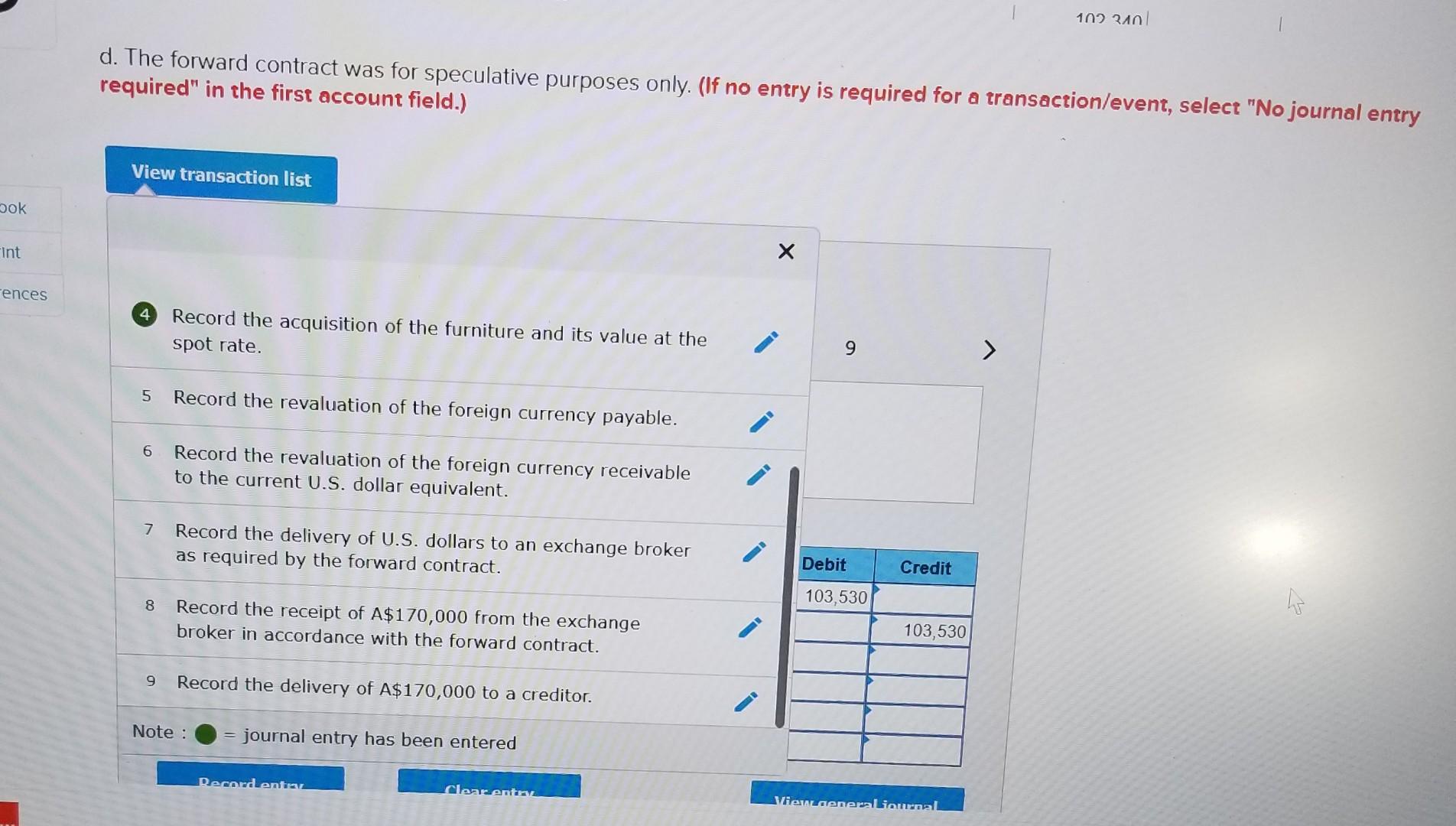

On December 1, 20x1, Micro World Inc. entered into a 120-day forward contract to purchase 170,000 Australian dollars (A$). Micro World's fiscal year ends on December 31. The direct exchange rates follow: Date December 1, 20x1 December 31, 20x1 January 30, 20X2 March 31, 20X2 Spot Rate $0.600 0.610 0.608 0.602 Forward Rate for March 31, 20X2 $0.609 0.612 0.605 Required: Prepare all journal entries for Micro World Inc. for the following independent situations: a. The forward contract was to manage the foreign currency risks from the purchase of furniture for A$170,000 on December 1, 20X1, with payment due on March 31, 20X2. The forward contract is not designated as a hedge. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) b. The forward contract was to hedge a firm commitment agreement made on December 1, 20X1, to purchase furniture on January 30, with payment due on March 31, 20X2. The derivative is designated as a fair value hedge. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 Dec. 1, 20X1 103,530 Foreign currency receivable from exchange broker (A$) Dollars payable to exchange broker ($) 103,530 2. Dec. 31, 20X1 510 Foreign currency receivable from exchange broker (A$) Foreign currency transaction gain > 510 3 Dec 31, 20X1 Foreign currency transaction loss 510 Firm commitment 510 4 Jan. 30, 20X2 1,190 Foreign currency transaction loss Foreign currency receivable from exchange broker (A$) 1,190 5 Jan 30, 20X2 1,190 Firm commitment Foreign currency transaction gain 1,190 6 Jan. 30, 20X2 61,200 X Inventory (or Purchases) Firm commitment 510 x d. The forward contract was for speculative purposes only. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) X Answer is not complete. No Date General Journal 1 Debit Dec. 1. 20X1 Credit Foreign currency receivable from exchange broker (A$) Dollars payable to exchange broker ($) 103,530 103,530 2 Dec 31, 20X1 Foreign currency receivable from exchange broker (A$) Foreign currency transaction gain 510 510 3 Jan 30, 20X2 Dollars payable to exchange broker ($) Cash thing 1,700 X x 1,700 X 4 Jan 30, 20X2 Foreign currency units (A$) Foreign currency receivable from exchange broker (A$) 102,340 102,340 e. Assume that interest is significant and the time value of money is considered in valuing the forward contract. Use a 12 percent annual interest rate. Prepare all journal entries required if, as in requirement (a), the forward contract was to manage the foreign currency-denominated payable from the purchase of furniture for 170,000 Australian dollars on December 1, 20X1. with payment due on March 31, 20X2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations to nearest whole amount and use these values in subsequent computations.) Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 Dec. 1, 20X1 102,000 Inventory (or Purchases) Accounts payable (AS) 102,000 2 Dec. 1, 20X1 103,530 Foreign currency receivable from exchange broker (AS) Dollars payable to exchange broker (S) 103,530 3 Dec 31, 20X1 1,700 Foreign currency transaction loss Accounts payable (AS) 1,700 4 Dec 31, 20X1 491 Foreign currency receivable from exchange broker (AS) Foreign currency transaction gain 491 5 loan in NY? No inurnal ontru renurod Foreign CurTEnly u anSaLLIVIT IUSS 1,1V Accounts payable (A$) 1,700 4 Dec. 31, 20X1 Foreign currency receivable from exchange broker (AS) Foreign currency transaction gain 491 x 491 x 5 Jan. 30, 20X2 No journal entry required > 6 Mar 31, 20X2 Foreign currency transaction loss Foreign currency receivable from exchange broker (AS) 991 991 x 7 Mar. 31, 20X2 Accounts payable (A$) Foreign currency transaction gain > 1,360 1,360 8 Mar 31, 20X2 Dollars payable to exchange broker ($) 103,530 Cash 103,530 9 Mar. 31, 20X2 Foreign currency units (AS) Foreign currency receivable from exchange broker (A$) 102,340 > 102,340 10 Mar 31, 20X2 Accounts payable (AS) Foreign currency units (AS) 102,340 102,340 d. The forward contract was for speculative purposes only. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list 1 Record a 120-day forward contract signed for speculation. 9 > Record the revaluation of the foreign currency receivable. 3 Record the revaluation of the foreign currency payable to the equivalent U.S. dollar value. 4 Record the acquisition of the furniture and its value at the spot rate. Debit 2 Credit 103,530 5 Record the revaluation of the foreign currency payable. 103,530 6 Record the revaluation of the foreign currency receivable to the current U.S. dollar equivalent. Note : journal entry has been entered Recordent Clear entre Viewenemalliournal d. The forward contract was for speculative purposes only. (If no entry is required for a transaction/event, select "No journa required" in the first account field.) View transaction list Dok Int ences 4 Record the acquisition of the furniture and its value at the spot rate. 9 > 5 Record the revaluation of the foreign currency payable. 6 Record the revaluation of the foreign currency receivable to the current U.S. dollar equivalent. 7 Record the delivery of U.S. dollars to an exchange broker as required by the forward contract. Debit Credit 103,530 8 Record the receipt of A$170,000 from the exchange broker in accordance with the forward contract. 103,530 9 Record the delivery of A$170,000 to a creditor. Note : journal entry has been entered On December 1, 20X1. Micro World Inc. entered into a 120-day forward contract to purchase 170,000 Australian dollars (A$). Micro World's fiscal year ends on December 31. The direct exchange rates follow: 34 ats Date December 1, 20x1 December 31, 20X1 January 30, 20X2 March 31, 20X2 Spot Rate $0.600 0.610 0.608 0.602 Forward Rate for March 31, 20X2 $0.609 0.612 0.605 Required: Prepare all journal entries for Micro World Inc. for the following independent situations: a. The forward contract was to manage the foreign currency risks from the purchase of furniture for A$170,000 on December 1, 20X1, with payment due on March 31, 20X2. The forward contract is not designated as a hedge. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) ho b. The forward contract was to hedge a firm commitment agreement made on December 1, 20X1, to purchase furniture on January 30, with payment due on March 31, 20X2. The derivative is designated as a fair value hedge. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 Dec 1, 20X1 103,530 Foreign currency receivable from exchange broker (A$) Dollars payable to exchange broker ($) 103,530 2 Dec 31, 20X1 510 Foreign currency receivable from exchange broker (A$) Foreign currency transaction gain 510 3 Dec. 31, 20X1 Foreign currency transaction loss 510 Firm commitment 510 4 Jan 30, 20X2 1,190 Foreign currency transaction loss Foreign currency receivable from exchange broker (A$) 1,190 5 Jan 30, 20X2 1,190 Firm commitment Foreign currency transaction gain 1,190 6 Jan. 30, 20X2 61,200 X Inventory (or Purchases) Firm commitment 510 x 2 f H. d. The forward contract was for speculative purposes only. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) X Answer is not complete. No Date General Journal Debit 1 Credit Dec. 1, 20X1 Foreign currency receivable from exchange broker (A$) Dollars payable to exchange broker ($) 103,530 103,530 2 Dec 31, 20X1 Foreign currency receivable from exchange broker (A$) Foreign currency transaction gain 510 510 3 Jan 30, 20X2 Dollars payable to exchange broker ($) Cash 1,700 1,700 4 Jan 30, 20X2 Foreign currency units (A$) Foreign currency receivable from exchange broker (A$) 102,340 102,340 e. Assume that interest is significant and the time value of money is considered in valuing the forward contract. Use a 12 percent annual interest rate. Prepare all journal entries required if, as in requirement (a), the forward contract was to manage the foreign currency-denominated payable from the purchase of furniture for 170,000 Australian dollars on December 1, 20X1, with payment due on March 31, 20X2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations to nearest whole amount and use these values in subsequent computations.) X Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 Dec. 1,20X1 102,000 Inventory (or Purchases) Accounts payable (AS) 102,000 2 Dec. 1, 20X1 103,530 Foreign currency receivable from exchange broker (AS) Dollars payable to exchange broker (S) 103,530 3 Dec 31, 20X1 1,700 Foreign currency transaction loss Accounts payable (AS) 1,700 4 Dec 31, 20X1 491 x Foreign currency receivable from exchange broker (AS) Foreign currency transaction gain 491 5 lan 30 2042 No alentoured IUSS 1,IVU Accounts payable (A$) 1,700 4. Dec 31, 20X1 Foreign currency receivable from exchange broker (A$) Foreign currency transaction gain 491 491 5 Jan 30, 20X2 No journal entry required 6 Mar 31, 20X2 Foreign currency transaction loss Foreign currency receivable from exchange broker (A$) 991 x 991 7 Mar 31, 20X2 Accounts payable (A$) Foreign currency transaction gain 1,360 1,360 8 Mar 31, 20X2 Dollars payable to exchange broker ($) 103,530 Cash 103,530 9 Mar. 31, 20X2 Foreign currency units (A$) Foreign currency receivable from exchange broker (A$) 102,340 102,340 10 Mar 31, 20X2 Accounts payable (A$) Foreign currency units (AS) 102,340 O 102,340 d. The forward contract was for speculative purposes only. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 34 nts View transaction list eBook Print References 1 Record a 120-day forward contract signed for speculation. 9 > 2 Record the revaluation of the foreign currency receivable. 3 Record the revaluation of the foreign currency payable to the equivalent U.S. dollar value. 4 Record the acquisition of the furniture and its value at the spot rate. Debit Credit 103,530 5 Record the revaluation of the foreign currency payable. 103,530 6 Record the revaluation of the foreign currency receivable to the current U.S. dollar equivalent. Note : = journal entry has been entered 102 2001 d. The forward contract was for speculative purposes only. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list bok int Fences 4 Record the acquisition of the furniture and its value at the spot rate. 9 5 Record the revaluation of the foreign currency payable. 6 Record the revaluation of the foreign currency receivable to the current U.S. dollar equivalent. 7 Record the delivery of U.S. dollars to an exchange broker as required by the forward contract. Debit Credit 103,530 8 ho Record the receipt of A$170,000 from the exchange broker in accordance with the forward contract. 103,530 9 Record the delivery of A$170,000 to a creditor. Note : journal entry has been entered Record entrar Clear entrs View aeneraliaural

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started