Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2022, Entity A invested $12,000,000 in new production machinery. The useful life is 5 years. The straight-line depreciation method is adopted.

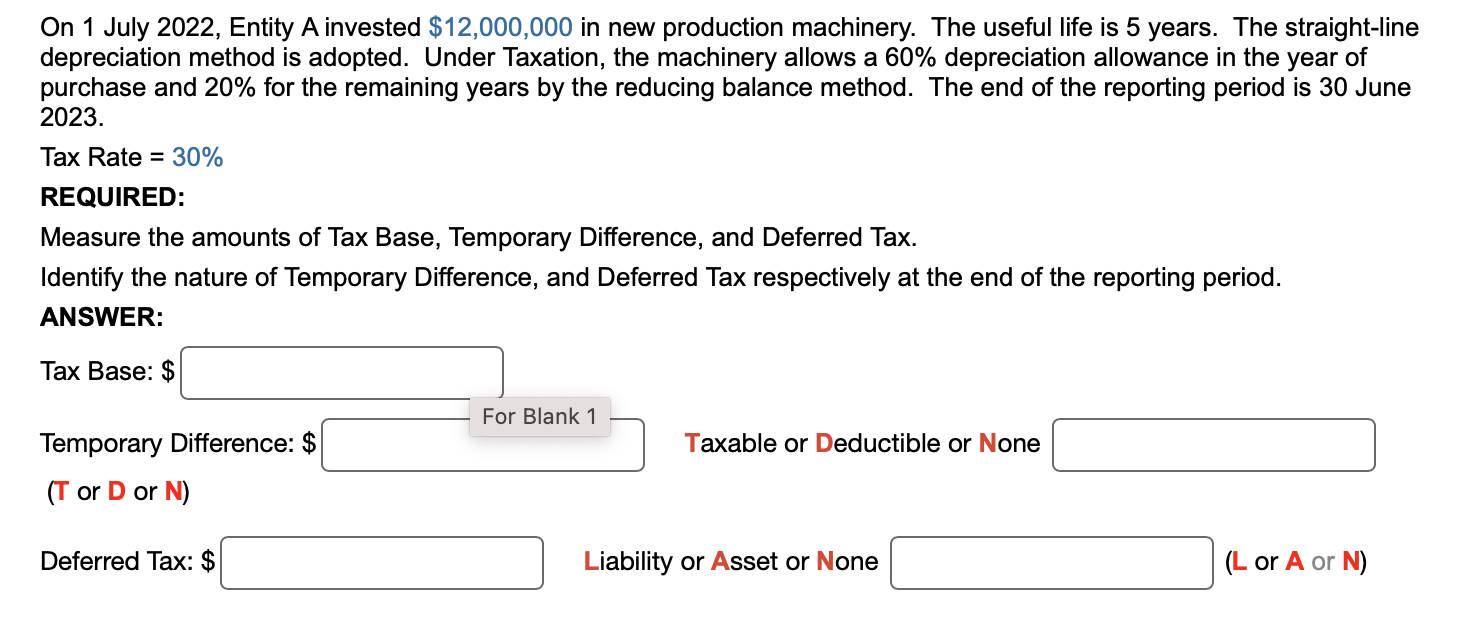

On 1 July 2022, Entity A invested $12,000,000 in new production machinery. The useful life is 5 years. The straight-line depreciation method is adopted. Under Taxation, the machinery allows a 60% depreciation allowance in the year of purchase and 20% for the remaining years by the reducing balance method. The end of the reporting period is 30 June 2023. Tax Rate = 30% REQUIRED: Measure the amounts of Tax Base, Temporary Difference, and Deferred Tax. Identify the nature of Temporary Difference, and Deferred Tax respectively at the end of the reporting period. ANSWER: Tax Base: $ Temporary Difference: $ (T or D or N) Deferred Tax: $ For Blank 1 Taxable or Deductible or None Liability or Asset or None (L or A or N)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question refers to the accounting for the tax base temporary differences and deferred tax for a piece of machinery Based on the information presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started