Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oman Cement Company has bought a machinery for RO 85,000 with an estimated useful life of 7 years. Ms. Safia, an Accounting Manager, is

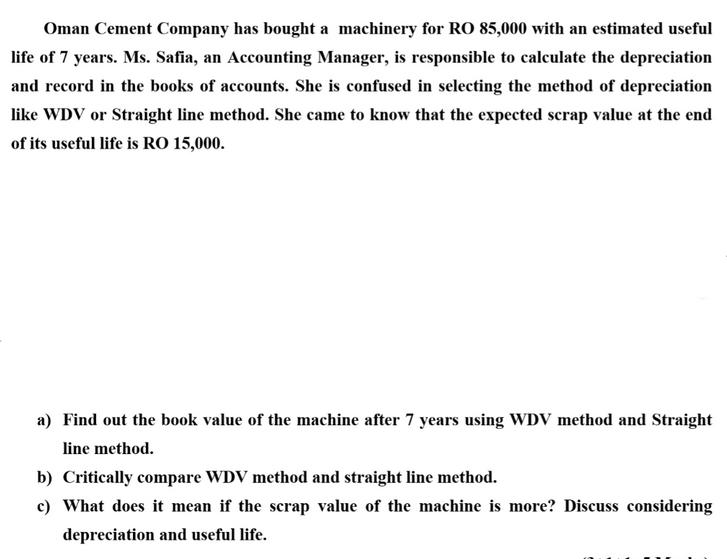

Oman Cement Company has bought a machinery for RO 85,000 with an estimated useful life of 7 years. Ms. Safia, an Accounting Manager, is responsible to calculate the depreciation and record in the books of accounts. She is confused in selecting the method of depreciation like WDV or Straight line method. She came to know that the expected scrap value at the end of its useful life is RO 15,000. a) Find out the book value of the machine after 7 years using WDV method and Straight line method. b) Critically compare WDV method and straight line method. c) What does it mean if the scrap value of the machine is more? Discuss considering depreciation and useful life.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find out the book value of the machine after 7 years using the WDV Written Down Value method and Straight Line method we need to consider the initial cost of the machinery the estimated useful li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started