Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2019, Happyland Bhd acquired 80% of Wonderland Bhd equity shares when the retained earnings of Wonderland Bhd stood at RM6 million.

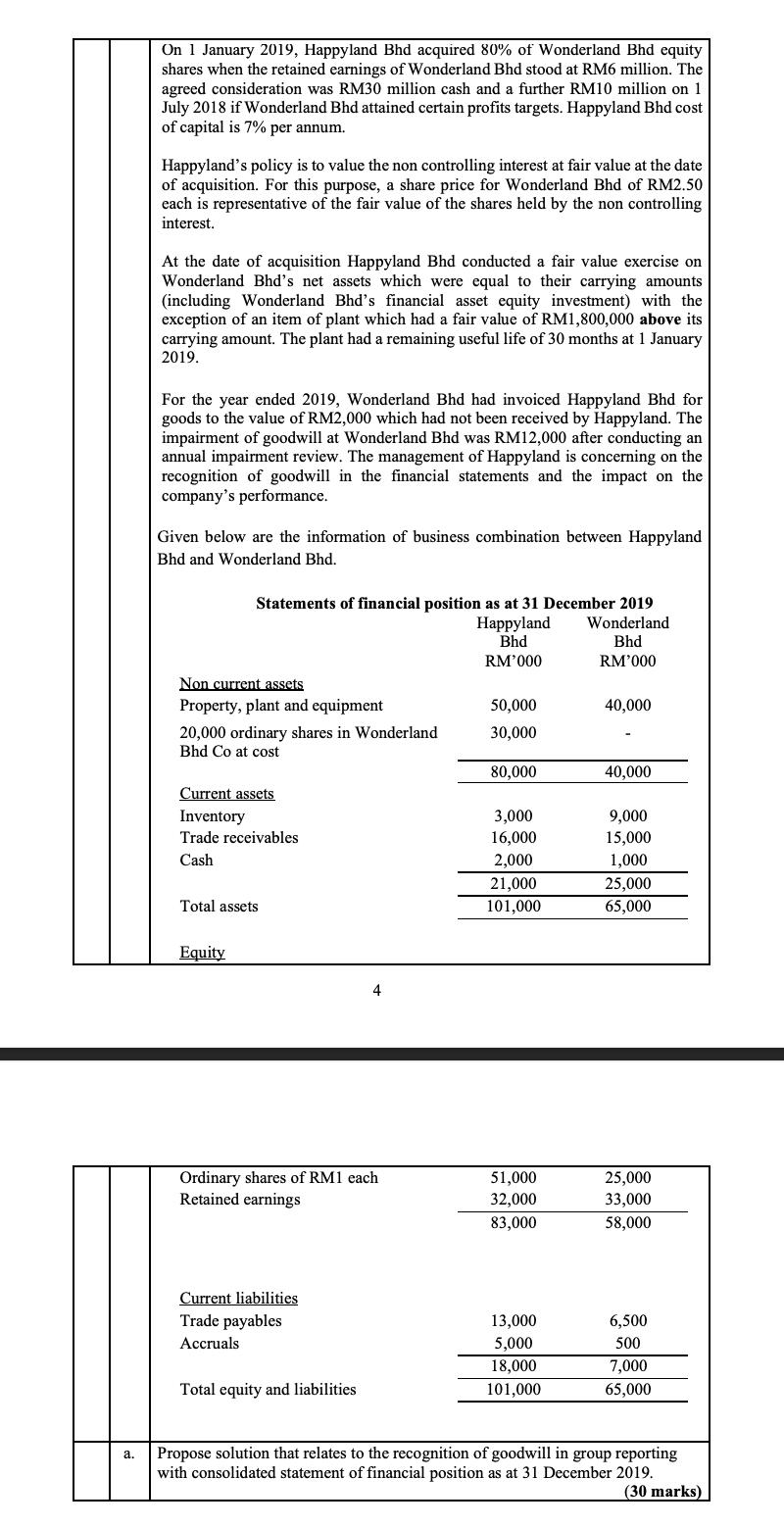

On 1 January 2019, Happyland Bhd acquired 80% of Wonderland Bhd equity shares when the retained earnings of Wonderland Bhd stood at RM6 million. The agreed consideration was RM30 million cash and a further RM10 million on 1 July 2018 if Wonderland Bhd attained certain profits targets. Happyland Bhd cost of capital is 7% per annum. Happyland's policy is to value the non controlling interest at fair value at the date of acquisition. For this purpose, a share price for Wonderland Bhd of RM2.50 each is representative of the fair value of the shares held by the non controlling interest. At the date of acquisition Happyland Bhd conducted a fair value exercise on Wonderland Bhd's net assets which were equal to their carrying amounts (including Wonderland Bhd's financial asset equity investment) with the exception of an item of plant which had a fair value of RM1,800,000 above its carrying amount. The plant had a remaining useful life of 30 months at 1 January 2019. For the year ended 2019, Wonderland Bhd had invoiced Happyland Bhd for goods to the value of RM2,000 which had not been received by Happyland. The impairment of goodwill at Wonderland Bhd was RM12,000 after conducting an annual impairment review. The management of Happyland is concerning on the recognition of goodwill in the financial statements and the impact on the company's performance. Given below are the information of business combination between Happyland Bhd and Wonderland Bhd. Statements of financial position as at 31 December 2019 yland Bhd Wonderland Bhd RM'000 RM'000 Non current assets Property, plant and equipment 50,000 40,000 20,000 ordinary shares in Wonderland Bhd Co at cost 30,000 80,000 40,000 Current assets 3,000 16,000 Inventory 9,000 15,000 Trade receivables Cash 2,000 1,000 21,000 25,000 Total assets 101,000 65,000 Equity Ordinary shares of RM1 each Retained earnings 51,000 25,000 33,000 32,000 83,000 58,000 Current liabilities Trade payables 13,000 5,000 6,500 Accruals 500 18,000 7,000 Total equity and liabilities 101,000 65,000 Propose solution that relates to the recognition of goodwill in group reporting with consolidated statement of financial position as at 31 December 2019. . (30 marks)

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started