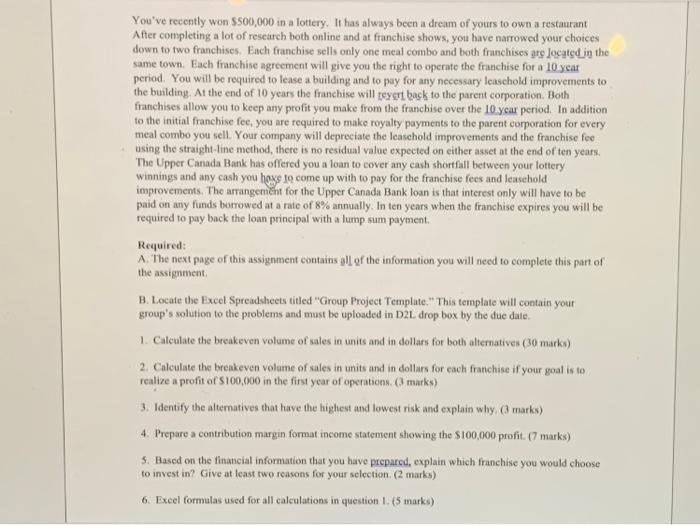

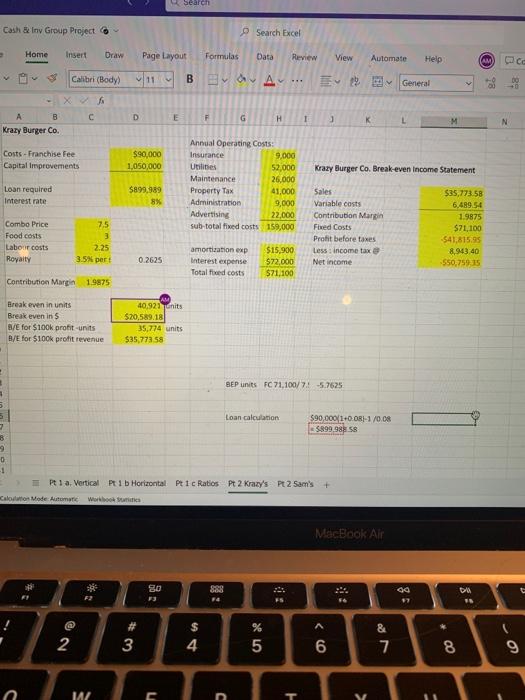

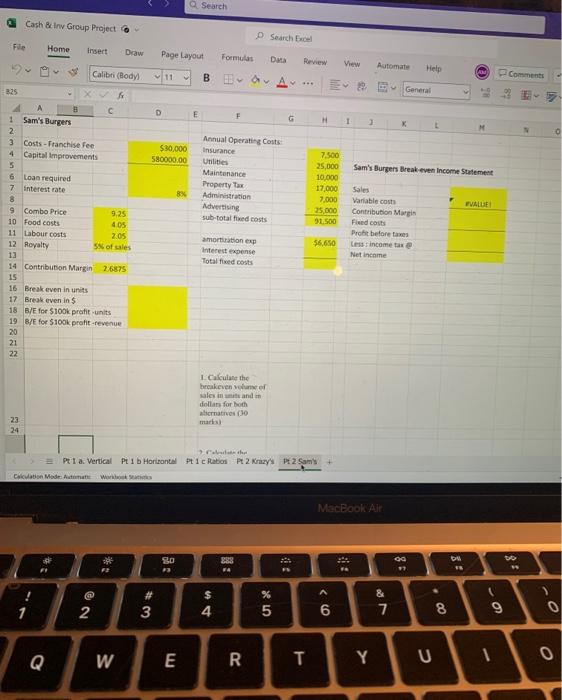

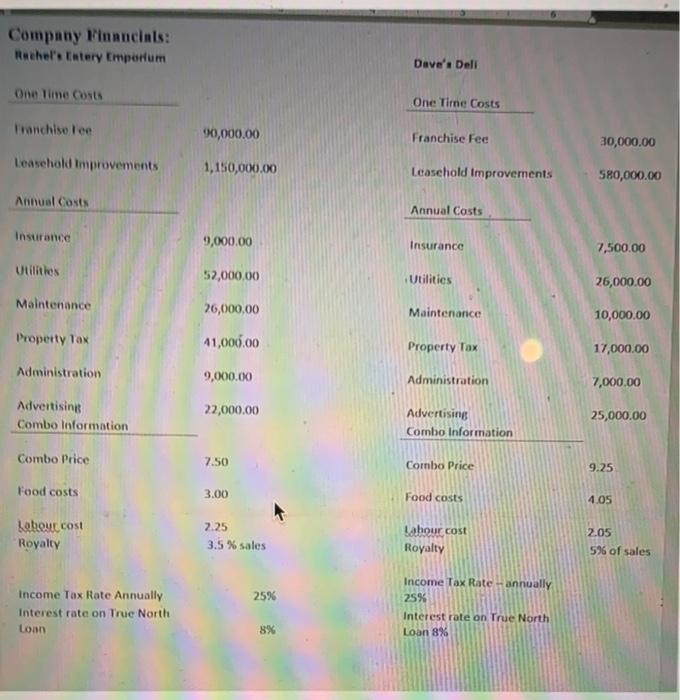

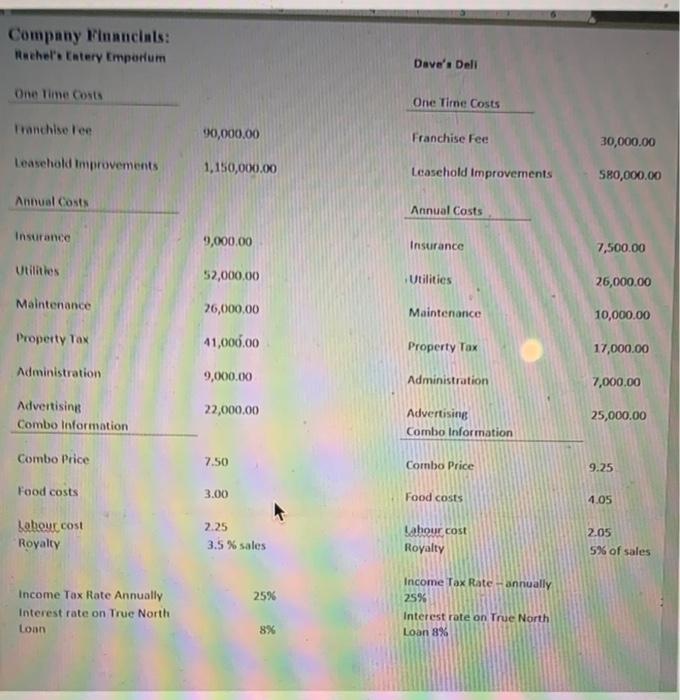

You've recently won $500,000 in a lottery. It has always been a dream of yours to own a restaurant After completing a lot of research both online and at franchise shows, you have narrowed your choices down to two franchises. Each franchise sells only one meal combo and both franchises are located in the same town. Fach franchise agreement will give you the right to operate the franchise for a 10 year period. You will be required to lease a building and to pay for any necessary leaschold improvements to the building. At the end of 10 years the franchise will teyert back to the parent corporation. Both franchises allow you to keep any profit you make from the franchise over the 10 ycar period. In addition to the initial franchise fee, you are required to make royalty payments to the parent corporation for every meal combo you sell. Your company will depreciate the leaschold improvements and the franchise fee using the straight-line method, there is no residual value expected on either asset at the end of ten years. The Upper Canada Bank has offered you a loan to cover any cash shortfall between your lottery winnings and any cash you hoyg to come up with to pay for the franchise fees and leasehold improvements. The arrangement for the Upper Canada Bank loan is that interest only will have to be paid on any funds borrowed at a rate of 8% anmually. In ten years when the franchise expires you will be required to pay back the loan principal with a lump sum payment. Required: A. The next page of this assignment contains all of the information you will need to complete this part of the assignment. B. Locate the Excel Spreadsheets titled "Group Project Template." This template will contain your group's solution to the problems and must be uploaded in D2L drop box by the due date. 1. Calculate the breakeven volume of sales in units and in dollars for both aliernatives ( 30 marks) 2. Calculate the breakeven volume of kales in units and in dollars for each franchise if your goal is to realize a profit of $100,000 in the first year of operations. ( 3 marks) 3. Identify the alternatives that have the highest and lowest risk and explain why, (3 marks) 4. Prepare a contribution margin format income statement showing the $100,000 profit. (7 marks) 5. Based on the financial information that you have prepared, explain which franchise you would choose to invest in? Give at least two reasons for your selection. (2 marks) 6. Exeel formulas used for all calculations in question 1. ( 5 marks) ven income statement EEP units FC7 71.100/7i5.7625 E Cash \&inw Group Project 0 Search Company Kinancials: Anchel's Entery rmpertum Dave's Deli Dine Iime costs Iranchise Iee Leasehold Improvements Antual Costs Insurance Utilithes Maintenance Propetty Tax Administration Advertising Combo Information Combo Price Food costs batourcost Royalty Income Tax Rate Annually Interest rate on True North Loan 90,000.00 1,150,000.00 9,000.00 52,000,00 26,000,00 41,0000.00 9,000.00 22,000.00 7.50 3.00 2.25 3.5% sales One Tirne Costs Franchise Fee Leasehold Improvements Annual Costs Insurance Utilities Maintenance Property Tax Administration Advertising Combo Information Combo Price Food costs Bahour cost Royalty Income Tax Rate-annually 25% Interest rate on True North Loan 8% 30,000.00 580,000.00 7,500.00 26,000.00 10,000.00 17,000.00 7,000.00 25,000.00 9.25 4.05 205 5% of sales 25% 8% Company Kinancials: Anehel's Entery Emportum Dave'a Deli One Iime Costs Inehise lee Leasehold improvements Antual Costs Insurance Utilitios Maintenance Property Tax Administration Advertising Combo Information Combo Price Food costs batoyrcost Royalty Income Tax Rate Annually Interest rate on True North Loan 90,000,00 1,150,000.00 9,000.00 52,000,00 26,000,00 41,000.00 9,000.00 22,000.00 7.50 3.00 2.25 3.5% sales 25% 8 One Time Costs Franchise Fee Leasehold Improvements Annual Costs Insurance Utilities Maintenance Property Tax Administration Advertising Combo Information Combo Price Food costs Dahour cost Royalty 7,500.00 26,000.00 10,000.00 17,000.00 7,000.00 25,000.00 Income Tax Rate - annually 25% Interest rate on True North Lan 8%