Question

On 1 July 2020, ABC Ltd entered into an agreement on to lease a processing plant with a fair value of $569,230 to Sydney Ltd.

On 1 July 2020, ABC Ltd entered into an agreement on to lease a processing plant with a fair value of $569,230 to Sydney Ltd. The terms of the lease agreement were:

| Lease term | 3 years |

| Annual rental payment, in arrears | $225,000 |

| The total residual value of the plant at the end of lease term | $50,000 |

| Residual value guarantee by Sydney (lessee) Ltd | $20,000 |

The economic life of this plant is four years. Annual rental payment commences on 30 June 2021. At the end of the lease term, the plant is to be returned to ABC Ltd. In setting up the lease agreement, ABC Ltd incurred $7,350 in legal fees and stamp duty costs. The annual rental payment includes $25,000 to reimburse ABC Ltd for maintenance costs incurred on behalf of Sydney Ltd. The lease is cancellable, but only with the permission of the lessor. Interest rate implicit in the lease 6%. ABC Ltd (lessor) treats this lease as a finance lease

REQUIRED

a) Provide journal entries for Sydney Ltd for the year ended 30 June 2021 in accordance with AASB 16 Leases. Exclude journal narrations.

b) Prepare journal entries in the records of ABC Ltd for the year ending 30 June 2021 in accordance with AASB 16 Leases. Exclude journal narrations.

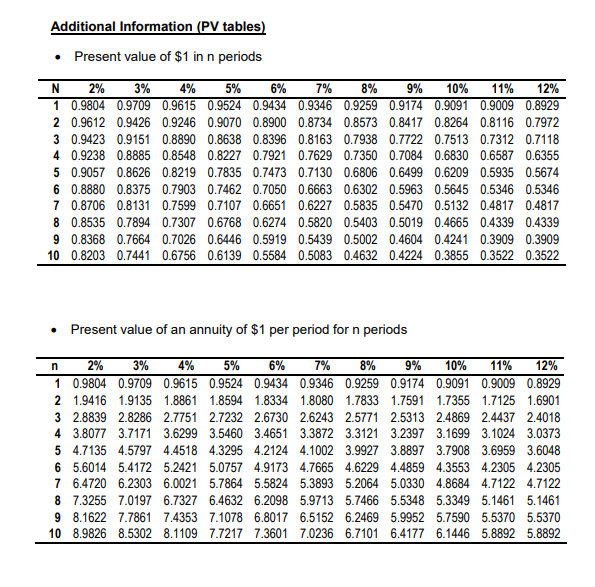

Additional Information (PV tables) Present value of $1 in n periods 6% 12% N 2% 3% 4% 5% 7% 8% 9% 10% 11% 1 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 2 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 3 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 4 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 5 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 6 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5346 7 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4817 8 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4339 9 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3909 10 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3522 . Present value of an annuity of $1 per period for n periods n 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 2 1.9416 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.7591 1.7355 1.7125 1.6901 3 2.8839 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.4869 2.4437 2.4018 4 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 54.7135 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7908 3.6959 3.6048 6 5.6014 5.41725.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.2305 7 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.7122 8 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 5.1461 9 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 5.5370 10 8.9826 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.8892Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started