Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2019, Gamora Ltd acquired all the assets and liabilities of Rocket Ltd. Rocket Ltd has several operating divisions, including a pizza

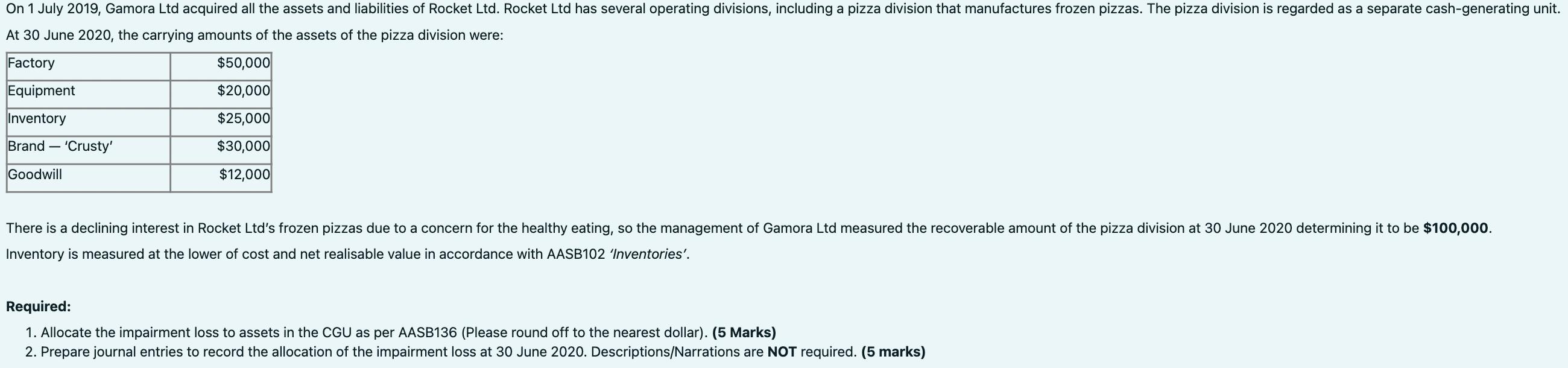

On 1 July 2019, Gamora Ltd acquired all the assets and liabilities of Rocket Ltd. Rocket Ltd has several operating divisions, including a pizza division that manufactures frozen pizzas. The pizza division is regarded as a separate cash-generating unit. At 30 June 2020, the carrying amounts of the assets of the pizza division were: Factory $50,000 Equipment $20,000 Inventory $25,000 Brand-'Crusty' $30,000 Goodwill $12,000 There is a declining interest in Rocket Ltd's frozen pizzas due to a concern for the healthy eating, so the management of Gamora Ltd measured the recoverable amount of the pizza division at 30 June 2020 determining it to be $100,000. Inventory is measured at the lower of cost and net realisable value in accordance with AASB102 'Inventories'. Required: 1. Allocate the impairment loss to assets in the CGU as per AASB136 (Please round off to the nearest dollar). (5 Marks) 2. Prepare journal entries to record the allocation of the impairment loss at 30 June 2020. Descriptions/Narrations are NOT required. (5 marks)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution Impairment is nothing but the decline or fall in value of an asset compared to it carry...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started