On 12/31/2021, 7-Eleven acquired 75 percent of Speedway's net identifiable assets for $177,000. The book value of Speedway's assets was equal to $210,000 at

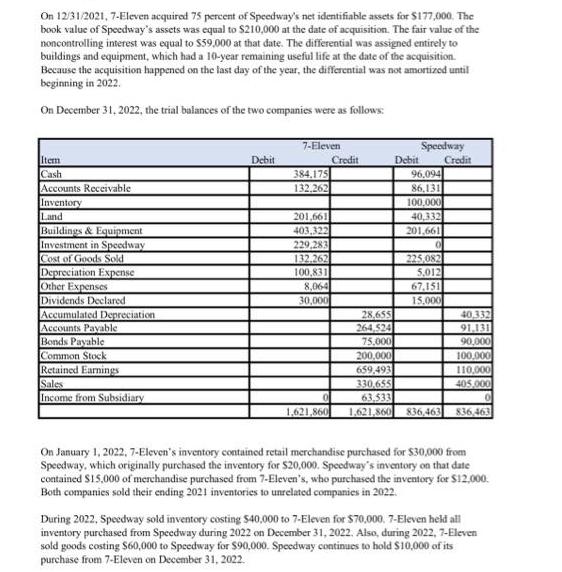

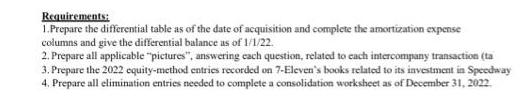

On 12/31/2021, 7-Eleven acquired 75 percent of Speedway's net identifiable assets for $177,000. The book value of Speedway's assets was equal to $210,000 at the date of acquisition. The fair value of the noncontrolling interest was equal to $59,000 at that date. The differential was assigned entirely to buildings and equipment, which had a 10-year remaining useful life at the date of the acquisition. Because the acquisition happened on the last day of the year, the differential was not amortized until beginning in 2022. On December 31, 2022, the trial balances of the two companies were as follows: Item Cash Accounts Receivable Inventory Land ildings & Equipment Investment in Speedway Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Subsidiary Debit 7-Eleven 384,175 132,262 201,661 403,322 229,283 132.262 100,831 8,064 30,000 Credit Debit Speedway 96,094 86,131 100,000 40,332 201,661 0 225,082 5,012 67,151 15,000 28,655 264,524 75,000 200,000 659,493 330,655 63,533 1,621,860 1,621,860 836,463 Credit 40,332 91,131 90,000 100,000 110,000 405.000 836,463 On January 1, 2022, 7-Eleven's inventory contained retail merchandise purchased for $30,000 from Speedway, which originally purchased the inventory for $20,000. Speedway's inventory on that date contained $15,000 of merchandise purchased from 7-Eleven's, who purchased the inventory for $12,000. Both companies sold their ending 2021 inventories to unrelated companies in 2022. During 2022, Speedway sold inventory costing $40,000 to 7-Eleven for $70,000, 7-Eleven held all inventory purchased from Speedway during 2022 on December 31, 2022. Also, during 2022, 7-Eleven sold goods costing $60,000 to Speedway for $90,000. Speedway continues to hold $10,000 of its purchase from 7-Eleven on December 31, 2022. Requirements: 1.Prepare the differential table as of the date of acquisition and complete the amortization expense columns and give the differential balance as of 1/1/22. 2. Prepare all applicable "pictures", answering each question, related to each intercompany transaction (ta 3. Prepare the 2022 equity-method entries recorded on 7-Eleven's books related to its investment in Speedway 4. Prepare all elimination entries needed to complete a consolidation worksheet as of December 31, 2022.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Sure here is the differential table as of the date of acquisition Year Amortization Expense Differential Balance 2022 260000 2340000 2023 260000 2080000 2024 260000 1820000 2025 260000 1560000 2026 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started