Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview s . Mwasowed to a rogo to employee on (4.2014 b) 15-6-2014 Hinta Casa (a) 1.300 C (0) 1,510) B-VII (viii) Transfer

Old MathJax webview

s

.

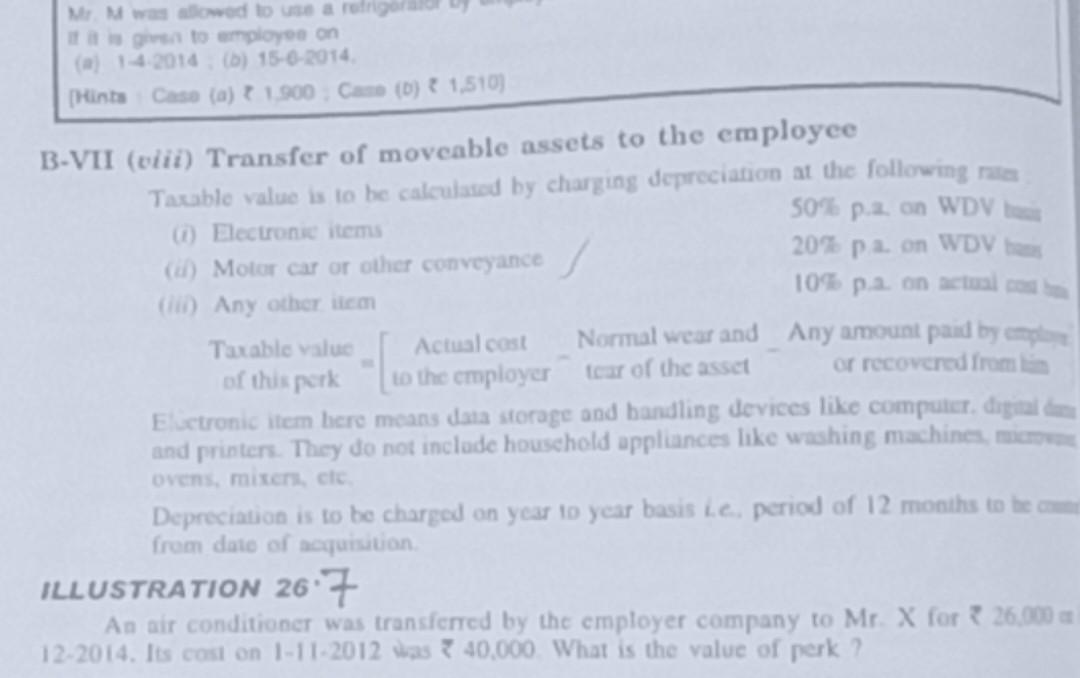

Mwasowed to a rogo to employee on (4.2014 b) 15-6-2014 Hinta Casa (a) 1.300 C (0) 1,510) B-VII (viii) Transfer of moveable assets to the employee Taxable value is to be calculated by charging depreciation at the following rate 50 pi on WDV ) Electronie items 20% pa on WDV (u) Motor car or other conveyance 105 pa on actual (HD) Any other item Taxable value Actual cast Normal wear and Any amount pand by me of this perk to the employer car of the asset or recovered from E ctronic item here means data storage and handling devices like computer digital and printers. They do not include houschold appliances like washing machines, mien ovens, mixers, etc. Depreciation is to be charged on year to year basis Le period of 12 months to be from date of acquisition ILLUSTRATION 267 An air conditioner was transferred by the employer company to Mr. X for? 26.000 12.2014. Its cost on 1-11-2012 was 7 40,000. What is the value of perkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started