Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2016, Gold Ltd acquired all the issued capital of Silver Ltd for a cash payment of $550 000 when the equity

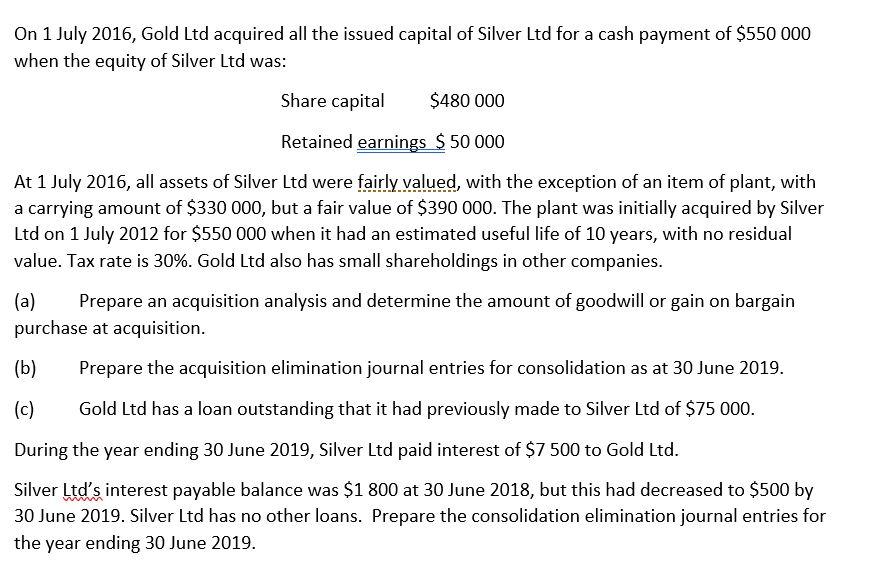

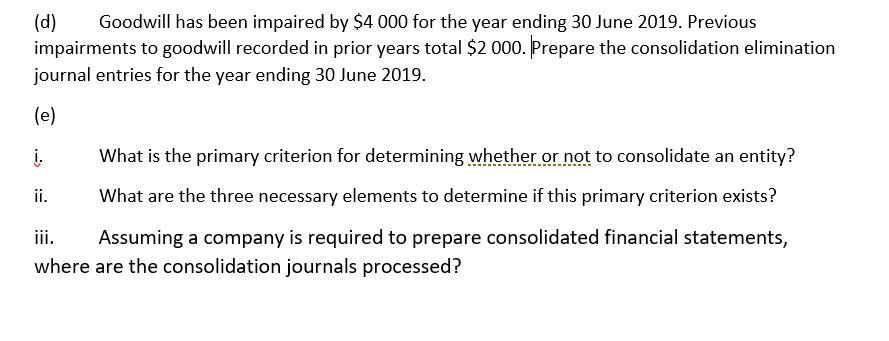

On 1 July 2016, Gold Ltd acquired all the issued capital of Silver Ltd for a cash payment of $550 000 when the equity of Silver Ltd was: Share capital $480 000 Retained earnings $ 50 000 At 1 July 2016, all assets of Silver Ltd were fairly valued, with the exception of an item of plant, with a carrying amount of $330 000, but a fair value of $390 000. The plant was initially acquired by Silver Ltd on 1 July 2012 for $550 000 when it had an estimated useful life of 10 years, with no residual value. Tax rate is 30%. Gold Ltd also has small shareholdings in other companies. (a) purchase at acquisition. Prepare an acquisition analysis and determine the amount of goodwill or gain on bargain (b) Prepare the acquisition elimination journal entries for consolidation as at 30 June 2019. (c) Gold Ltd has a loan outstanding that it had previously made to Silver Ltd of $75 000. During the year ending 30 June 2019, Silver Ltd paid interest of $7 500 to Gold Ltd. Silver Ltd's interest payable balance was $1 800 at 30 June 2018, but this had decreased to $500 by 30 June 2019. Silver Ltd has no other loans. Prepare the consolidation elimination journal entries for the year ending 30 June 2019. (d) Goodwill has been impaired by $4 000 for the year ending 30 June 2019. Previous impairments to goodwill recorded in prior years total $2 000. Prepare the consolidation elimination journal entries for the year ending 30 June 2019. (e) . What is the primary criterion for determining whether or not to consolidate an entity? ii. What are the three necessary elements to determine if this primary criterion exists? iii. Assuming a company is required to prepare consolidated financial statements, where are the consolidation journals processed?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Gain on bargain purchase 40000 e i The primary criterion for determining whether to consolidate is CONTROL criterion for identifying when a p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started