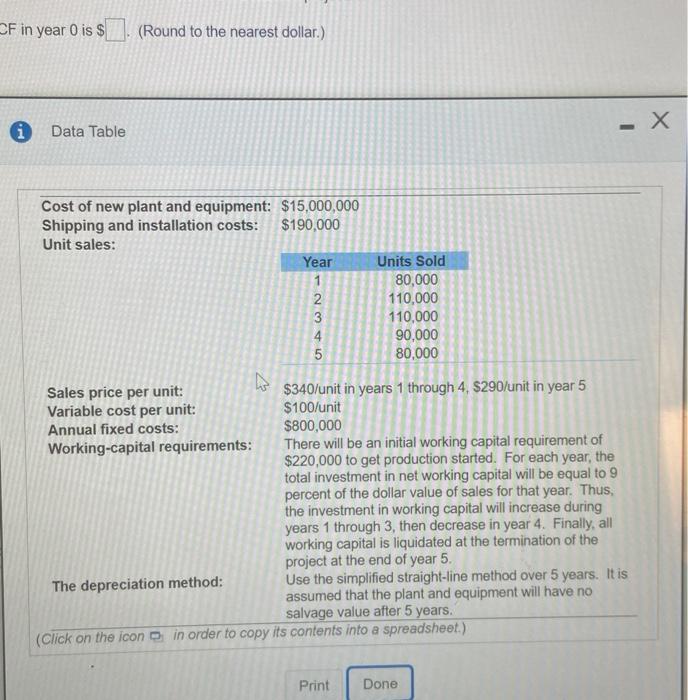

omework: Chapter 12 Homework Save ore: 0 of 4 pts 5 of 5 (4 complete HW Score: 75%, 12 of 16 pts 12-22 (similar to) Question Help Related to Checkpoint 121) (Comprehensive problem-calculating project cash flows, NPV, PI, and IRR) raid Winds Corporation, a firm in the 32 percent marginal tax bracket with a required rate of return or discount rate of 3 percent, is considering a new project. This project involves the introduction of a new product. The project is xpected to last 5 years and then, because this is somewhat of a fad product, it will be terminated. Given the following information, determine the free cash flows associated with the project, the project's not present value, the profitability index, and the internal rate of return. Apply the appropriate decision criteria. a. Determine the free cash flows associated with the project The FCF in year O is $(Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer Clear All parts 9 732 PM 4/21/2021 remaining CF in year 0 is $ (Round to the nearest dollar.) . Data Table N Cost of new plant and equipment: $15,000,000 Shipping and installation costs: $190,000 Unit sales: Year Units Sold 1 80,000 2 110,000 3 110,000 4 90,000 5 80,000 Sales price per unit: $340/unit in years 1 through 4, $290/unit in year 5 Variable cost per unit: $100/unit Annual fixed costs: $800,000 Working-capital requirements: There will be an initial working capital requirement of $220,000 to get production started. For each year, the total investment in net working capital will be equal to 9 percent of the dollar value of sales for that year. Thus, the investment in working capital will increase during years 1 through 3, then decrease in year 4. Finally, all working capital is liquidated at the termination of the project at the end of year 5. The depreciation method: Use the simplified straight-line method over 5 years. It is assumed that the plant and equipment will have no salvage value after 5 years. (Click on the icon in order to copy its contents into a spreadsheet.) Print Done