Question

Omaha Corp. has no debt and operates in a frictionless financial market. Its assets will be worth either $300 million or $150 million in

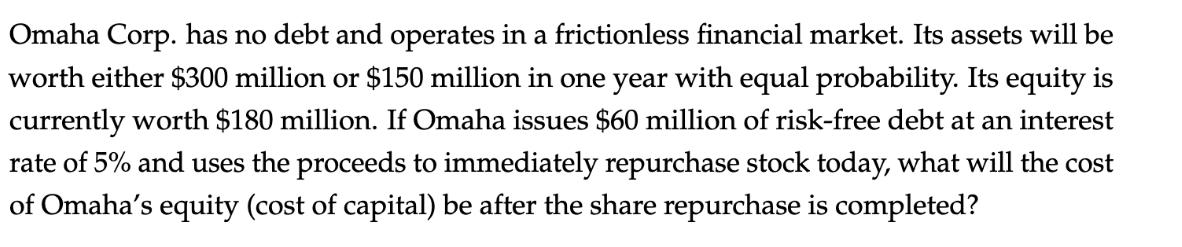

Omaha Corp. has no debt and operates in a frictionless financial market. Its assets will be worth either $300 million or $150 million in one year with equal probability. Its equity is currently worth $180 million. If Omaha issues $60 million of risk-free debt at an interest rate of 5% and uses the proceeds to immediately repurchase stock today, what will the cost of Omaha's equity (cost of capital) be after the share repurchase is completed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

What will be the cost of Omahas equity after share repurchase Answer 3500 Working We issue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational Finance Evaluating Opportunities Costs and Risks of Operations

Authors: Kirt C. Butler

5th edition

1118270126, 978-1118285169, 1118285166, 978-1-119-2034, 978-1118270127

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App