Answered step by step

Verified Expert Solution

Question

1 Approved Answer

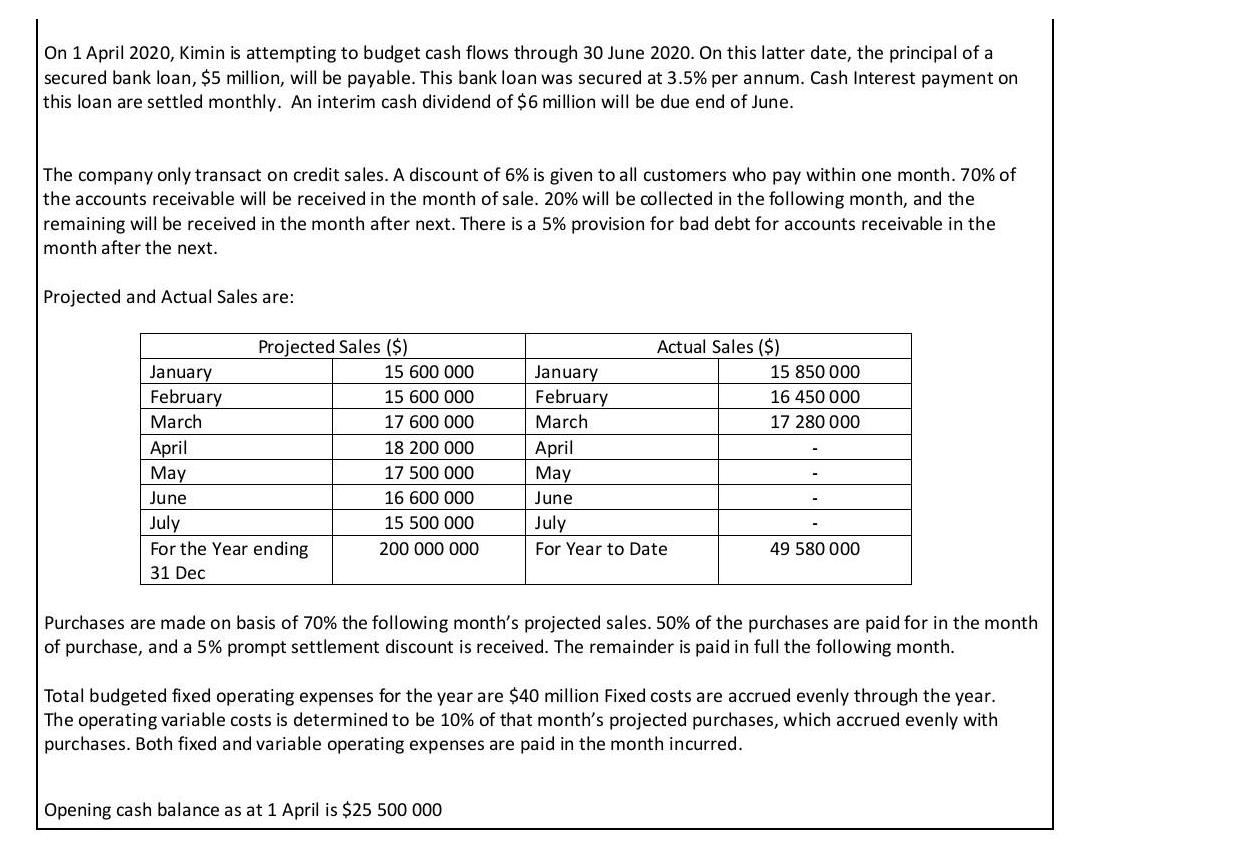

On 1 April 2020, Kimin is attempting to budget cash flows through 30 June 2020. On this latter date, the principal of a secured

On 1 April 2020, Kimin is attempting to budget cash flows through 30 June 2020. On this latter date, the principal of a secured bank loan, $5 million, will be payable. This bank loan was secured at 3.5% per annum. Cash Interest payment on this loan are settled monthly. An interim cash dividend of $6 million will be due end of June. The company only transact on credit sales. A discount of 6% is given to all customers who pay within one month. 70% of the accounts receivable will be received in the month of sale. 20% will be collected in the following month, and the remaining will be received in the month after next. There is a 5% provision for bad debt for accounts receivable in the month after the next. Projected and Actual Sales are: January February March April May June Projected Sales ($) July For the Year ending 31 Dec 15 600 000 15 600 000 17 600 000 18 200 000 17 500 000 16 600 000 15 500 000 200 000 000 January February March April May June Opening cash balance as at 1 April is $25 500 000 Actual Sales ($) July For Year to Date 15 850 000 16 450 000 17 280 000 49 580 000 Purchases are made on basis of 70% the following month's projected sales. 50% of the purchases are paid for in the month of purchase, and a 5% prompt settlement discount is received. The remainder is paid in full the following month. Total budgeted fixed operating expenses for the year are $40 million Fixed costs are accrued evenly through the year. The operating variable costs is determined to be 10% of that month's projected purchases, which accrued evenly with purchases. Both fixed and variable operating expenses are paid in the month incurred. Requirements: You will be required to write a management report in which the following points should be discussed. Analyse the Investment proposals by using NPV and IRR and provide recommendations. You should also briefly comment on other investment proposal techniques that Kimin may use, and the limitations of using these techniques. Provide an explanation on the different sources of funding available to the company, and their advantages and disadvantages and make recommendations as to how these funding sources are appropriate to the planned investment project. Analyse the level of breakeven required if Kimin proceeds with the investment. Prepare a forecasted cash budget for April to June 2020. An evaluation of Kimin's performance or position during the same period. A detailed Literature Review of the tools you have used such as capital investment techniques, breakeven analysis and budgets and their importance to the business case. Other issues for management to consider that you think are vital for them to survive and make a profit.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The investment proposals are as follows 1 The purchase of new machinery which will cost 10 million This machinery will have a 4year life and it is expected to generate savings of 25 million per year i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started