Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table reports the expected level of sales and cost of goods sold for the next four years related to an investment that

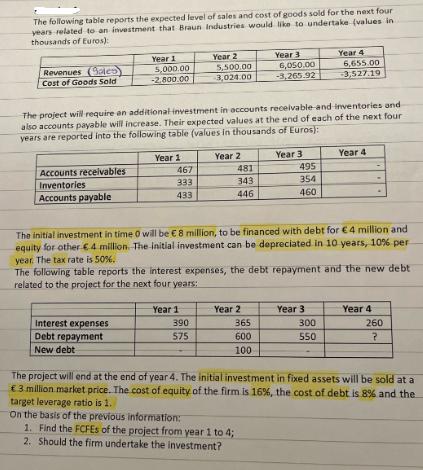

The following table reports the expected level of sales and cost of goods sold for the next four years related to an investment that Braun Industries would like to undertake (values in thousands of Euros): Revenues (Sale) Cost of Goods Sold Accounts receivables Inventories Accounts payable Year 1 5,000.00 -2.800.00 Interest expenses Debt repayment New debt Year 1 467 333 433 The project will require an additional investment in accounts receivable and inventories and also accounts payable will increase. Their expected values at the end of each of the next four years are reported into the following table (values in thousands of Euros): Year 2 Year 1 5,500.00 3,024.00 390 575 Year 2 481 343 446 Year 2 Year 3 365 600 100 6,050.00 -3,265.92 The initial investment in time 0 will be 8 million, to be financed with debt for 4 million and equity for other 4 million. The initial investment can be depreciated in 10 years, 10% per year. The tax rate is 50%. The following table reports the interest expenses, the debt repayment and the new debt related to the project for the next four years: 1. Find the FCFEs of the project from year 1 to 4; 2. Should the firm undertake the investment? Year 3 495 354 460 Year 4 6,655.00 -3,527.19 Year 3 300 550 Year 4 Year 4 260 ? The project will end at the end of year 4. The initial investment in fixed assets will be sold at a 3 million market price. The cost of equity of the firm is 16%, the cost of debt is 8% and the target leverage ratio is 1. On the basis of the previous information:

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The image provided contains a financerelated question where a company is considering an investment and the following information is provided 1 Revenue and cost of goods sold COGS projections over four ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started