Question

On 1.1.2010, Sudarshan Sinha obtained a mining lease and from that date he sub-leased a part of the mine to Sujit Saha. Show ledger accounts

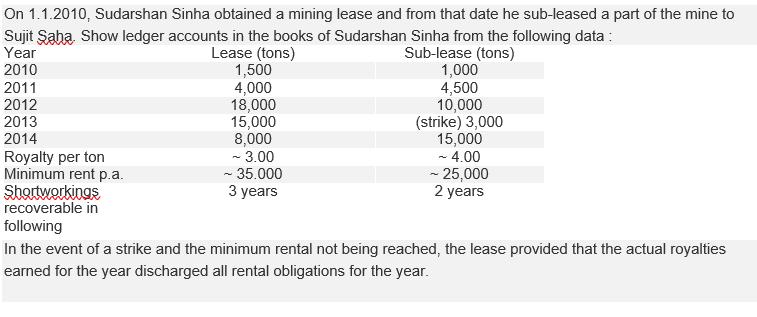

On 1.1.2010, Sudarshan Sinha obtained a mining lease and from that date he sub-leased a part of the mine to Sujit Saha. Show ledger accounts in the books of Sudarshan Sinha from the following data : Year Lease (tons) Sub-lease (tons) 2010 1,500 1,000 2011 4,000 4,500 2012 18,000 10,000 2013 15,000 (strike) 3,000 2014 8,000 15,000 Royalty per ton ~ 3.00 ~ 4.00 Minimum rent p.a. ~ 35.000 ~ 25,000 Shortworkings recoverable in following 3 years 2 years In the event of a strike and the minimum rental not being reached, the lease provided that the actual royalties earned for the year discharged all rental obligations for the year.

On 1.1.2010, Sudarshan Sinha obtained a mining lease and from that date he sub-leased a part of the mine to Sujit Saha. Show ledger accounts in the books of Sudarshan Sinha from the following data : Year Lease (tons) Sub-lease (tons) 2010 1,500 1,000 2011 4,000 4,500 2012 18,000 10,000 2013 15,000 (strike) 3,000 2014 8,000 15,000 Royalty per ton ~ 3.00 ~ 4.00 Minimum rent p.a. ~ 35.000 ~ 25,000 Shortworkings recoverable in following 3 years 2 years In the event of a strike and the minimum rental not being reached, the lease provided that the actual royalties earned for the year discharged all rental obligations for the year.

On 1.1.2010, Sudarshan Sinha obtained a mining lease and from that date he sub-leased a part of the mine to Sujit aha. Show ledger accounts in the books of Sudarshan Sinha from the following data: Year Lease (tons) Sub-lease (tons) 2010 2011 2012 2013 2014 Royalty per ton Minimum rent p.a. Shortworkings recoverable in 1,500 4,000 18,000 15,000 8,000 ~ 3.00 ~ 35.000 3 years 1,000 4,500 10,000 (strike) 3,000 15,000 ~ 4.00 - 25,000 2 years following In the event of a strike and the minimum rental not being reached, the lease provided that the actual royalties earned for the year discharged all rental obligations for the year.

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the ledger accounts in the books of Sudarshan Sinha based on the given data Mining Lease Account Date Particulars Tons Rate Amount Balance 010110 To Cash Ac 1500 300 450000 450000 010111 To Cash Ac 4000 300 1200000 1650000 010112 To Cash Ac 18000 300 5400000 7050000 010113 To Cash Ac 15000 300 4500000 11550000 010114 To Cash Ac 8000 300 2400000 13950000 Balance cd 13950000 SubLease Account Date Particulars Tons Rate Amount Balance 010110 To Mining Lease Ac ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started