Answered step by step

Verified Expert Solution

Question

1 Approved Answer

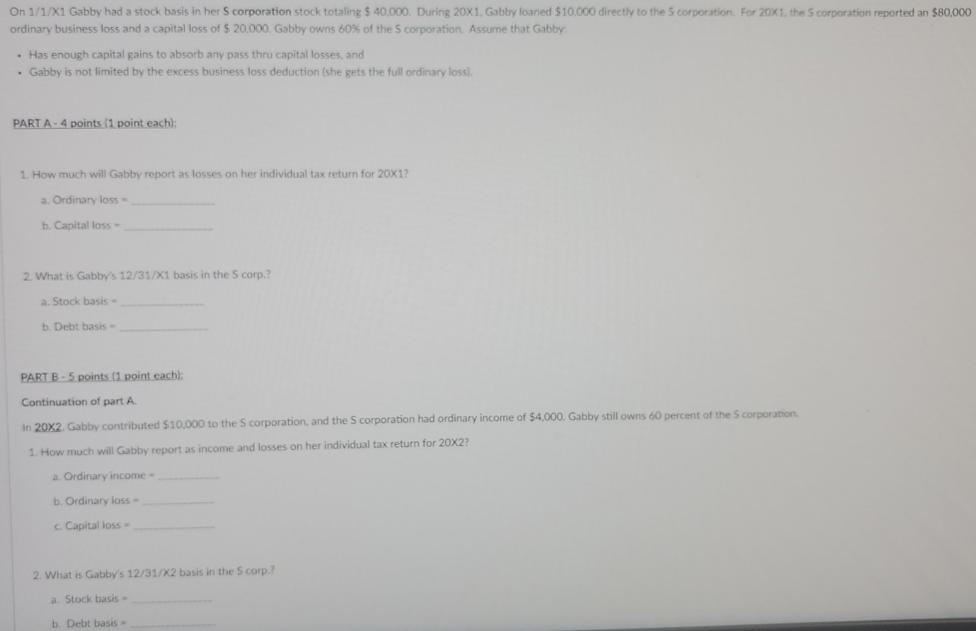

On 1/1/X1 Gabby had a stock basis in her S corporation stock totaling $ 40.000. During 20x1, Gabby loaned $10.000 directly to the 5

On 1/1/X1 Gabby had a stock basis in her S corporation stock totaling $ 40.000. During 20x1, Gabby loaned $10.000 directly to the 5 corporation For 20X1, the 5 corporation reported an $80,000 ordinary business loss and a capital loss of $20,000, Gabby owns 60% of the S corporation. Assume that Gabby Has enough capital gains to absorb any pass thru capital losses, and . Gabby is not limited by the excess business loss deduction (she gets the full ordinary loss). PART A-4 points (1 point each): 1. How much will Gabby report as losses on her individual tax return for 20X1? a. Ordinary loss- b. Capital loss- 2. What is Gabby's 12/31/X1 basis in the 5 corp.? a. Stock basis- b. Debt basis- PART B-5 points (1 point cach); Continuation of part A. in 20X2. Gabby contributed $10,000 to the S corporation, and the S corporation had ordinary income of $4,000. Gabby still owns 60 percent of the 5 corporation. 1. How much will Gabby report as income and losses on her individual tax return for 20X2? a. Ordinary income- b. Ordinary loss- c. Capital loss- 2. What is Gabby's 12/31/X2 basis in the 5 corp. a. Stock basis- b. Debt basis-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

PART A 1 Gabbys reportable losses on her individual tax return for 20X1 a Ordinary loss Gabbys share ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started