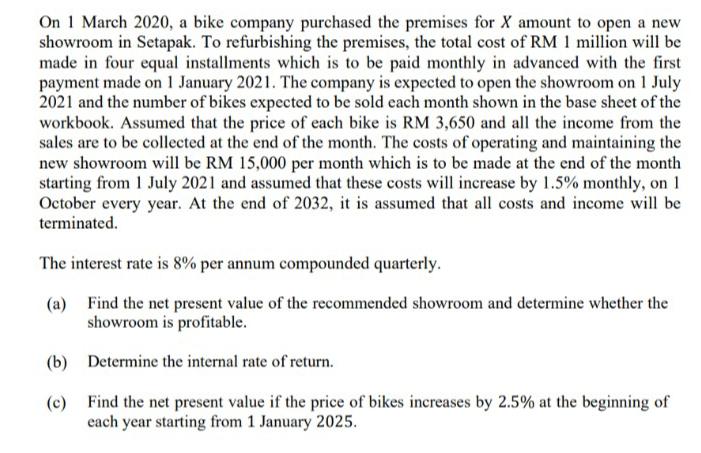

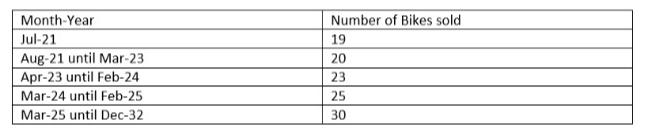

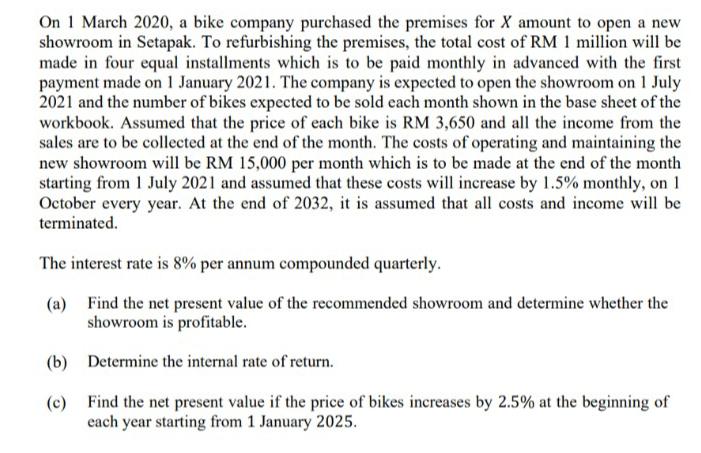

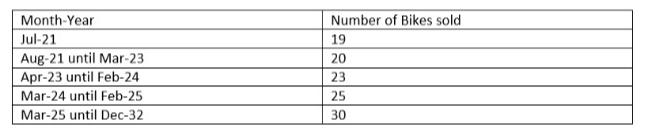

On 1 March 2020, a bike company purchased the premises for X amount to open a new showroom in Setapak. To refurbishing the premises, the total cost of RM 1 million will be made in four equal installments which is to be paid monthly in advanced with the first payment made on 1 January 2021. The company is expected to open the showroom on 1 July 2021 and the number of bikes expected to be sold each month shown in the base sheet of the workbook. Assumed that the price of each bike is RM 3,650 and all the income from the sales are to be collected at the end of the month. The costs of operating and maintaining the new showroom will be RM 15,000 per month which is to be made at the end of the month starting from 1 July 2021 and assumed that these costs will increase by 1.5% monthly, on 1 October every year. At the end of 2032, it is assumed that all costs and income will be terminated. The interest rate is 8% per annum compounded quarterly. (a) Find the net present value of the recommended showroom and determine whether the showroom is profitable. (b) Determine the internal rate of return. (e) Find the net present value if the price of bikes increases by 2.5% at the beginning of each year starting from 1 January 2025. Number of Bikes sold 19 Month-Year Jul-21 Aug-21 until Mar-23 Apr-23 until Feb-24 Mar-24 until Feb-25 20 23 25 Mar-25 until Dec-32 30 On 1 March 2020, a bike company purchased the premises for X amount to open a new showroom in Setapak. To refurbishing the premises, the total cost of RM 1 million will be made in four equal installments which is to be paid monthly in advanced with the first payment made on 1 January 2021. The company is expected to open the showroom on 1 July 2021 and the number of bikes expected to be sold each month shown in the base sheet of the workbook. Assumed that the price of each bike is RM 3,650 and all the income from the sales are to be collected at the end of the month. The costs of operating and maintaining the new showroom will be RM 15,000 per month which is to be made at the end of the month starting from 1 July 2021 and assumed that these costs will increase by 1.5% monthly, on 1 October every year. At the end of 2032, it is assumed that all costs and income will be terminated. The interest rate is 8% per annum compounded quarterly. (a) Find the net present value of the recommended showroom and determine whether the showroom is profitable. (b) Determine the internal rate of return. (e) Find the net present value if the price of bikes increases by 2.5% at the beginning of each year starting from 1 January 2025. Number of Bikes sold 19 Month-Year Jul-21 Aug-21 until Mar-23 Apr-23 until Feb-24 Mar-24 until Feb-25 20 23 25 Mar-25 until Dec-32 30