Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview what is incomplete about this. I gave the whole hilton repost and the questions? what else do you need? UNITED STATES SECURITIES

Old MathJax webview

what is incomplete about this. I gave the whole hilton repost and the questions? what else do you need?

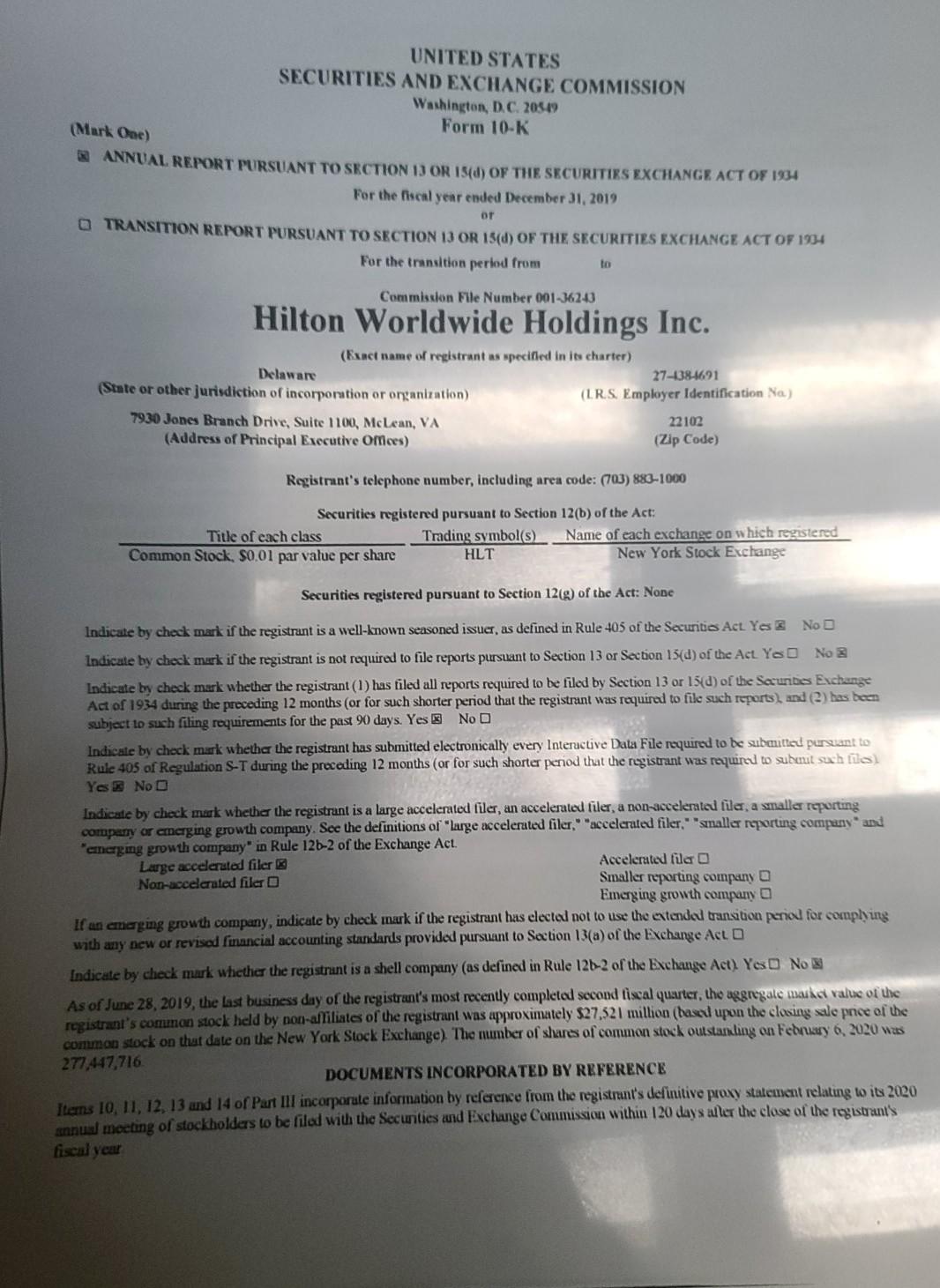

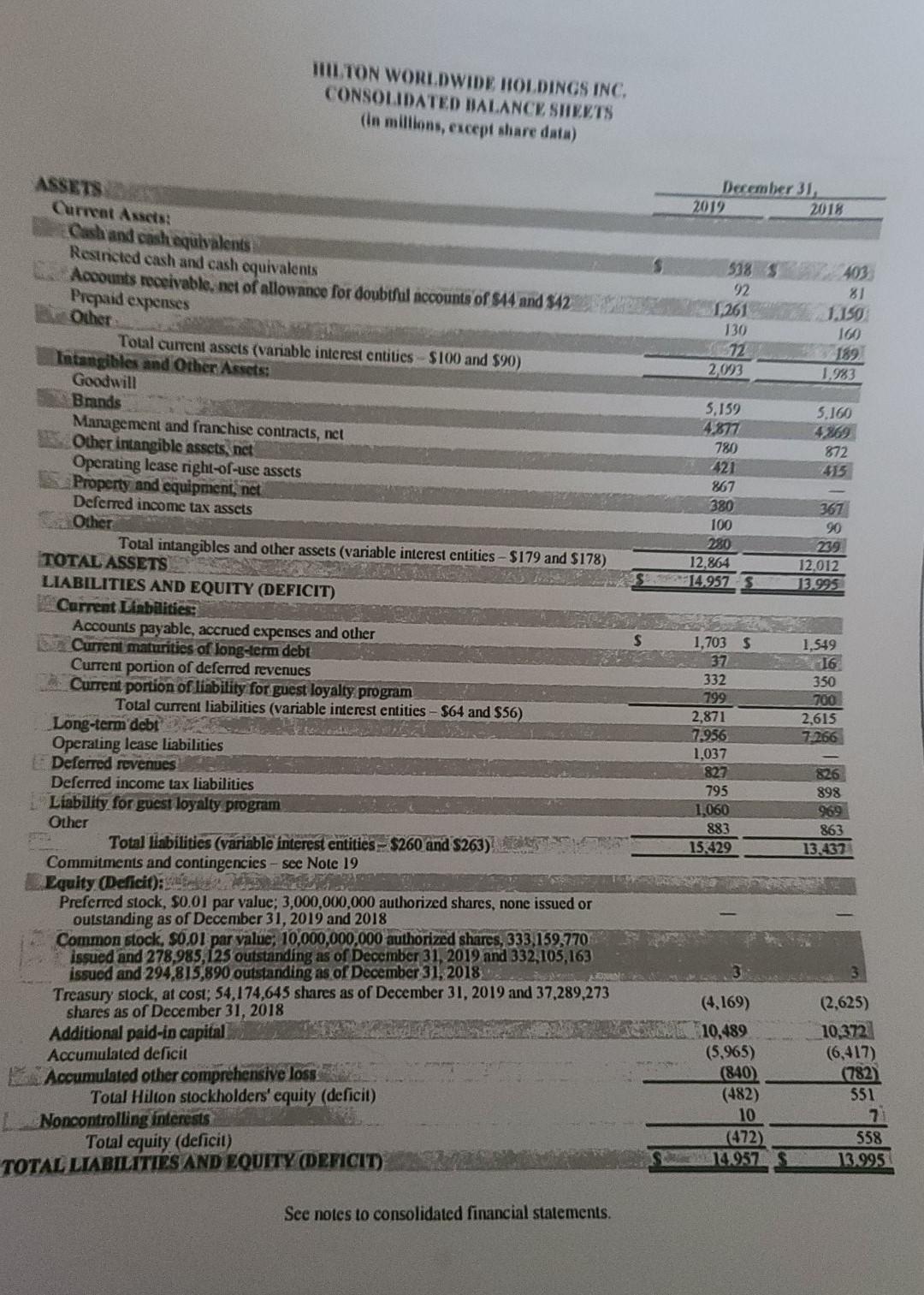

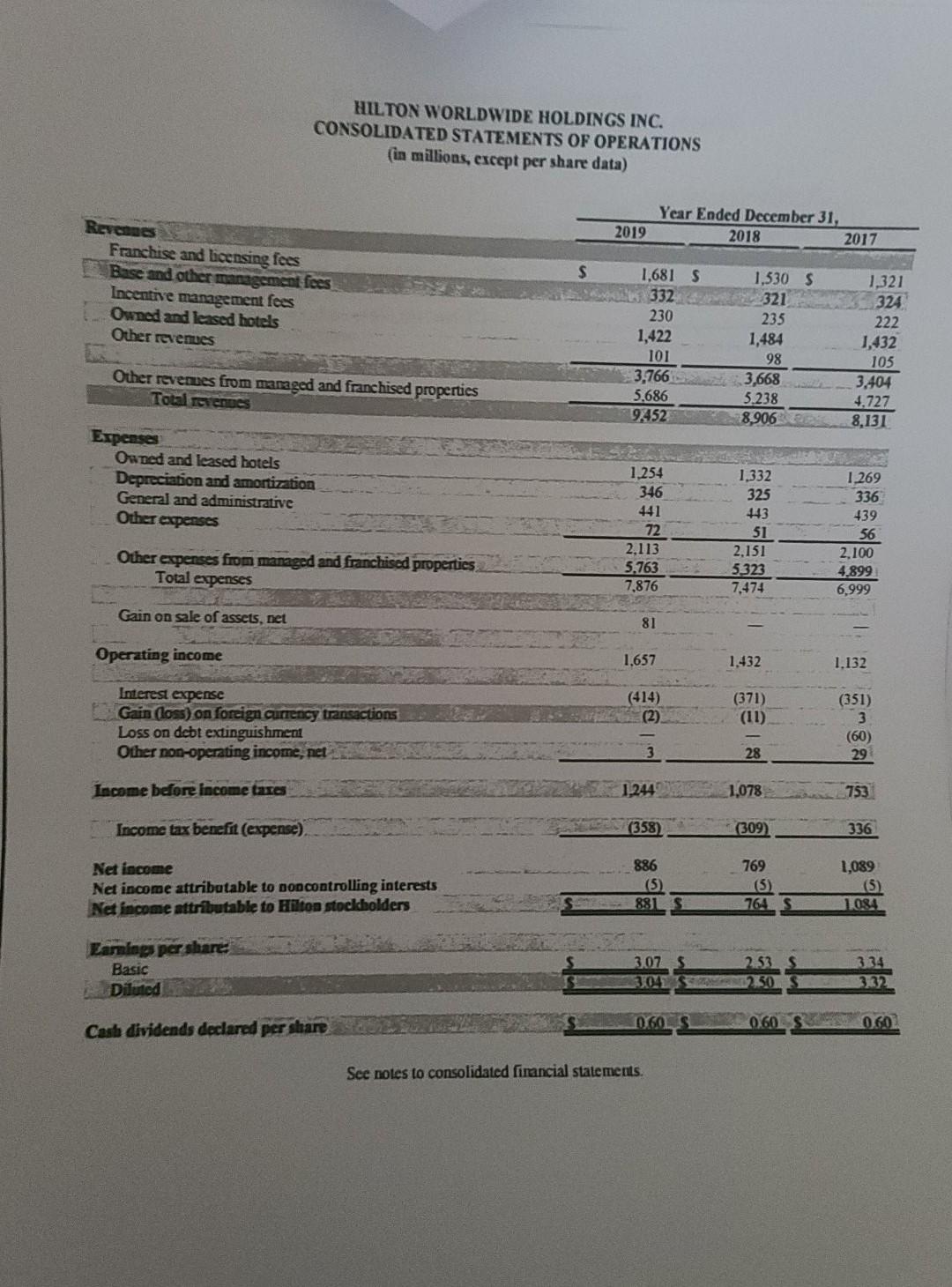

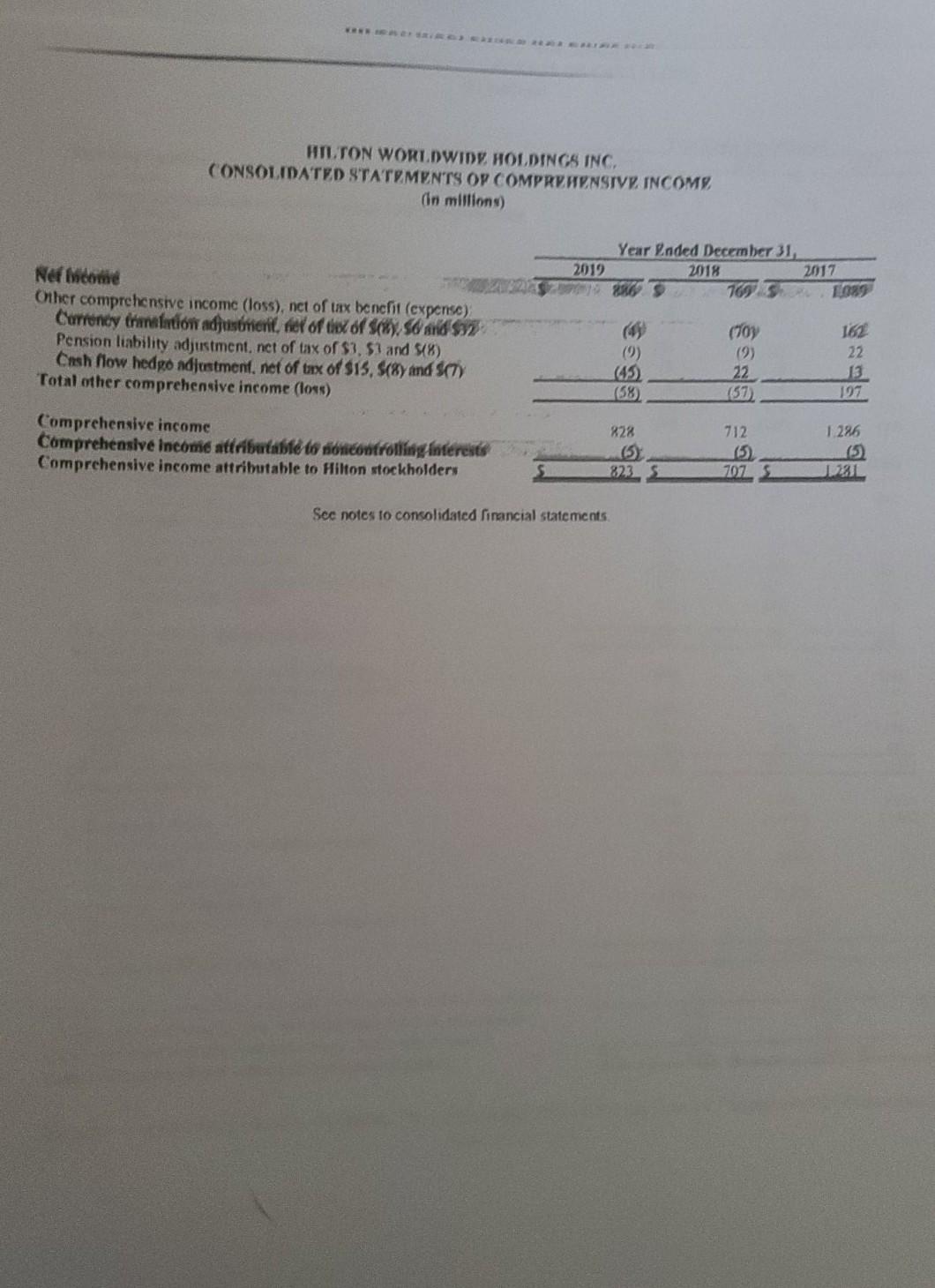

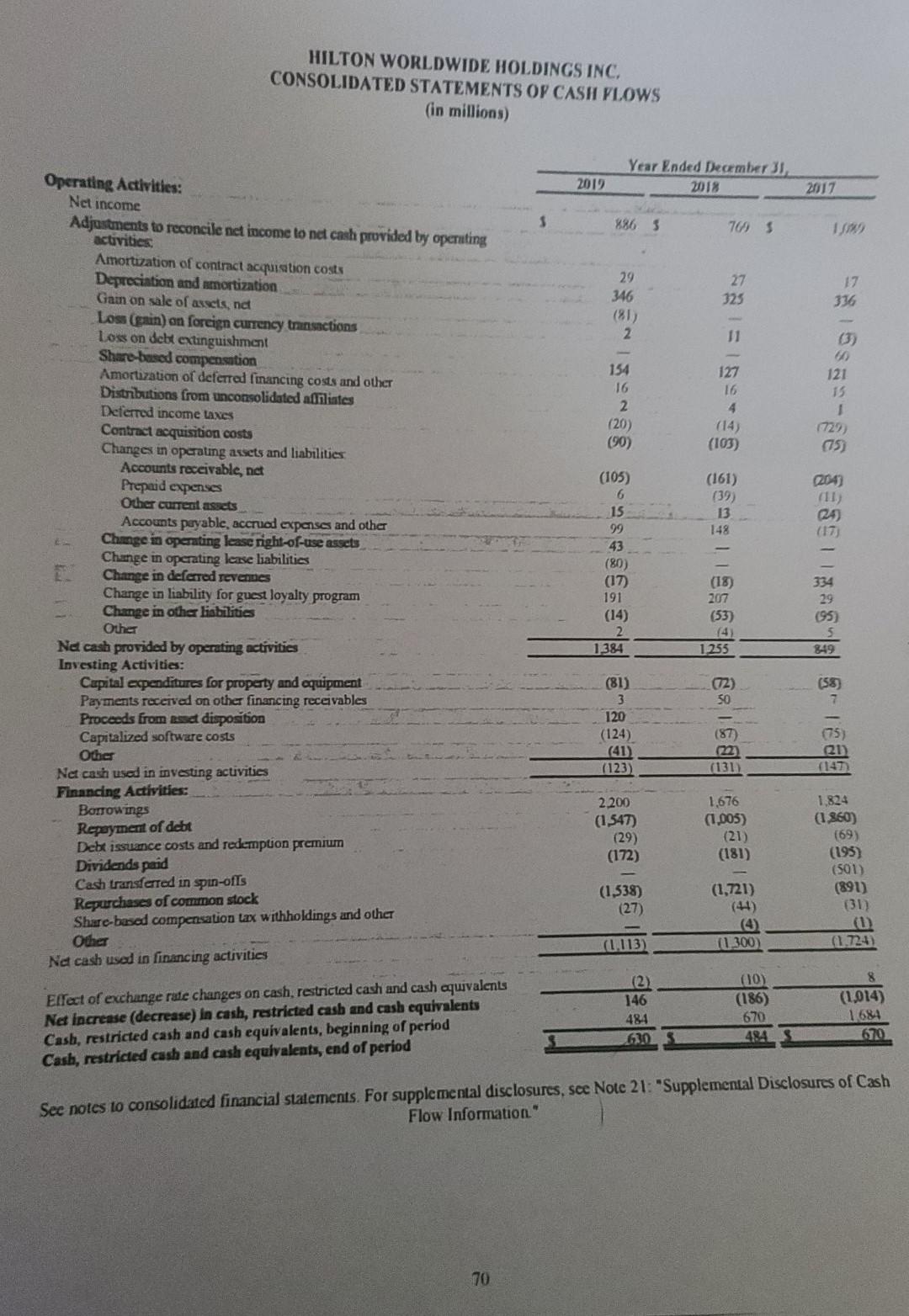

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 205-19 Form 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 13(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-36243 Hilton Worldwide Holdings Inc. (Exact name of registrant as specified in its charter) Delaware 27-438-4691 (State or other jurisdiction of incorporation or organization) (LR.S. Employer Identification Na) 7930 Jones Branch Drive, Suite 1100, McLean, VA 22102 (Address of Principal Executive Omees) (Zip Code) Registrant's telephone number, including area code: (703) 883-1000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol(s) Name of each exchange on which registered Common Stock, $0.01 par value per share HLT New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yo No 3 Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Saubes Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports and e) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be subantted pursuant to Rulc 405 of Regulation S-T during the preceding 12 months (or for such shorter penod that the registrant was required to submit such files! Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of large accelerated filer, accelerated filer," "smaller reporting company and "emergmg growth company in Rule 126-2 of the Exchange Act. Large accelerated filer Accelerated filar Non-accelerated filer Smaller reporting company Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised fmancial accounting standards provided pursuant to Section 13(a) of the Exchange Act Indicate by check mark whether the registrant is a shell company (as defined in Rule 121-2 of the Exchange Act) Yes No As of June 28, 2019, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was approximately $27,521 million (based upon the closing sale pnce of the common stock on that date on the New York Stock Exchange) The number of shares of common stock outstanding on February 6, 2020 was 277,447,716 DOCUMENTS INCORPORATED BY REFERENCE Items 10, 11, 12, 13 and 14 of Part III incorporate information by reference from the registrant's definitive proxy statement relating to its 2020 annual meeting of stockholdas to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant's fiscal year MILTON WORLDWIDE ROLDINGS INC. CONSOLIDATED BALANCE SHEETS (in millions, except share data) December 31 2018 2012 ASSETS Current Assets: Cash and casheqlvalents Restricted cash and cash equivalents Amounts receivable. net of allowance for doubtful accounts of $44 and 842 Prepaid expenses Other Total current assets (variable interest entities $100 and $90) Intangibles and Other Assets: Goodwill 5385403 92 81 1,261 1.150 130 189 2,003 1.983 5.160 872 415 5.159 4877 780 421 867 380 100 280 12,864 14.957_$ 367 90 29 12.012 13.995 1,549 16 350 700 2,615 7.266 Brands Management and franchise contracts, net Other intangible assets, net Operating lease right-of-use assets Property and equipment, net Deferred income tax assets Other Total intangibles and other assets (variable interest entities - $179 and $178) TOTAL ASSETS LIABILITIES AND EQUITY (DEFICIT) Current Liabilities: Accounts payable, accrued expenses and other Current maturities of long-term debt Current portion of deferred revenues Current portion of liability for guest loyalty program Total current liabilities (variable interest entities - $64 and $56) Long-term debt Operating Icase liabilities Deferred revenues Deferred income tax liabilities Liability for guest loyalty program Other Total liabilities (variable interest entities - $260 and $263) Commitments and contingencies - see Note 19 Equity (Deficit): Preferred stock, 30.01 par value; 3,000,000,000 authorized shares, none issued or outstanding as of December 31, 2019 and 2018 Common stock, S0.01 par value: 10,000,000,000 authorized shares, 333.159,770 issued and 278,985, 125 outstanding as of December 31, 2019 and 332,105,163 issued and 294,815,890 outstanding as of December 31, 2018 Treasury stock, at cost; 54,174,645 shares as of December 31, 2019 and 37,289,273 shares as of December 31, 2018 Additional paid-in capital Accumulated deficit Accumulated other comprehensive loss Total Hilton stockholders' equity (deficit) Noncontrolling interests Total equity (deficit) TOTAL LIABILITIES AND EQUITY (DEFICIT) 1,703 $ 37 332 799 2,871 1-956 1,037 822 795 1,060 883 15:429 826 898 969 863 13,437 19 (4.169) 10,489 (5,965) (840) (482) 10 (472) 14.957 $ (2,625) 10,372 (6,417) (782) 551 7 558 13.995 See notes to consolidated financial statements. HILTON WORLDWIDE HOLDINGS INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Year Ended December 31, 2018 2017 2019 Revens Franchise and licensing fees Base and other management fees Incentive management fees Owned and leased hotels Other revenues $ 1,321 1,681 S 1,330 S 332_321 230 235 1,422 1,484 101 98 3.766 3,668 5.686 3.238 9:52 8,906 324 222 1,432 105 3,404 4,727 8,131 Other revenues from managed and franchised properties Total sendes Expenses Owned and leased hotels Depreciation and amortization General and administrative 1.254 346 Other expenses 441 1.332 325 443 51 2.151 5323 7,474 72 2,113 5.763 7.876 1.269 336 439 56 2.100 4,899 6,999 Other expenses from managed and franchised properties Total expenses Gain on sale of assets, net 81 Operating income 1.657 1,432 1.132 Interest expense Gain (loss) on foreign currency transactions Loss on debt extinguishment Other non-operating income, net (414) (2) (371) (11) (351) 3 (60) 3 28 29 Income before income taxes 1,244 1,078 753 Income tax benefit (expense) (358) (309) 336 Net income Net income attributable to non controlling interests Net income attributable to Hilton stockholders 886 (5) 881 769 (5) 764S 1,089 (5) 1.089 S 334 Earnings per share: Basic Diluted 3.07 104 0602 60 060 Cash dividends declared per share See notes to consolidated financial statements. HILTON WORLDWIDE, HOLDINGS INC. CONSOLIDATED STATEMENTS OY COMPREHENSIVE INCOME an millions) Year Ended December 31 2019 2018 2017 886 1695 1089 Nef income Other comprehensive income (loss), nct of tax bcncfit (expense) Currency translation adjusment, te of the of Scy, 56 and Pension liability adjustment, nct of tax of 53, 51 and 518) Cash flow hedgo adjustment, net of tax of S15, S(8y and S(TY Total other comprehensive income (lons) (9) (foy (9) 22 164 22 13 197 (58) 828 Comprehensive income Comprehensive Income attributable to noncontrolling interests Comprehensive income attributable to Hilton stockholders 712 (5 7075 1.286 5 JL 8225 See notes to consolidated financial statements HILTON WORLDWIDE HOLDINGS INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Year Ended December 31 2018 2019 2017 886 5 7095 17 336 121 15 1729 675 2043 ) Operating Activities: Nct income Adjustments to reconcile nct income to net cash provided by operating activities Amortization of contract accpisation costs Depreciation and amortization Gain on sale of assets, net Loss (gain) on foreign currency transactions Loss on debt extinguishment Share based compensation Amortization of deferred financing costs and other Distributions from unconsolidated adites Deferred income taxes Contract acquisition costs Changes in operating assets and liabilities Accounts receivable, net Prepaid expenses Other Currest assets Accounts payable, accrued expenses and other Change in operating lease right-of-use assets Change in operating lease liabilities Change in deferred revenues Change in liability for guest loyalty program Change in other liabilities Other Ne cash provided by operating activities Investing Activities: Capital expenditures for property and equipment Payments received on other financing receivables Proceeds from a disposition Capitalized software costs Other Net cash used in investing activities Financing Activities: Borrowings Repayment of debt Debt issuance costs and redemption premium Dividends paid Cash transferred in spin-ofts Repurchases of common stock Share-based compensation tax withholdings and other Other Net cash used in financing activities (17) *E*13m3k 284863* | -30 faelge 4m5! --s% ;; ng-n-us*gw GSBS --y Es-swam 334 29 (95) (4) 1,384 849 (58) 7 (87) 22 (131) (75) 21) (147) ( 1,824 (1860) (69) (195) (501) (891) (31) (0) (1.724) (1,721) (27) (1.113) 1 300) Elfect of exchange rate changes on cash, restricted cash and cash equivalents Net increase (decrease) in cash, restricted cash and cash equivalents Cash, restricted cash and cash equivalents, beginning of period Cash, restricted cash and cash equivalents, end of period (2) 146 484 630 (10) (186) 670 484 (1.014) 1684 670 See notes to consolidated financial statements. For supplemental disclosures, see Note 21: "Supplemental Disclosures of Cash Flow Information" 70 APPLICATION EXERCISE RATIO ANALYSIS - HILTON WORLDWIDE RATIO ANALYSIS (Please compute the following ratios and tell for what purpose the ratio is used): . Current Ratio . Debt to Assets Ratio Working Capital . Solvency Ratio Property and Equipment (Fixed Asset) Turnover Ratio Total Asset Turnover Ratio . Profit Margin Gross Return on Assets RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started