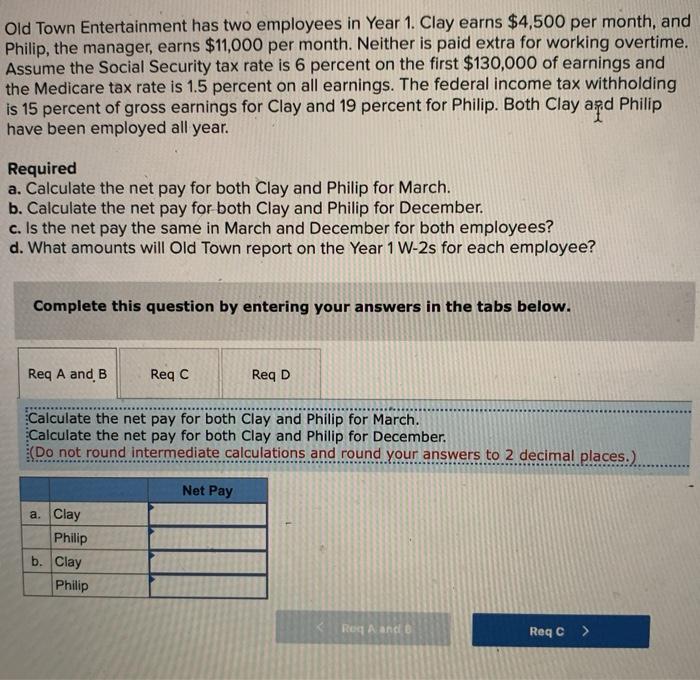

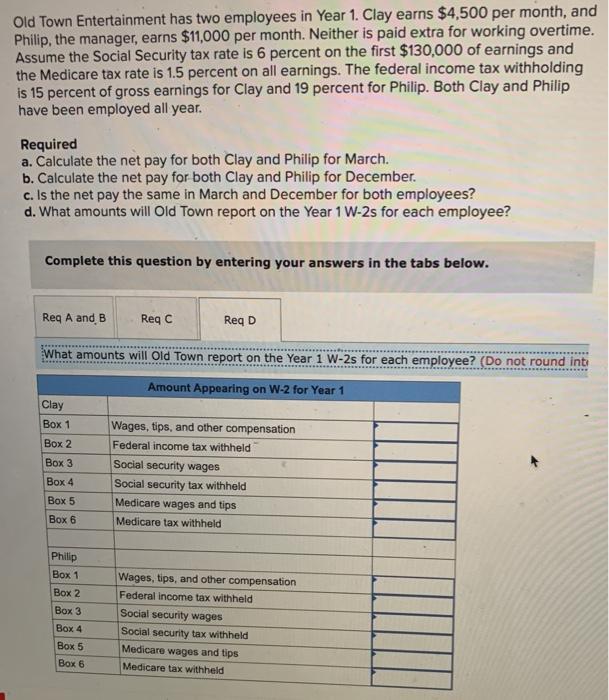

Old Town Entertainment has two employees in Year 1. Clay earns $4,500 per month, and Philip, the manager, earns $11,000 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $130,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 15 percent of gross earnings for Clay and 19 percent for Philip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee? Complete this question by entering your answers in the tabs below. Req A and B ReqC Reg D Calculate the net pay for both Clay and Philip for March. Calculate the net pay for both Clay and Philip for December. (Do not round intermediate calculations and round your answers to 2 decimal places.). Net Pay a. Clay Philip b. Clay Philip KROGA and Reqc > Old Town Entertainment has two employees in Year 1. Clay earns $4,500 per month, and Philip, the manager, earns $11,000 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $130,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 15 percent of gross earnings for Clay and 19 percent for Philip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee? Complete this question by entering your answers in the tabs below. Req A and B Reqc Reg D Is the net pay the same in March and December for both employees? Is the net pay the same in March and December for both employees? be Old Town Entertainment has two employees in Year 1. Clay earns $4,500 per month, and Philip, the manager, earns $11,000 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $130,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 15 percent of gross earnings for Clay and 19 percent for Philip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee? Complete this question by entering your answers in the tabs below. Reg A and B Reg C Reg D What amounts will Old Town report on the Year 1 W-2s for each employee? (Do not round int Amount Appearing on W-2 for Year 1 Clay Box 1 Box 2 Box 3 Box 4 Box 5 Box 6 Wages, tips, and other compensation Federal income tax withheld Social security wages Social security tax withheld Medicare wages and tips Medicare tax withheld Philip Box 1 Box 2 Box 3 Box 4 Box 5 Box 6 Wages, tips, and other compensation Federal income tax withheld Social security wages Social security tax withheld Medicare wages and tips Medicare tax withheld