Answered step by step

Verified Expert Solution

Question

1 Approved Answer

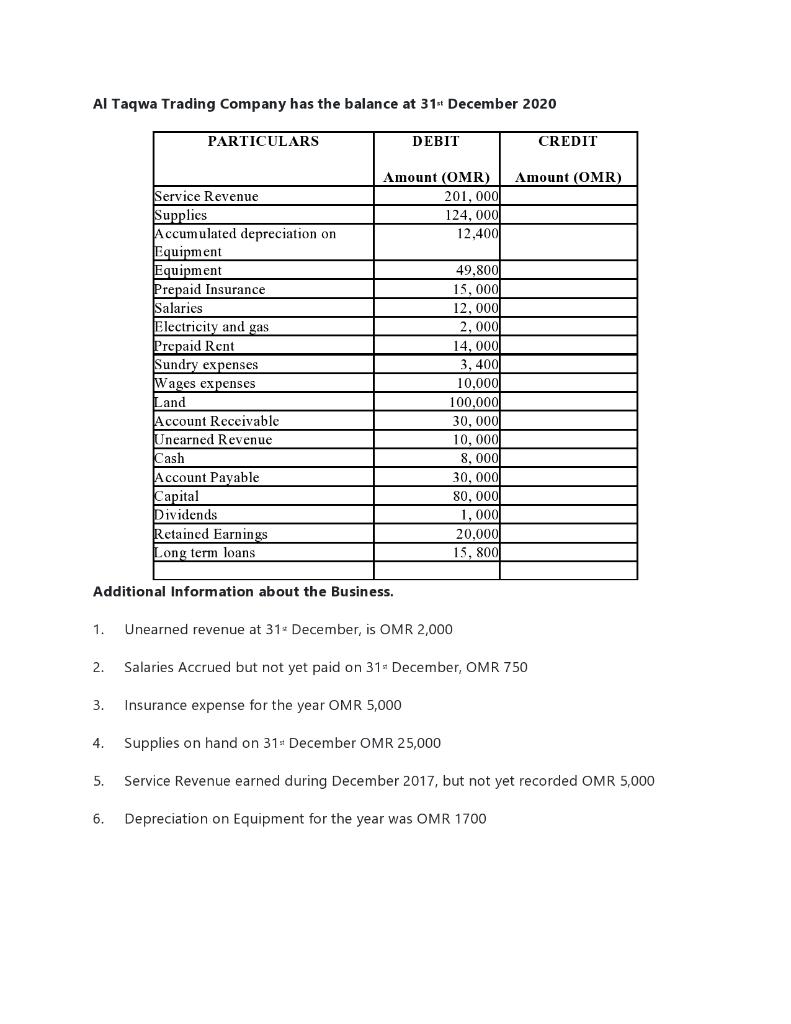

OMR is the currency used. Al Taqwa Trading Company has the balance at 31 December 2020 PARTICULARS DEBIT CREDIT Amount (OMR) Amount (OMR) 201, 0001

OMR is the currency used.

Al Taqwa Trading Company has the balance at 31 December 2020 PARTICULARS DEBIT CREDIT Amount (OMR) Amount (OMR) 201, 0001 124, 000 12,400 Service Revenue Supplies Accumulated depreciation on Equipment Equipment Prepaid Insurance Salaries Electricity and gas Prepaid Rent Sundry expenses Wages expenses Land Account Receivable Unearned Revenue Cash Account Payable Capital Dividends Retained Earnings Long term loans 49,800 15,000 12,000 2,000 14,000 3,400 10,000 100,000 30,000 10,000 8,000 30,000 80,000 1,000 20,000 15,800 Additional Information about the Business. 1. Unearned revenue at 31 December, is OMR 2,000 2. Salaries Accrued but not yet paid on 31 - December, OMR 750 3. Insurance expense for the year OMR 5,000 4. Supplies on hand on 31December OMR 25,000 5. Service Revenue earned during December 2017, but not yet recorded OMR 5,000 6. Depreciation on Equipment for the year was OMR 1700 A. Prepare the necessary Adjusting Entries on 31st December 2020 B. Prepare the Adjusted Trial Balance. C. Prepare Income Statement, Statement of Owners' Equity and FINANCIAL POSITIONStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started