Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Omega Corporation reports the following results for the current year (Click the icon to view the results for the current year.) Read the requirements LAM

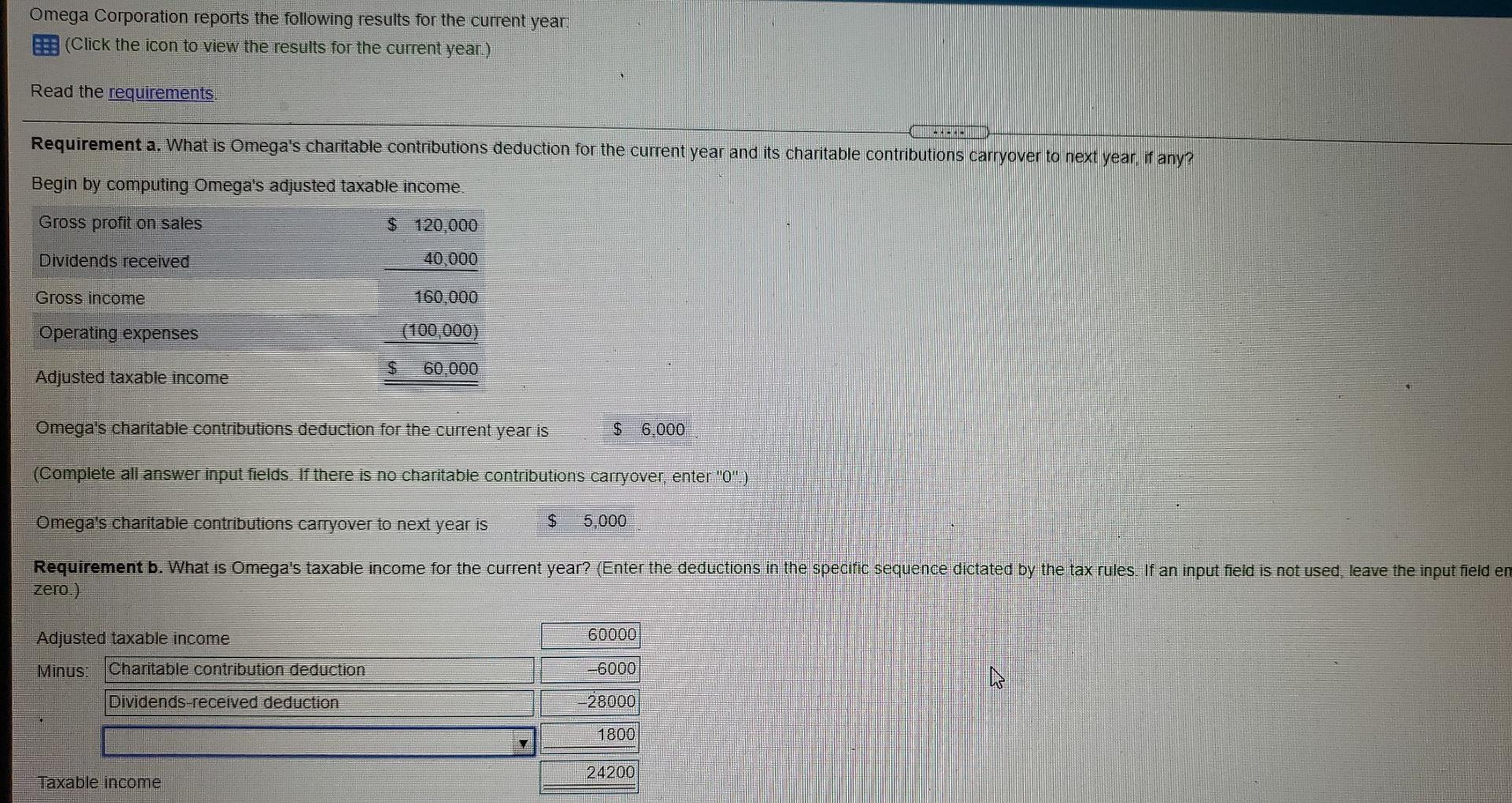

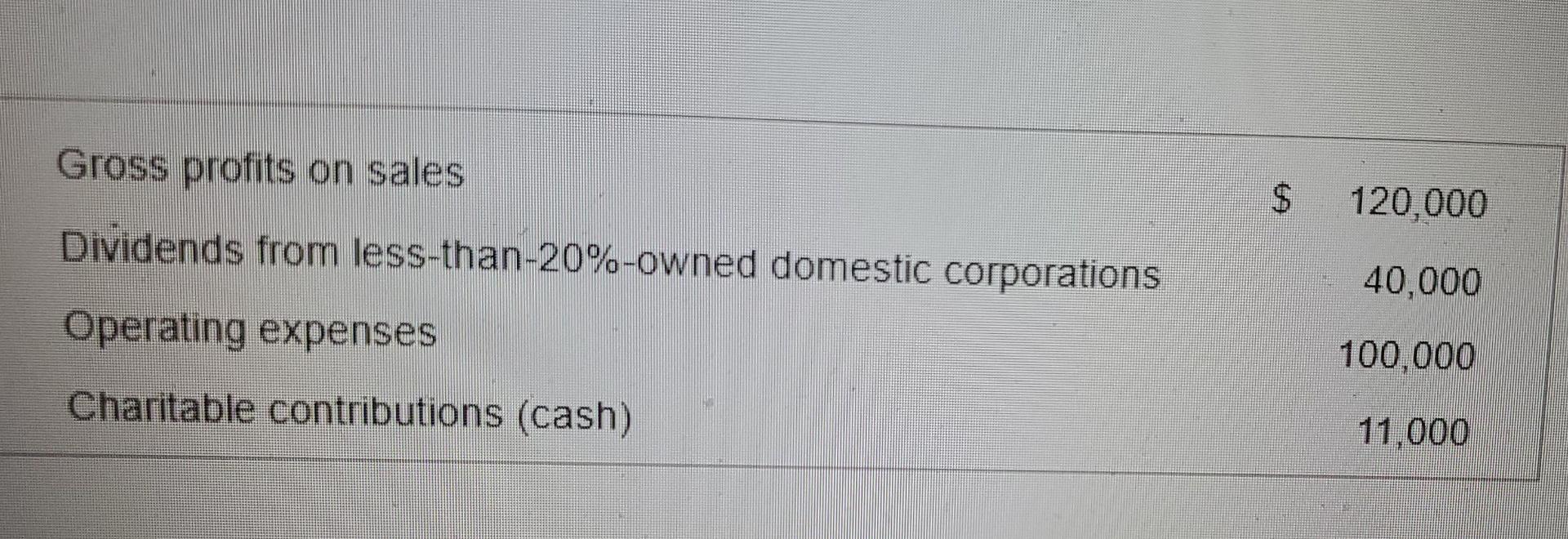

Omega Corporation reports the following results for the current year (Click the icon to view the results for the current year.) Read the requirements LAM Requirement a. What is Omega's charitable contributions deduction for the current year and its charitable contributions carryover to next year, if any? Begin by computing Omega's adjusted taxable income. Gross profit on sales $ 120,000 Dividends received 40 000 Gross income 160,000 Operating expenses (100,000) $ 60.000 Adjusted taxable income Omega's charitable contributions deduction for the current year is $ 6.000 (Complete all answer input fields. If there is no charitable contributions carryover, enter "0") Omega's charitable contributions carryover to next year is $ 5.000 Requirement b. What is Omega's taxable income for the current year? (Enter the deductions in the specific sequence dictated by the tax rules. If an input field is not used, leave the input field en zero.) 60000 Adjusted taxable income Minus Charitable contribution deduction -6000 Dividends-received deduction 28000 1800 24200 Taxable income Gross profits on sales $ 120,000 Dividends from less-than-20%-owned domestic corporations Operating expenses 40,000 100,000 Charitable contributions (cash) 11,000 What is Omega's charitable contributions deduction for the current year and its charitable contributions carryover to next year, if any? What is Omega's taxable income for the current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started