Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January of the current calendar year, an employer purchased a new car at a cost of $58,000. The car is given to

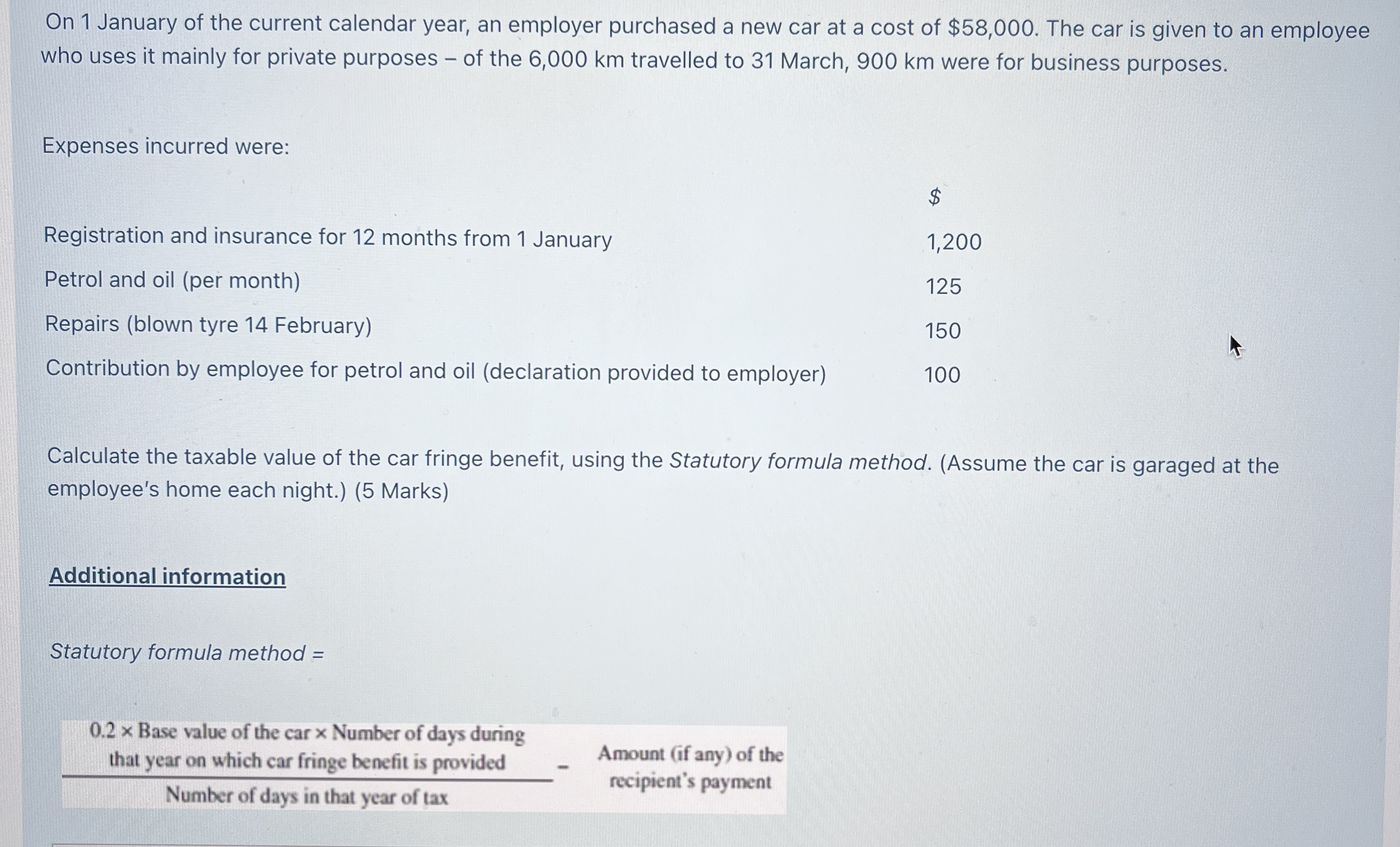

On 1 January of the current calendar year, an employer purchased a new car at a cost of $58,000. The car is given to an employee who uses it mainly for private purposes of the 6,000 km travelled to 31 March, 900 km were for business purposes. Expenses incurred were: Registration and insurance for 12 months from 1 January Petrol and oil (per month) Repairs (blown tyre 14 February) Contribution by employee for petrol and oil (declaration provided to employer) - Additional information Statutory formula method = Calculate the taxable value of the car fringe benefit, using the Statutory formula method. (Assume the car is garaged at the employee's home each night.) (5 Marks) 0.2 x Base value of the car x Number of days during that year on which car fringe benefit is provided Number of days in that year of tax $ Amount (if any) of the recipient's payment 1,200 125 150 100

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Taxable Car Fringe Benefit Step 1 Determine Relevant Dates and Period Purchase D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started