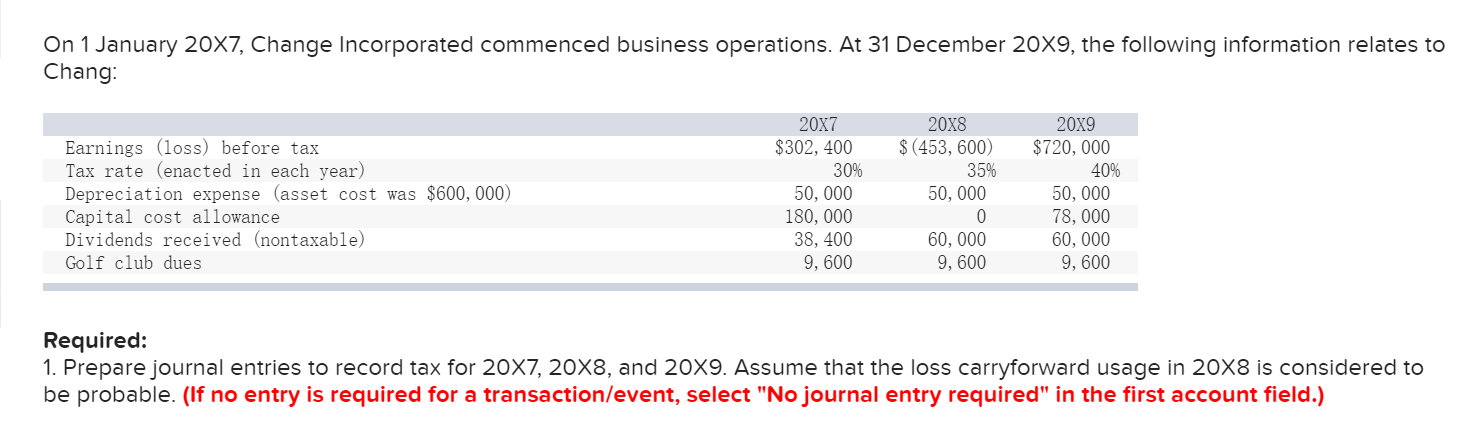

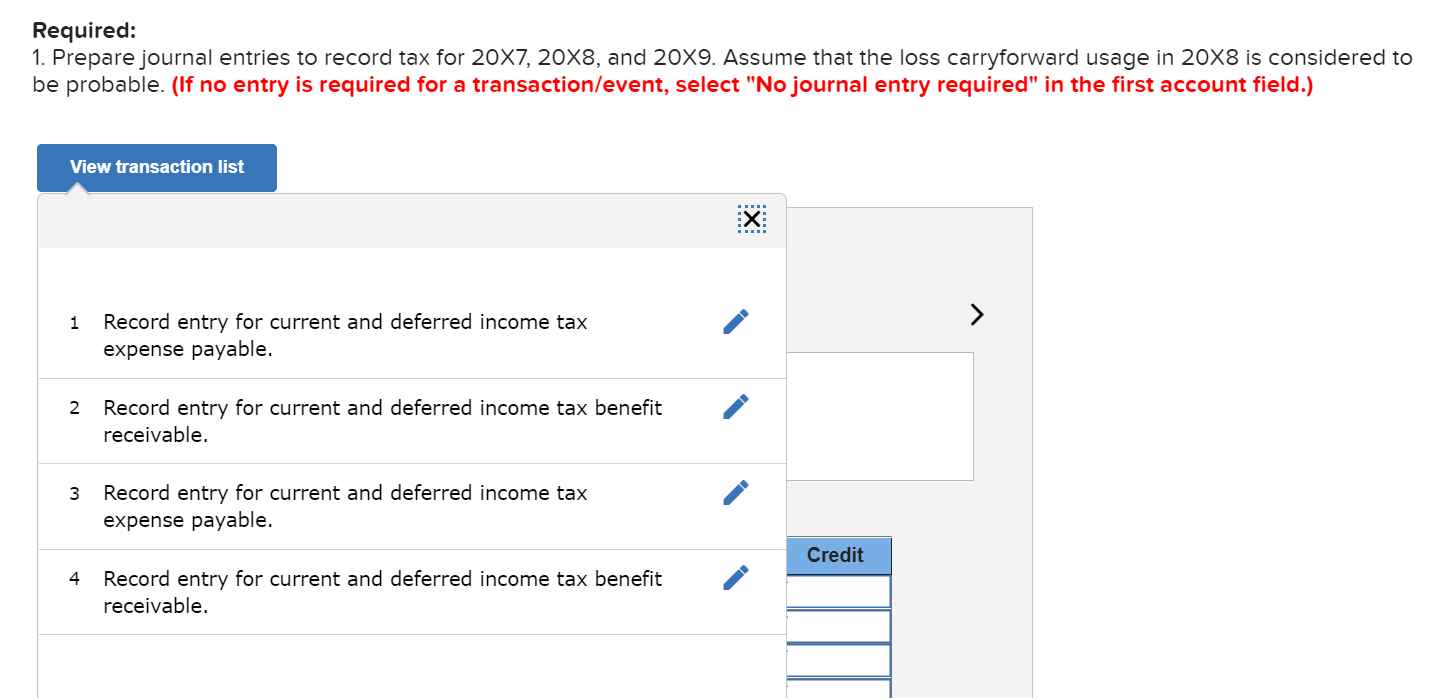

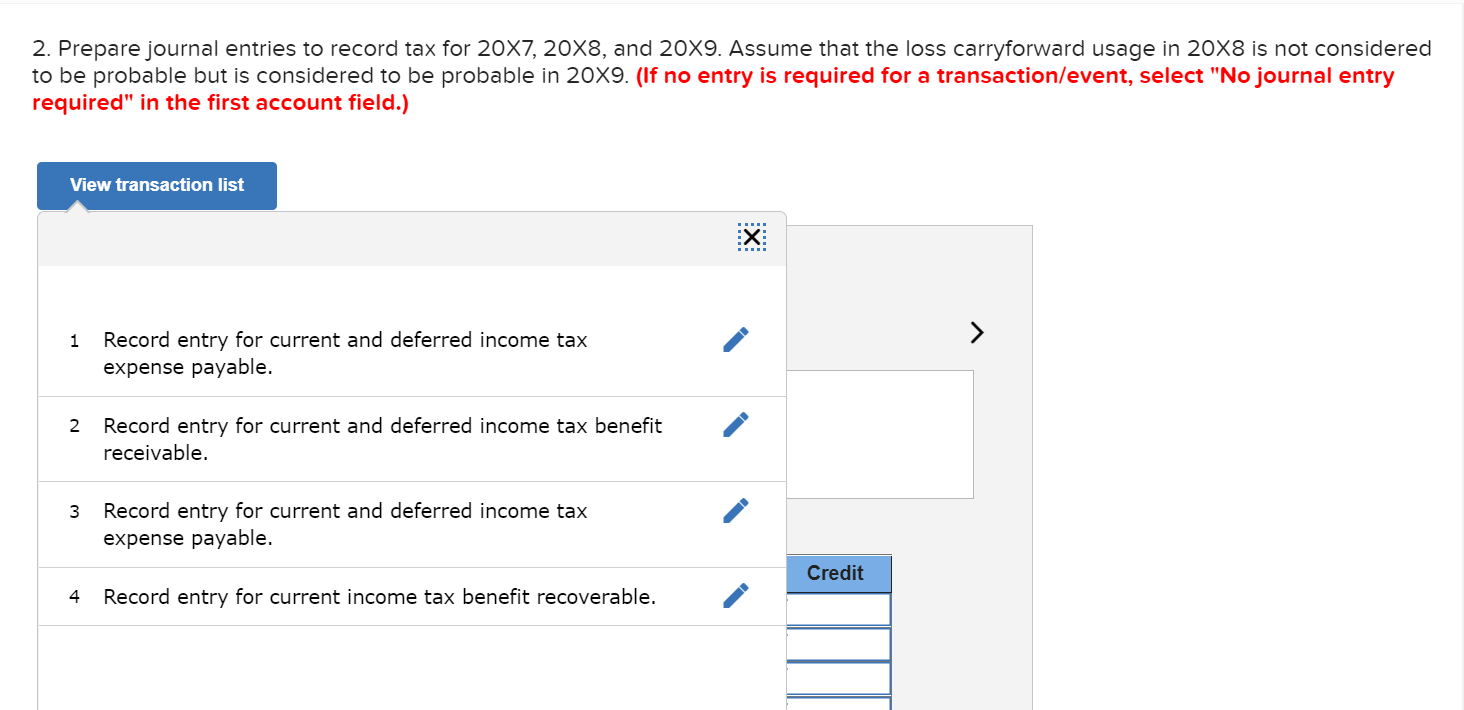

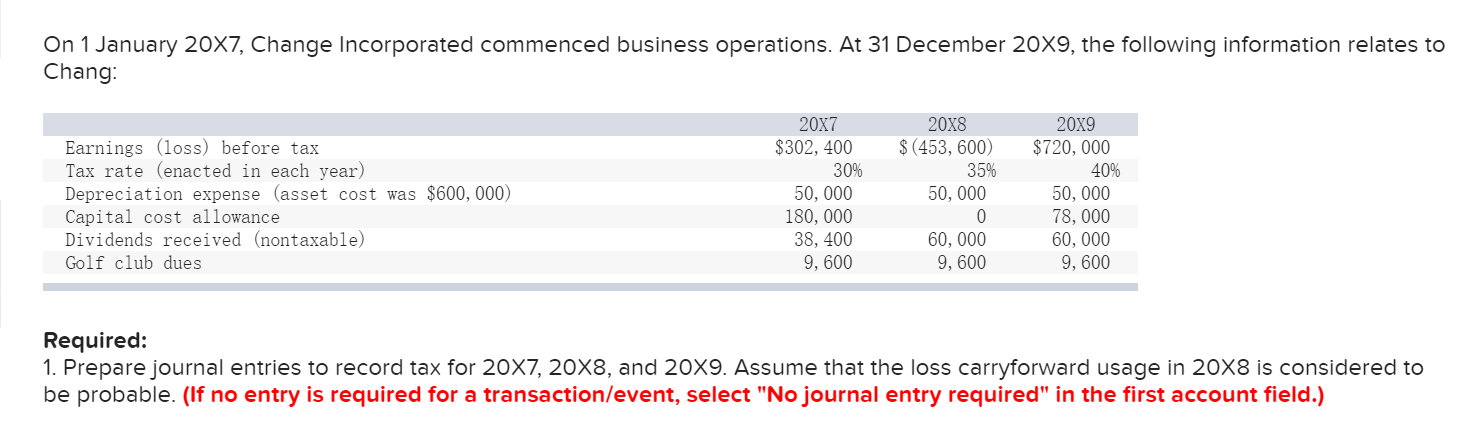

On 1 January 20X7, Change Incorporated commenced business operations. At 31 December 20X9, the following information relates to Chang: Earnings (loss) before tax Tax rate (enacted in each year) Depreciation expense (asset cost was $600,000) Capital cost allowance Dividends received (nontaxable) Golf club dues 20x7 $302, 400 30% 50,000 180,000 38, 400 9, 600 20x8 $(453, 600) 35% 50,000 0 60,000 9, 600 20x9 $720,000 40% 50,000 78,000 60,000 9, 600 Required: 1. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20x8 is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: 1. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20x8 is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X: 1 Record entry for current and deferred income tax expense payable. 2 Record entry for current and deferred income tax benefit receivable. 3 Record entry for current and deferred income tax expense payable. Credit 4 Record entry for current and deferred income tax benefit receivable. 2. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20X8 is not considered to be probable but is considered to be probable in 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X: > 1 Record entry for current and deferred income tax expense payable. 2 Record entry for current and deferred income tax benefit receivable. 3 Record entry for current and deferred income tax expense payable. Credit 4 Record entry for current income tax benefit recoverable. On 1 January 20X7, Change Incorporated commenced business operations. At 31 December 20X9, the following information relates to Chang: Earnings (loss) before tax Tax rate (enacted in each year) Depreciation expense (asset cost was $600,000) Capital cost allowance Dividends received (nontaxable) Golf club dues 20x7 $302, 400 30% 50,000 180,000 38, 400 9, 600 20x8 $(453, 600) 35% 50,000 0 60,000 9, 600 20x9 $720,000 40% 50,000 78,000 60,000 9, 600 Required: 1. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20x8 is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: 1. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20x8 is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X: 1 Record entry for current and deferred income tax expense payable. 2 Record entry for current and deferred income tax benefit receivable. 3 Record entry for current and deferred income tax expense payable. Credit 4 Record entry for current and deferred income tax benefit receivable. 2. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20X8 is not considered to be probable but is considered to be probable in 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X: > 1 Record entry for current and deferred income tax expense payable. 2 Record entry for current and deferred income tax benefit receivable. 3 Record entry for current and deferred income tax expense payable. Credit 4 Record entry for current income tax benefit recoverable