Answered step by step

Verified Expert Solution

Question

1 Approved Answer

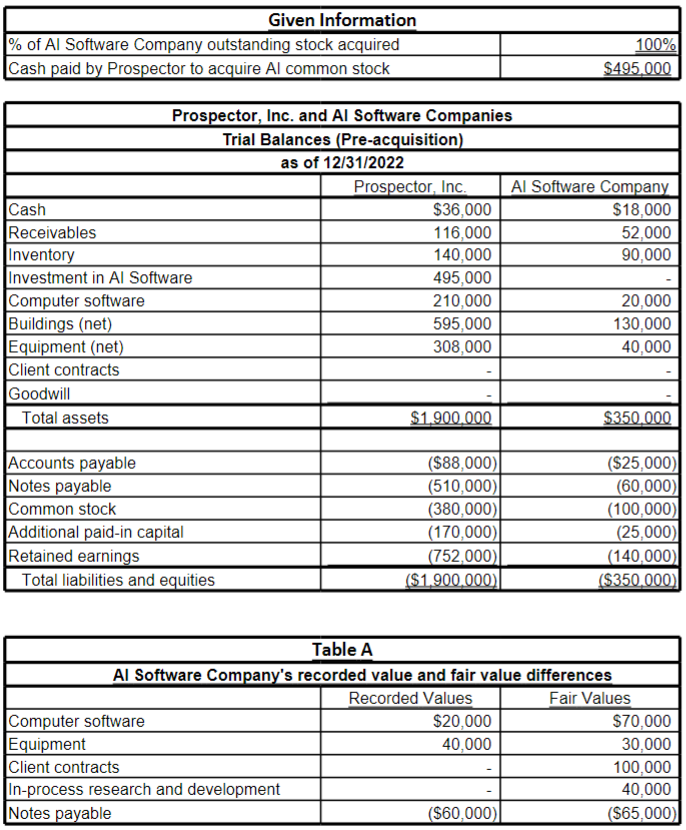

On 1 2 / 3 1 / 2 0 2 3 , P , Inc. paid $ 4 9 5 , 0 0 0 cash

On P Inc. paid $ cash to acquire of the outstanding voting common stock of AI

Software Company.

At the acquisition date, AI Software's net assets equaled their recorded values, except:

Computer software fair value $

Equipment fair value $

Unrecorded client contracts had a fair value $ and

Unrecorded inprocess R&D had a fair value $

Note : See the accompanying Excel worksheet for P Inc. and AI Softwares preacquisition trial balances that

must be used for this problem and a schedule, Table A which details the recorded values and fair values discussed

above.

Required

Prepare a schedule showing the allocation of s acquisition price to AI Software's net assets acquired,

including goodwill, if applicable.

Assuming AI Software Company is dissolved at acquisition and its assets and liabilities are transferred to Prospector,

Inc., prepare the journal entry to record Prospector's acquisition of AI Software.

Assuming AI Software Company remains in business as a separate operating subsidiary of P Inc., prepare:

a A journal entry to record Ps acquisition of AI Software,

b The worksheet to consolidate P Inc., and AI Software Company as of the acquisition date,

I do not understand how to solve!!! Pls help.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started