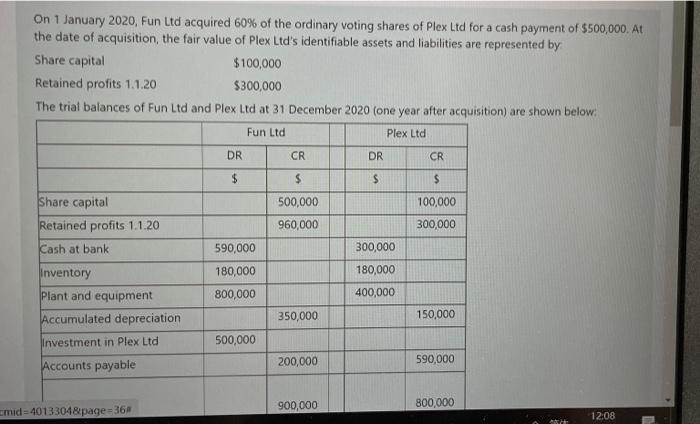

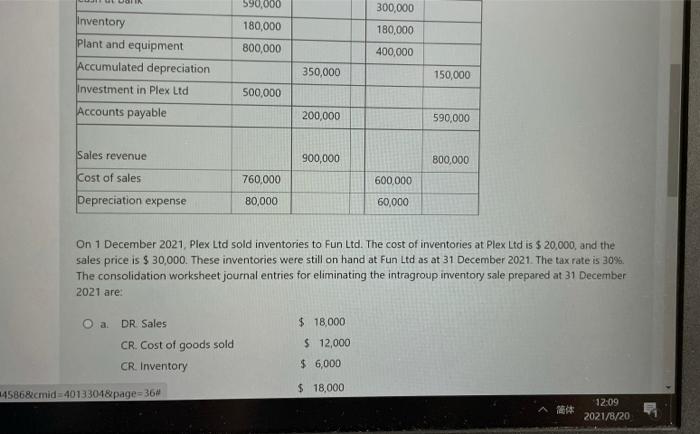

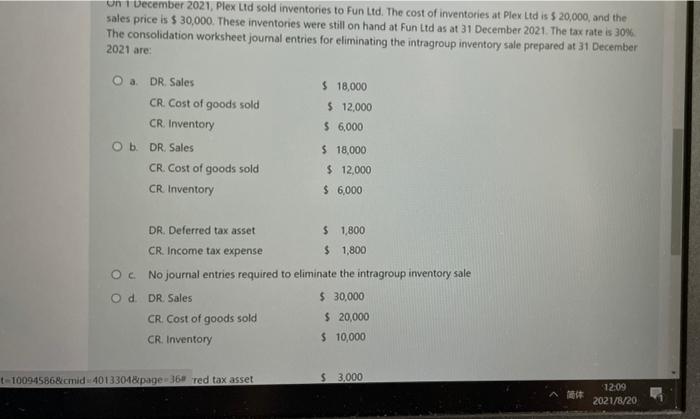

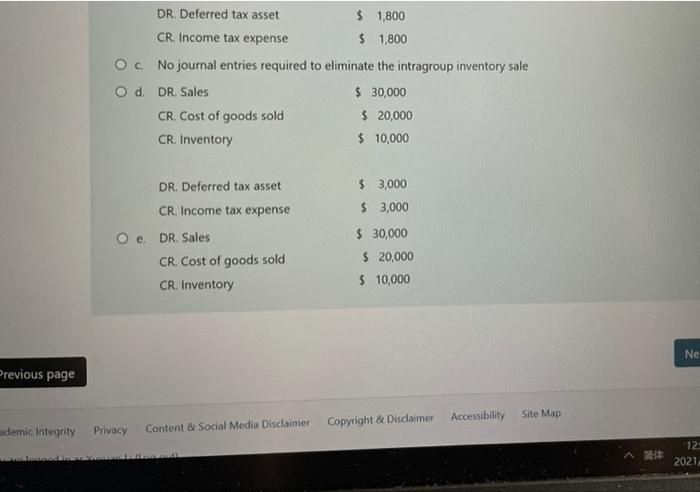

On 1 January 2020, Fun Ltd acquired 60% of the ordinary voting shares of Plex Ltd for a cash payment of $500,000. At the date of acquisition, the fair value of Plex Ltd's identifiable assets and liabilities are represented by Share capital $100,000 Retained profits 1.1.20 $300,000 The trial balances of Fun Ltd and Plex Ltd at 31 December 2020 (one year after acquisition) are shown below: Fun Ltd Plex Ltd DR CR DR CR $ $ $ Share capital Retained profits 1.1.20 Cash at bank $ 500,000 960,000 100,000 300,000 590,000 180,000 800,000 300,000 180,000 Inventory plant and equipment Accumulated depreciation 400,000 350,000 150,000 Investment in Plex Ltd 500,000 200,000 Accounts payable 590,000 900,000 800,000 cmid=4013304&page=36 12:08 590,000 300,000 180,000 Inventory plant and equipment Accumulated depreciation 180,000 800,000 400,000 350,000 150,000 Investment in Plex Ltd 500,000 Accounts payable 200,000 590,000 Sales revenue 900,000 800,000 Cost of sales 760,000 600,000 Depreciation expense 80,000 60,000 On 1 December 2021, Plex Ltd sold inventories to Fun Ltd. The cost of inventories at Plex Ltd is $ 20,000, and the sales price is $ 30,000. These inventories were still on hand at Fun Ltd as at 31 December 2021. The tax rate is 30% The consolidation worksheet journal entries for eliminating the intragroup inventory sale prepared at 31 December 2021 are: a DR Sales CR. Cost of goods sold CR Inventory $ 18,000 $ 12,000 $ 6,000 $ 18,000 14586&cmid=4013301&page=36 1 12:09 2021/8/20 un 1 December 2021, Plex Ltd sold inventories to Fun Ltd. The cost of inventories at Plex Ltd is $ 20,000, and the sales price is $ 30,000. These inventories were still on hand at Fun Ltd as at 31 December 2021. The tax rate is 30% The consolidation worksheet journal entries for eliminating the intragroup inventory sale prepared at 31 December 2021 are $ 18,000 $ 12,000 $ 6,000 O. DR. Sales CR. Cost of goods sold CR. Inventory Ob. DR. Sales CR. Cost of goods sold CR. Inventory $ 18,000 $ 12,000 $ 6,000 DR. Deferred tax asset $ 1,800 CR Income tax expense $ 1,800 O No journal entries required to eliminate the intragroup inventory sale od DR. Sales $ 30,000 CR. Cost of goods sold $ 20,000 CR. Inventory $ 10,000 t 10094586&cmid:4013304&page 36 red tax asset $3,000 12:09 2021/8/20 DR. Deferred tax asset CR. Income tax expense $ 1,800 $ 1,800 Oc No journal entries required to eliminate the intragroup inventory sale Od DR. Sales $ 30,000 CR. Cost of goods sold $ 20,000 CR. Inventory $ 10,000 3,000 $ 3,000 DR. Deferred tax asset CR. Income tax expense Oe. DR. Sales CR. Cost of goods sold CR. Inventory $ 30,000 $ 20,000 $ 10,000 Ne Previous page Accessibility Site Map Copyright & Disclaimer ademic Integrity Privacy Content & Social Media Disclaimer 12 2021