On 1 July 2016, Parent Ltd acquired 70 percent of shares in Subsidiary Ltd. On 31 March 2017 Parent Ltd sold $100,000 of inventory-type

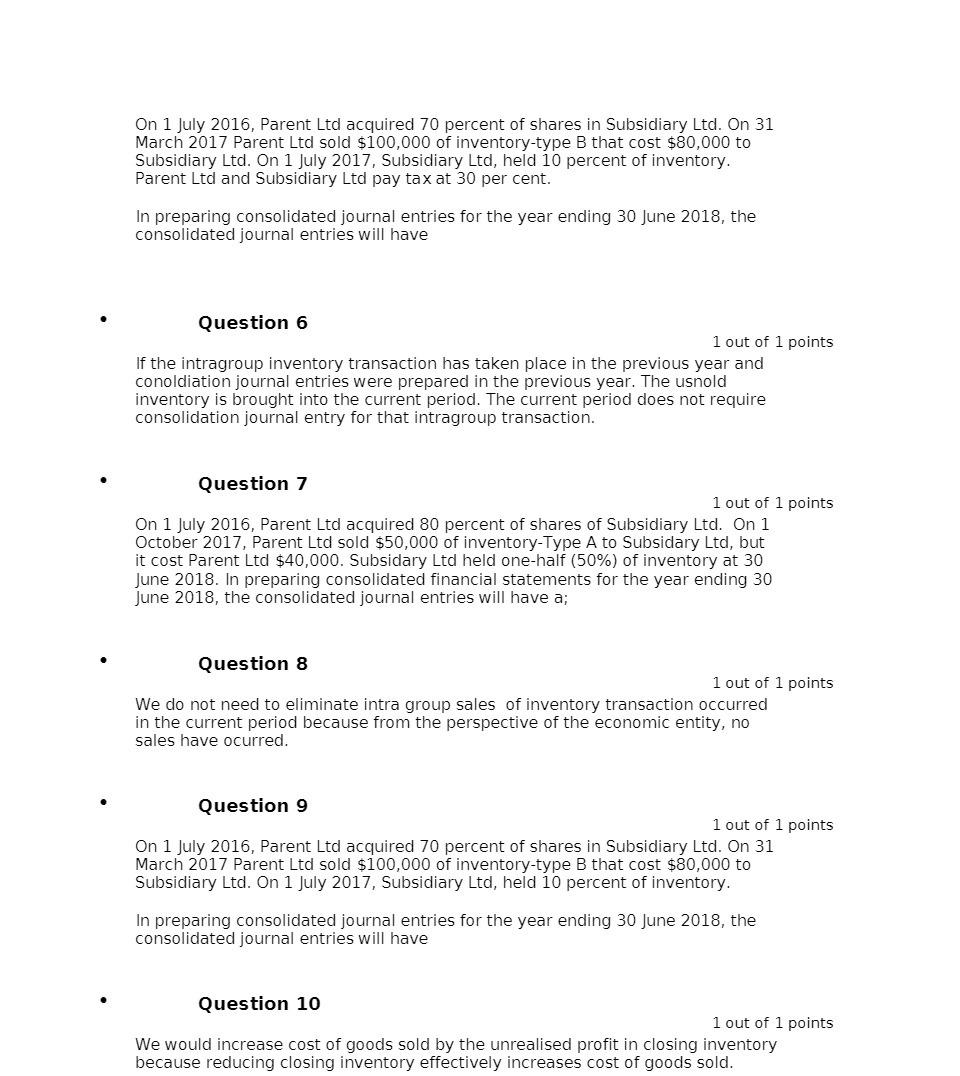

On 1 July 2016, Parent Ltd acquired 70 percent of shares in Subsidiary Ltd. On 31 March 2017 Parent Ltd sold $100,000 of inventory-type B that cost $80,000 to Subsidiary Ltd. On 1 July 2017, Subsidiary Ltd, held 10 percent of inventory. Parent Ltd and Subsidiary Ltd pay tax at 30 per cent. In preparing consolidated journal entries for the year ending 30 June 2018, the consolidated journal entries will have Question 6 If the intragroup inventory transaction has taken place in the previous year and conoldiation journal entries were prepared in the previous year. The usnold inventory is brought into the current period. The current period does not require consolidation journal entry for that intragroup transaction. 1 out of 1 points Question 7 1 out of 1 points On 1 July 2016, Parent Ltd acquired 80 percent of shares of Subsidiary Ltd. On 1 October 2017, Parent Ltd sold $50,000 of inventory-Type A to Subsidary Ltd, but it cost Parent Ltd $40,000. Subsidary Ltd held one-half (50%) of inventory at 30 June 2018. In preparing consolidated financial statements for the year ending 30 June 2018, the consolidated journal entries will have a; Question 8 We do not need to eliminate intra group sales of inventory transaction occurred in the current period because from the perspective of the economic entity, no sales have ocurred. 1 out of 1 points Question 9 1 out of 1 points On 1 July 2016, Parent Ltd acquired 70 percent of shares in Subsidiary Ltd. On 31 March 2017 Parent Ltd sold $100,000 of inventory-type B that cost $80,000 to Subsidiary Ltd. On 1 July 2017, Subsidiary Ltd, held 10 percent of inventory. In preparing consolidated journal entries for the year ending 30 June 2018, the consolidated journal entries will have Question 10 1 out of 1 points We would increase cost of goods sold by the unrealised profit in closing inventory because reducing closing inventory effectively increases cost of goods sold.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 6 True If the intragroup inven...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started