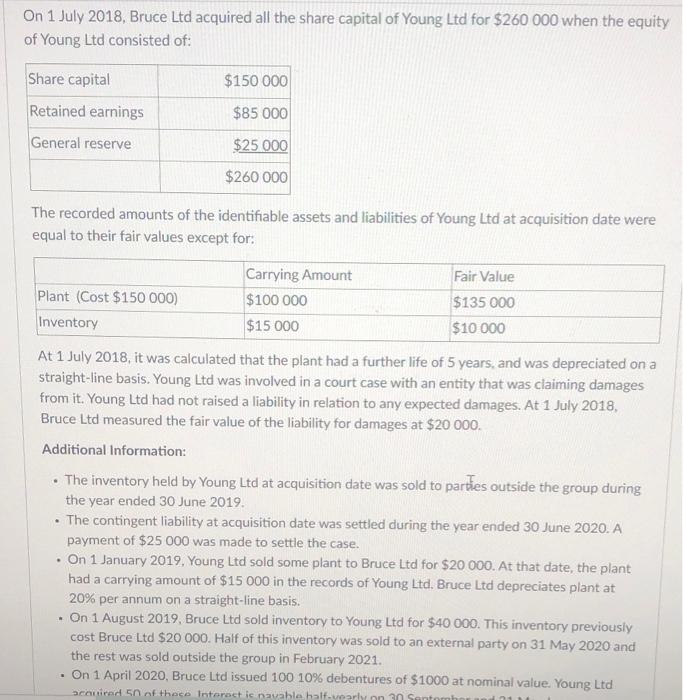

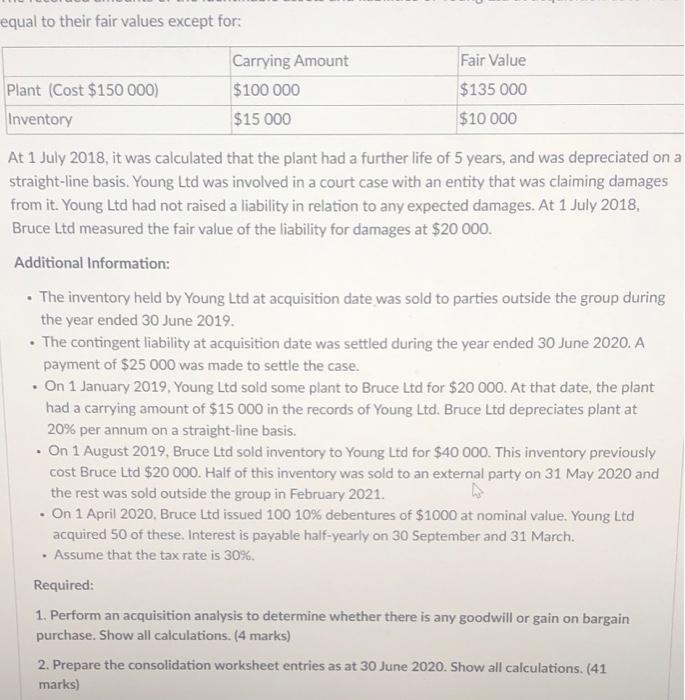

On 1 July 2018, Bruce Ltd acquired all the share capital of Young Ltd for $260 000 when the equity of Young Ltd consisted of: $150 000 Share capital Retained earnings General reserve $85 000 $25 000 $260 000 The recorded amounts of the identifiable assets and liabilities of Young Ltd at acquisition date were equal to their fair values except for: Fair Value Plant (Cost $150 000) Inventory Carrying Amount $100 000 $15 000 $135 000 $10 000 At 1 July 2018, it was calculated that the plant had a further life of 5 years, and was depreciated on a straight-line basis. Young Ltd was involved in a court case with an entity that was claiming damages from it. Young Ltd had not raised a liability in relation to any expected damages. At 1 July 2018, Bruce Ltd measured the fair value of the liability for damages at $20 000. Additional Information: The inventory held by Young Ltd at acquisition date was sold to parties outside the group during the year ended 30 June 2019. The contingent liability at acquisition date was settled during the year ended 30 June 2020. A payment of $25 000 was made to settle the case. On 1 January 2019, Young Ltd sold some plant to Bruce Ltd for $20 000. At that date, the plant had a carrying amount of $15 000 in the records of Young Ltd, Bruce Ltd depreciates plant at 20% per annum on a straight-line basis. - On 1 August 2019, Bruce Ltd sold inventory to Young Ltd for $40 000. This inventory previously cost Bruce Ltd $20 000. Half of this inventory was sold to an external party on 31 May 2020 and the rest was sold outside the group in February 2021. . On 1 April 2020, Bruce Ltd issued 100 10% debentures of $1000 at nominal value. Young Ltd acquired 5 of theco Interactic navabla halfovearly on 30 Santo equal to their fair values except for: Carrying Amount Fair Value $100 000 Plant (Cost $150 000) Inventory $135 000 $10 000 $15 000 At 1 July 2018, it was calculated that the plant had a further life of 5 years, and was depreciated on a straight-line basis. Young Ltd was involved in a court case with an entity that was claiming damages from it. Young Ltd had not raised a liability in relation to any expected damages. At 1 July 2018, Bruce Ltd measured the fair value of the liability for damages at $20 000. Additional Information: The inventory held by Young Ltd at acquisition date was sold to parties outside the group during the year ended 30 June 2019. The contingent liability at acquisition date was settled during the year ended 30 June 2020. A payment of $25 000 was made to settle the case. On 1 January 2019, Young Ltd sold some plant to Bruce Ltd for $20 000. At that date, the plant had a carrying amount of $15 000 in the records of Young Ltd. Bruce Ltd depreciates plant at 20% per annum on a straight-line basis. On 1 August 2019, Bruce Ltd sold inventory to Young Led for $40 000. This inventory previously cost Bruce Ltd $20 000. Half of this inventory was sold to an external party on 31 May 2020 and the rest was sold outside the group in February 2021. . On 1 April 2020. Bruce Ltd issued 100 10% debentures of $1000 at nominal value. Young Ltd acquired 50 of these. Interest is payable half-yearly on 30 September and 31 March. Assume that the tax rate is 30%. Required: 1. Perform an acquisition analysis to determine whether there is any goodwill or gain on bargain purchase. Show all calculations. (4 marks) 2. Prepare the consolidation worksheet entries as at 30 June 2020. Show all calculations. (41 marks)