Answered step by step

Verified Expert Solution

Question

1 Approved Answer

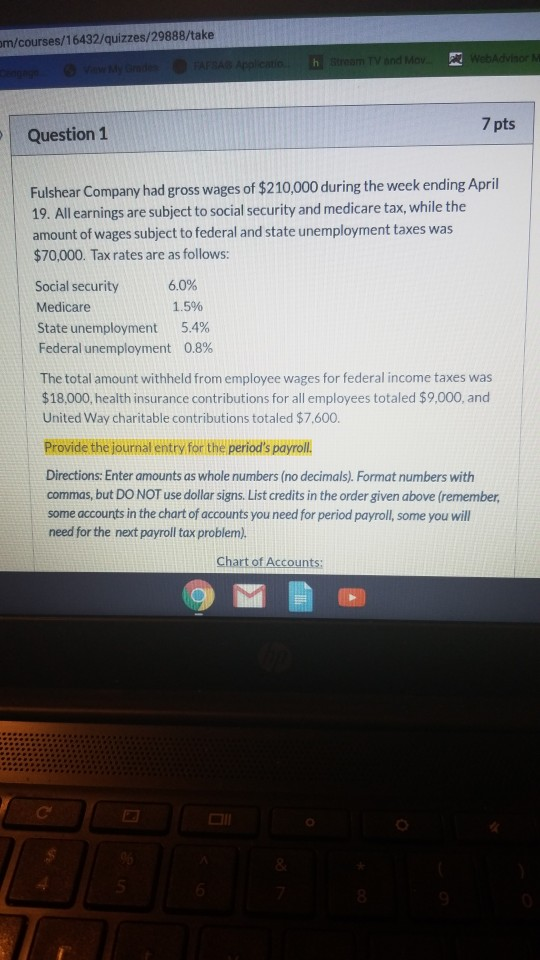

om/courses/16432/quizzes/29888/take TV and Mo WebAdvor W A LA Acah 7 pts Question 1 Fulshear Company had gross wages of $210,000 during the week ending April

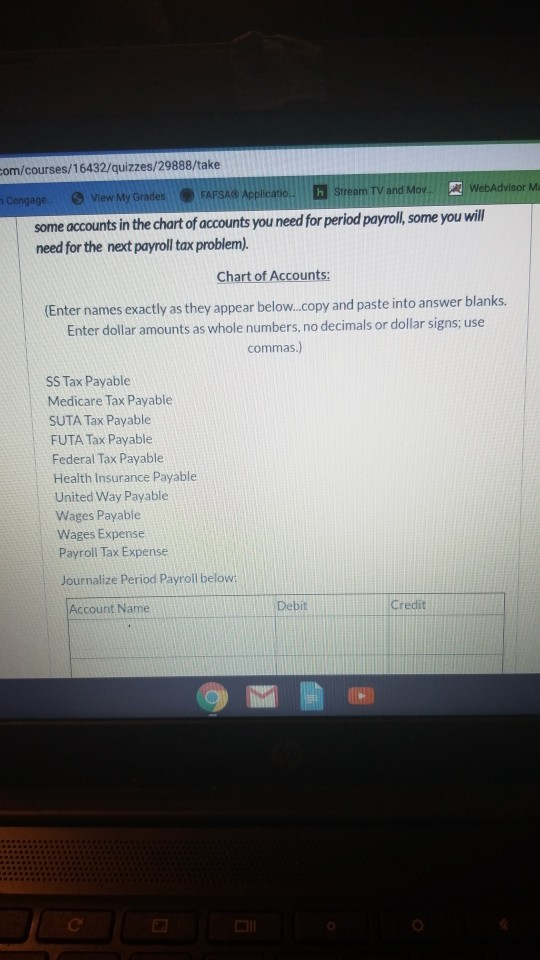

om/courses/16432/quizzes/29888/take TV and Mo WebAdvor W A LA Acah 7 pts Question 1 Fulshear Company had gross wages of $210,000 during the week ending April 19. All earnings are subject to social security and medicare tax, while the amount of wages subject to federal and state unemployment taxes was $70,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal income taxes was $18,000, health insurance contributions for all employees totaled $9,000, and United Way charitable contributions totaled $7,600. Provide the journal entry for the period's payroll. Directions: Enter amounts as whole numbers (no decimals). Format numbers with commas, but DO NOT use dollar signs. List credits in the order given above (remember, some accounts in the chart of accounts you need for period payroll, some you will need for the next payroll tax problem). Chart of Accounts: om/courses/16432/quizzes/29888/take Cengage. View My Grades FAFSA Application Stream TV and Mov. WebAdvisor some accounts in the chart of accounts you need for period payroll, some you will need for the next payroll tax problem). Chart of Accounts: (Enter names exactly as they appear below...copy and paste into answer blanks. Enter dollar amounts as whole numbers, no decimals or dollar signs; use commas.) SS Tax Payable Medicare Tax Payable SUTA Tax Payable FUTA Tax Payable Federal Tax Payable Health Insurance Payable United Way Payable Wages Payable Wages Expense Payroll Tax Expense Journalize Period Payroll below: Account Name Debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started