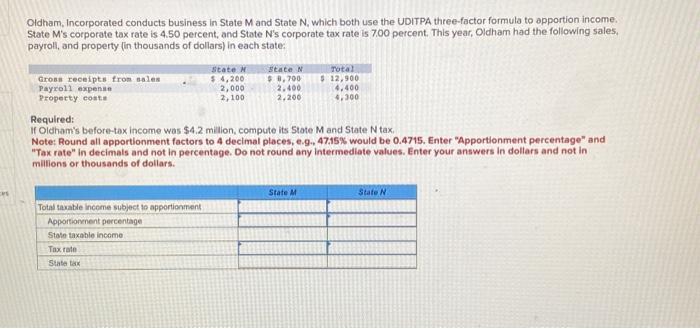

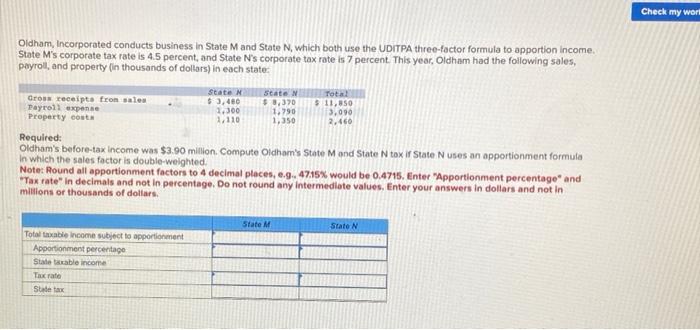

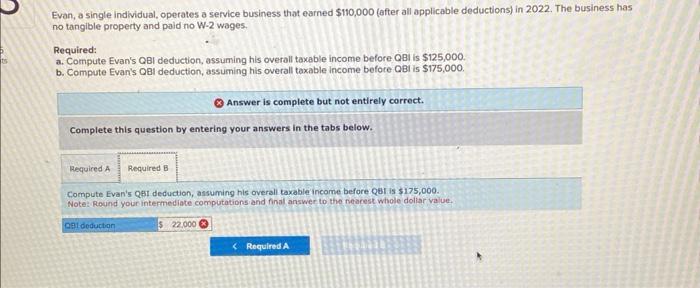

Oldham, Incorporated conducts business in State M and State N, which both use the UDITPA three-foctor formula to apportion income. State M 's corporate tax rate is 4.50 percent, and State N 's corporate tax rate is 7.00 percent. This year, Oldham had the following sales. payroll, and property (in thousands of dollars) in each state: Required: If Oldham's before-tax income was $4.2 milion, compute its State M and S tate N tax. Note: Pound all apportionment factors to 4 decimal places, e.g., 47.15\% would be 0.4715 . Enter "Apportionment percentage" and "Tax rate" in decimals and not in percentage. Do not round any intermediate values. Enter your answers in dollars and not in militions or thousands of dollars. Oldham, Incorporated conducts business in State M and State N, which both use the UDiTPA three-factor formula to apportion income. State M's corporate tax rate is 4.5 percent, and State N's corporate tax rate is 7 percent. This year, Oldham had the following sales, poyrol, and property (in thousands of dollars) in each state: Required: Oldham's before-tax income was $3.90 million. Compute Oidham's state M and State N tox if State N uses an apportionment formula In which the sales factor is double-weighted. Note: Round all apportionment factors to 4 decimal places, e.9. 47.15\% would be 0.4715. Enter "Apportionment percentage" and "Tax rate" In decimals and not in percentage. Do not round any intermediote values. Enter your answers in dollars and not in millions or thousands of dollars. Evan, a single indlvidual, operates a service business that earned $110,000 (after all applicable deductions) in 2022. The business has no tangible property and paid no W-2 wages. Required: a. Compute Evan's QBI deduction, assuming his overall taxable income before QBi is $125,000. b. Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $175,000. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute Evan's Q61 deduction, assuming his overall taxable income before Qut is $175,000. Note: Round your intermediate computations and finil answer to the nearest whole doliar value