Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Olive Companies (OC) paid $5,760,000 for an oil reserve estimated to hold 90,000 barrels of oil. Oil production is expected to be 14,000 barrels

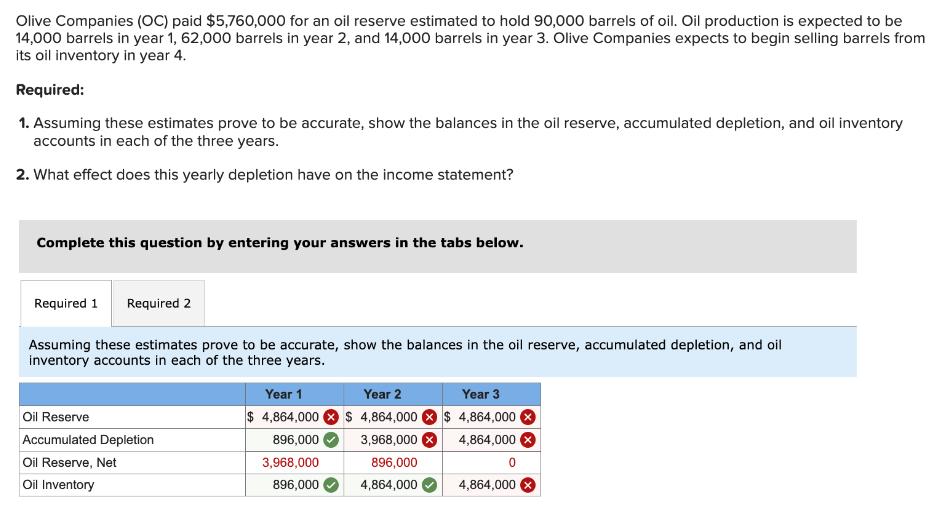

Olive Companies (OC) paid $5,760,000 for an oil reserve estimated to hold 90,000 barrels of oil. Oil production is expected to be 14,000 barrels in year 1, 62,000 barrels in year 2, and 14,000 barrels in year 3. Olive Companies expects to begin selling barrels from its oil inventory in year 4. Required: 1. Assuming these estimates prove to be accurate, show the balances in the oil reserve, accumulated depletion, and oil inventory accounts in each of the three years. 2. What effect does this yearly depletion have on the income statement? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming these estimates prove to be accurate, show the balances in the oil reserve, accumulated depletion, and oil inventory accounts in each of the three years. Year 1 Year 2 Year 3 Oil Reserve Accumulated Depletion Oil Reserve, Net Oil Inventory $ 4,864,000 $4,864,000 $4,864,000 3,968,000 4,864,000 896,000 3,968,000 896,000 0 896,000 4,864,000 4,864,000

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Olive Companies Oil Reserves Depletion Required 1 Account Balances Account Year 1 Year 2 Year 3 Oil ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started