Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview . Title Assume that a firm has Rs. 1,00.000 in debt at 5% af interest. the expected level of EBIT is Rs.

Old MathJax webview

.

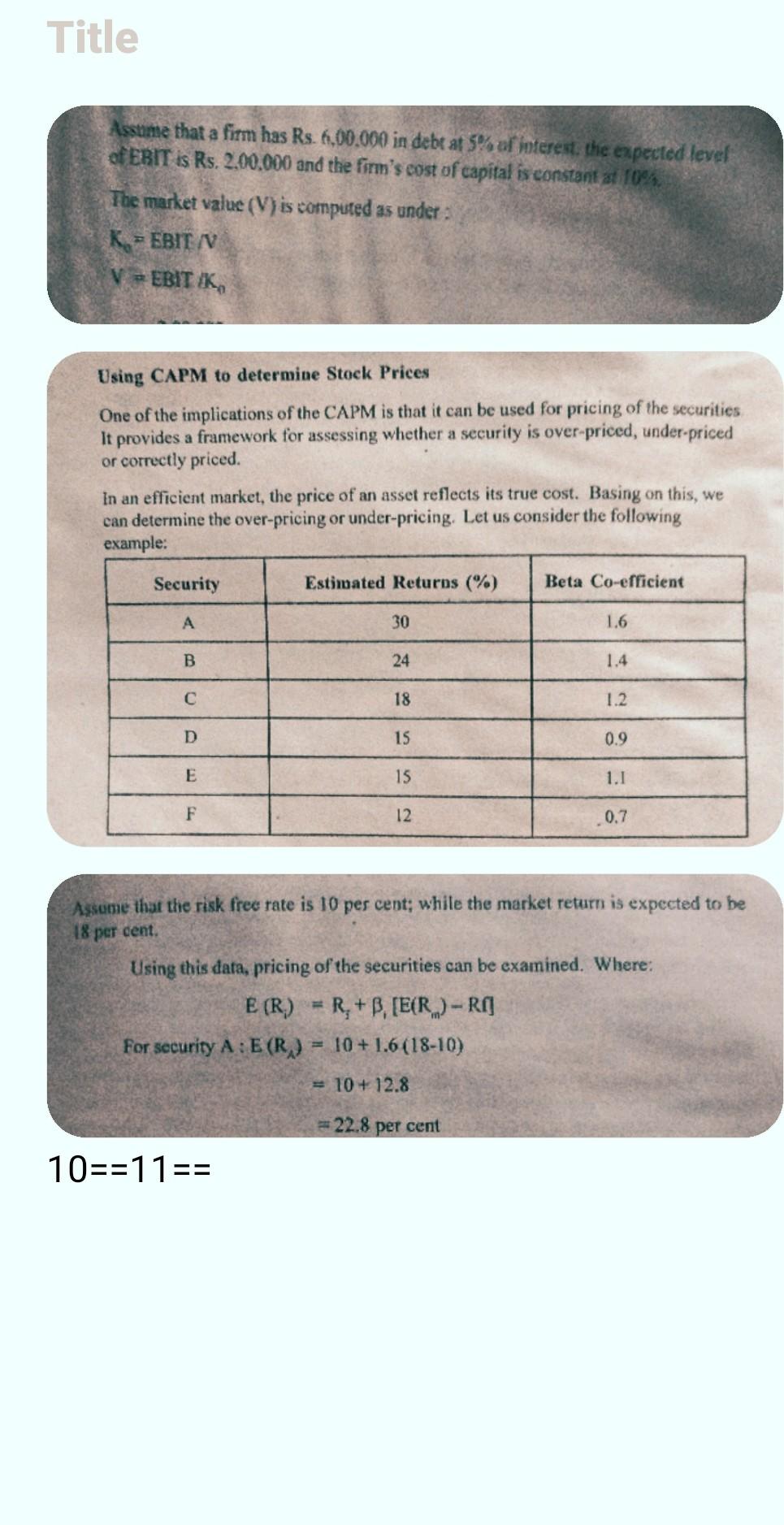

Title Assume that a firm has Rs. 1,00.000 in debt at 5% af interest. the expected level of EBIT is Rs. 2,00.000 and the firm's cost of capital is constant at 10% The market value (V) is computed as under: K = EBIT / V = EBITIK, Using CAP to determine Stock Prices One of the implications of the CAPM is that it can be used for pricing of the securities It provides a framework for assessing whether a security is over-priced, under-priced or correctly priced. In an efficient market, the price of an asset reflects its true cost. Basing on this, we can determine the over-pricing or under-pricing. Let us consider the following example: Security Estimated Returns (%) Beta Co-efficient A 30 1.6 B 24 1.4 18 1.2 D 15 0.9 E 15 1.1 F 12 0.7 Assume that the risk free rate is 10 pes cent; while the market return is expected to be 18 per cent Using this data, pricing of the securities can be examined. Where: E (R) R+B. (E(R)-RA] For security A : E(R) = 10+ 1.6(18-10) = 10+ 12.8 22.8 per cent 10==11==Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started