Answered step by step

Verified Expert Solution

Question

1 Approved Answer

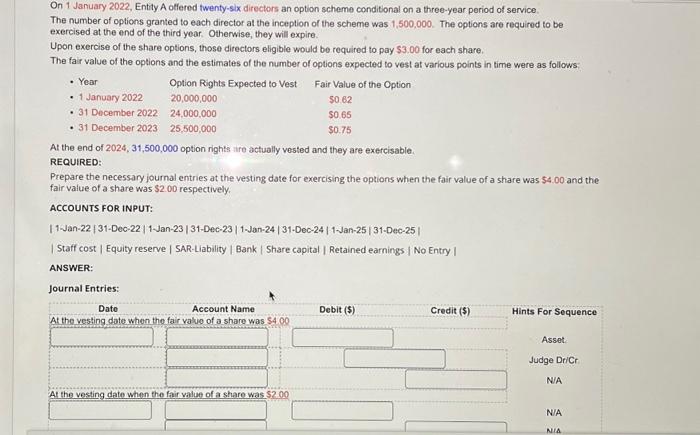

On 1 January 2022, Entity A offered twenty-six directors an option scheme conditional on a three-year period of service. The number of options granted

On 1 January 2022, Entity A offered twenty-six directors an option scheme conditional on a three-year period of service. The number of options granted to each director at the inception of the scheme was 1,500,000. The options are required to be exercised at the end of the third year. Otherwise, they will expire. Upon exercise of the share options, those directors eligible would be required to pay $3.00 for each share. The fair value of the options and the estimates of the number of options expected to vest at various points in time were as follows: Option Rights Expected to Vest 20,000,000 24,000,000 25,500,000 Year 1 January 2022 31 December 2022 31 December 2023 At the end of 2024, 31,500,000 option rights are actually vested and they are exercisable. REQUIRED: Fair Value of the Option $0.62 $0.65 $0.75 Prepare the necessary journal entries at the vesting date for exercising the options when the fair value of a share was $4.00 and the fair value of a share was $2.00 respectively. ACCOUNTS FOR INPUT: 11-Jan-22 | 31-Dec-22 | 1-Jan-23 | 31-Dec-23 | 1-Jan-24 | 31-Dec-24 | 1-Jan-25 | 31-Dec-25 | | Staff cost | Equity reserve | SAR-Liability | Bank | Share capital | Retained earnings | No Entry | ANSWER: Journal Entries: Date Account Name At the vesting date when the fair value of a share was $4.00 At the vesting date when the fair value of a share was $2.00 Debit ($) Credit ($) Hints For Sequence Asset Judge Dr/Cr N/A N/A NIA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image youve provided includes a question related to accounting for sharebased payments specifically stock options provided to directors under an employee stock option plan ESOP The scenario detail...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started