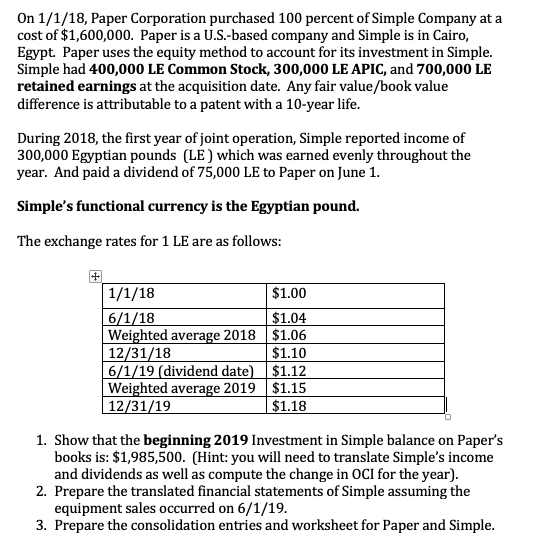

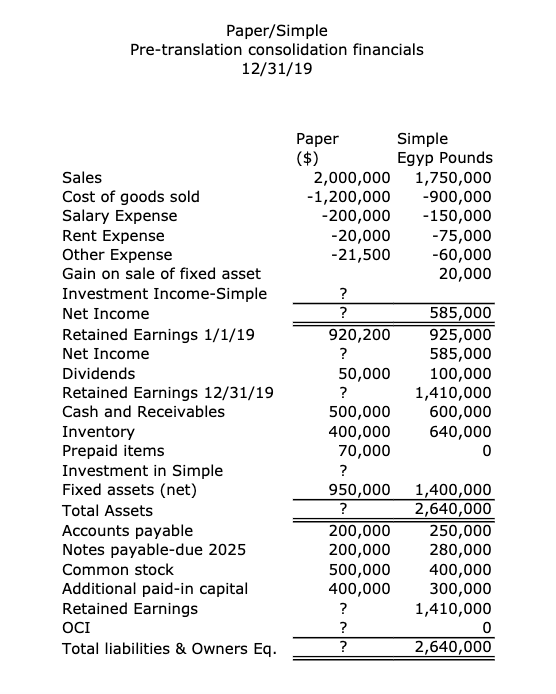

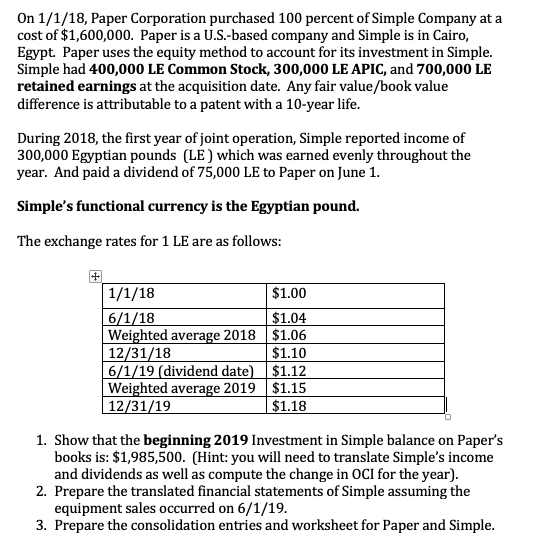

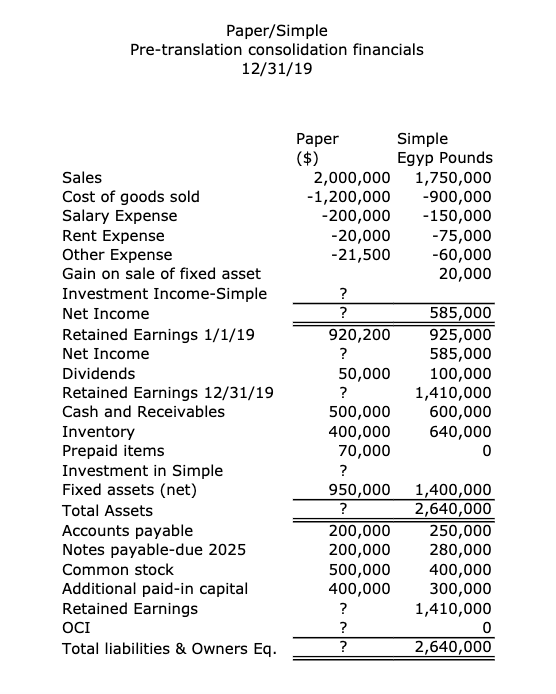

On 1/1/18, Paper Corporation purchased 100 percent of Simple Company at a cost of $1,600,000. Paper is a U.S.-based company and Simple is in Cairo, Egypt Paper uses the equity method to account for its investment in Simple. Simple had 400,000 LE Common Stock, 300,000 LE APIC, and 700,000 LE retained earnings at the acquisition date. Any fair value/book value difference is attributable to a patent with a 10-year life. During 2018, the first year of joint operation, Simple reported income of 300,000 Egyptian pounds (LE) which was earned evenly throughout the year. And paid a dividend of 75,000 LE to Paper on June 1. Simple's functional currency is the Egyptian pound. The exchange rates for 1 LE are as follows: 1/1/18 $1.00 6/1/18 $1.04 Weighted average 2018 $1.06 12/31/18 $1.10 6/1/19 (dividend date) $1.12 Weighted average 2019 $1.15 12/31/19 $1.18 1. Show that the beginning 2019 Investment in Simple balance on Paper's books is: $1,985,500. (Hint: you will need to translate Simple's income and dividends as well as compute the change in OCI for the year). 2. Prepare the translated financial statements of Simple assuming the equipment sales occurred on 6/1/19. 3. Prepare the consolidation entries and worksheet for Paper and Simple. Paper/Simple Pre-translation consolidation financials 12/31/19 Paper Simple ($) Egyp Pounds 2,000,000 1,750,000 -1,200,000 -900,000 -200,000 -150,000 -20,000 -75,000 -21,500 -60,000 20,000 ? ? 585,000 920,200 925,000 585,000 50,000 100,000 ? 1,410,000 500,000 600,000 400,000 640,000 70,000 0 Sales Cost of goods sold Salary Expense Rent Expense Other Expense Gain on sale of fixed asset Investment Income-Simple Net Income Retained Earnings 1/1/19 Net Income Dividends Retained Earnings 12/31/19 Cash and Receivables Inventory Prepaid items Investment in Simple Fixed assets (net) Total Assets Accounts payable Notes payable-due 2025 Common stock Additional paid-in capital Retained Earnings OCI Total liabilities & Owners Eq. ? ? 950,000 ? 200,000 200,000 500,000 400,000 1,400,000 2,640,000 250,000 280,000 400,000 300,000 1,410,000 0 2,640,000 ? ? ? On 1/1/18, Paper Corporation purchased 100 percent of Simple Company at a cost of $1,600,000. Paper is a U.S.-based company and Simple is in Cairo, Egypt Paper uses the equity method to account for its investment in Simple. Simple had 400,000 LE Common Stock, 300,000 LE APIC, and 700,000 LE retained earnings at the acquisition date. Any fair value/book value difference is attributable to a patent with a 10-year life. During 2018, the first year of joint operation, Simple reported income of 300,000 Egyptian pounds (LE) which was earned evenly throughout the year. And paid a dividend of 75,000 LE to Paper on June 1. Simple's functional currency is the Egyptian pound. The exchange rates for 1 LE are as follows: 1/1/18 $1.00 6/1/18 $1.04 Weighted average 2018 $1.06 12/31/18 $1.10 6/1/19 (dividend date) $1.12 Weighted average 2019 $1.15 12/31/19 $1.18 1. Show that the beginning 2019 Investment in Simple balance on Paper's books is: $1,985,500. (Hint: you will need to translate Simple's income and dividends as well as compute the change in OCI for the year). 2. Prepare the translated financial statements of Simple assuming the equipment sales occurred on 6/1/19. 3. Prepare the consolidation entries and worksheet for Paper and Simple. Paper/Simple Pre-translation consolidation financials 12/31/19 Paper Simple ($) Egyp Pounds 2,000,000 1,750,000 -1,200,000 -900,000 -200,000 -150,000 -20,000 -75,000 -21,500 -60,000 20,000 ? ? 585,000 920,200 925,000 585,000 50,000 100,000 ? 1,410,000 500,000 600,000 400,000 640,000 70,000 0 Sales Cost of goods sold Salary Expense Rent Expense Other Expense Gain on sale of fixed asset Investment Income-Simple Net Income Retained Earnings 1/1/19 Net Income Dividends Retained Earnings 12/31/19 Cash and Receivables Inventory Prepaid items Investment in Simple Fixed assets (net) Total Assets Accounts payable Notes payable-due 2025 Common stock Additional paid-in capital Retained Earnings OCI Total liabilities & Owners Eq. ? ? 950,000 ? 200,000 200,000 500,000 400,000 1,400,000 2,640,000 250,000 280,000 400,000 300,000 1,410,000 0 2,640,000