Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 20X1, DEF Ltd issues a $10 million 3-year 5% bond at $8,756,574. The annual coupon payment is payable on 31 December

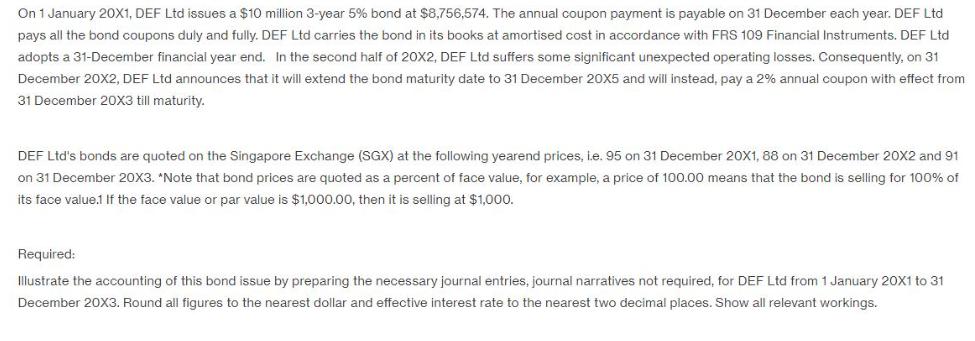

On 1 January 20X1, DEF Ltd issues a $10 million 3-year 5% bond at $8,756,574. The annual coupon payment is payable on 31 December each year. DEF Ltd pays all the bond coupons duly and fully. DEF Ltd carries the bond in its books at amortised cost in accordance with FRS 109 Financial Instruments. DEF Ltd adopts a 31-December financial year end. In the second half of 20X2, DEF Ltd suffers some significant unexpected operating losses. Consequently, on 31 December 20X2, DEF Ltd announces that it will extend the bond maturity date to 31 December 20X5 and will instead, pay a 2% annual coupon with effect from 31 December 20X3 till maturity. DEF Ltd's bonds are quoted on the Singapore Exchange (SGX) at the following yearend prices, i.e. 95 on 31 December 20X1, 88 on 31 December 20X2 and 91 on 31 December 20X3. *Note that bond prices are quoted as a percent of face value, for example, a price of 100.00 means that the bond is selling for 100% of its face value.1 If the face value or par value is $1,000.00, then it is selling at $1,000. Required: Illustrate the accounting of this bond issue by preparing the necessary journal entries, journal narratives not required, for DEF Ltd from 1 January 20X1 to 31 December 20X3. Round all figures to the nearest dollar and effective interest rate to the nearest two decimal places. Show all relevant workings.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Working Note At the time of issue bond company gets 8756574 and will pay 500000 Interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started