Question

On 2009, the company's sales was p500, 000. Its fixed costs amounts to P100,000 per year. In 2010, sales was 20% higher, while fit

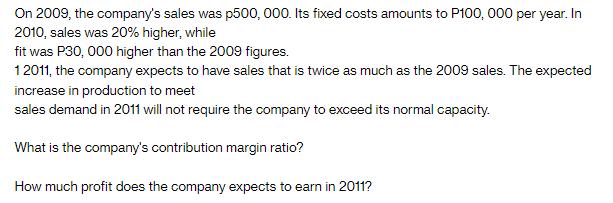

On 2009, the company's sales was p500, 000. Its fixed costs amounts to P100,000 per year. In 2010, sales was 20% higher, while fit was P30, 000 higher than the 2009 figures. 12011, the company expects to have sales that is twice as much as the 2009 sales. The expected increase in production to meet sales demand in 2011 will not require the company to exceed its normal capacity. What is the company's contribution margin ratio? How much profit does the company expects to earn in 2011?

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given Sales in 2009 P500000 Fixed costs P100000 per year Sales in 2010 20 higher than 2009 sales Fixed costs in 2010 P30000 higher than 2009 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App